Galaxy Digital CEO Calls Next Fed Chair Bitcoin’s Bull Catalyst, Sets $200K BTC Target

Highlights

- Galaxy Digital CEO Mike Novogratz says the next Fed Chair appointment could be the biggest bull catalyst for Bitcoin.

- He projected BTC could surge to $200,000 in this bull cycle if a dovish Fed Chair is selected.

- Bitcoin trades near $109K after a 6% drop, with $1.1B liquidations across crypto and bearish derivatives sentiment.

Galaxy Digital’s CEO believes that the appointment of the next Fed chair could trigger Bitcoin to new heights. He further projected BTC could hit the $200,000 mark in this bull cycle.

Fed Chair Nominee Could Define Bitcoin’s Next Big Rally

In a recent interview with Kyle Chasse, Galaxy Digital CEO Mike Novogratz said the choice of the next Fed Chair to replace Jerome Powell may become “the biggest bull catalyst for Bitcoin and the rest of crypto.”

According to him, if the incoming leader adopts an aggressively dovish stance, it could set off a parabolic rally across markets. This could drive both gold and the token sharply higher.

“Can Bitcoin get to $200K? Of course it could,” Novogratz declared, pointing out that such a move would fundamentally change how BTC is perceived. However, he cautioned that the following economic trade-off could be severe.

Earlier this month, President Donald Trump confirmed Fed chair nominees he is considering to succeed Powell. This includes Kevin Hassett, former Fed Governor Kevin Warsh, and current Fed Governor Chris Waller. Treasury Secretary Scott Bessent was also mentioned, though he has signaled no interest in the role.

The Galaxy CEO emphasized that while markets may anticipate a dovish pick, confirmation will only come once the appointment is made. “I don’t think the market will buy that Trump’s going to do the crazy, until he does the crazy,” Novogratz said.

Bold BTC $200K Ambition Despite Market Decline

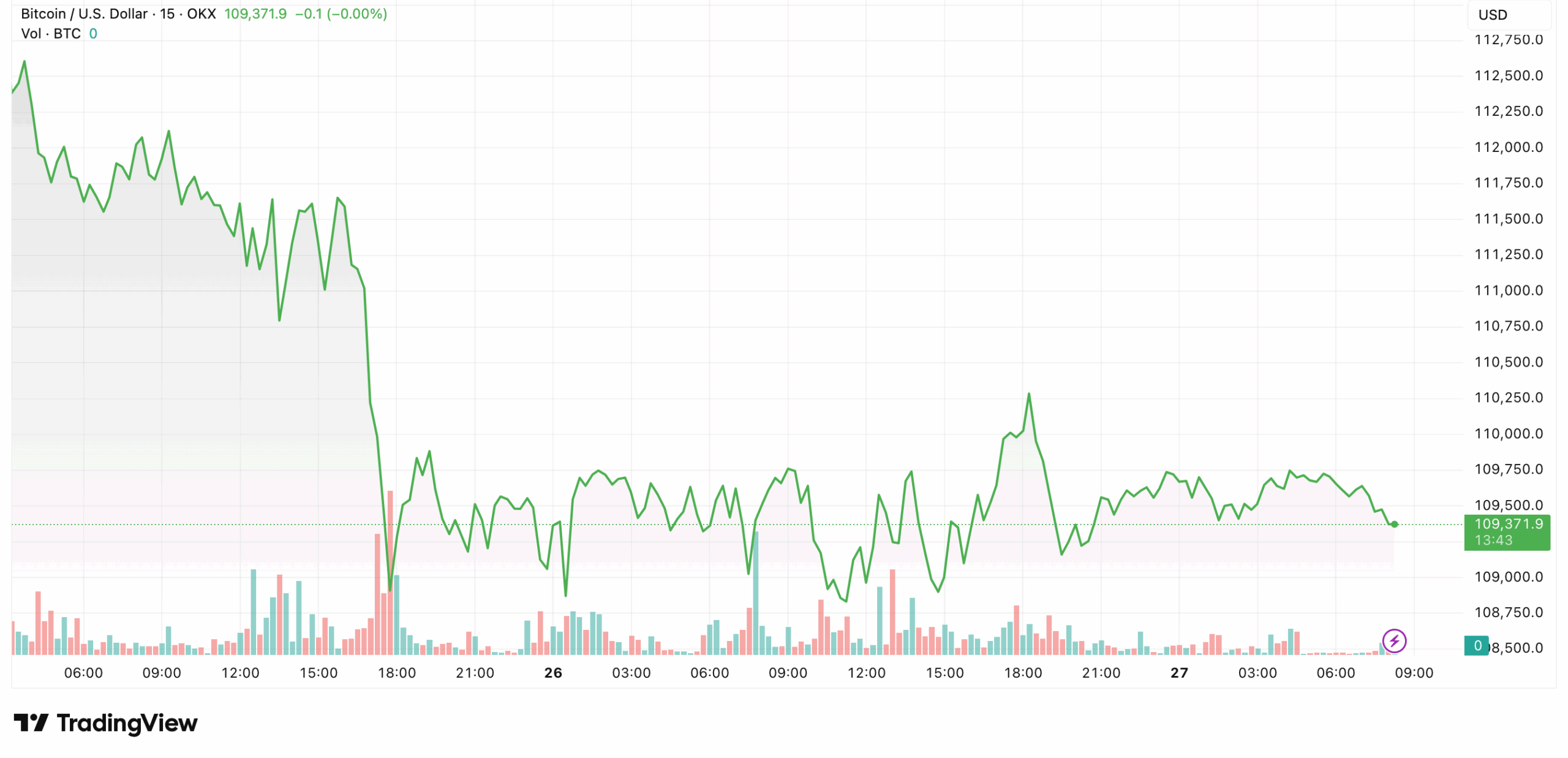

There has been downward pressure on the Bitcoin price, and the cryptocurrency market has been in a bearish phase. The coin is currently trading close to $109,000, following a 6% drop in the previous week.

This downturn could be attributed to several factors. For example, Jerome Powell cooled further rate cut expectations for this year. Bullish sentiment was tempered when the Fed Chair emphasized at an economic outlook luncheon that policy remains data-dependent and not predetermined.

Novogratz acknowledged that a dovish pivot might help BTC in the short run, but warned it could come at the cost of the Fed’s independence. He described the outcome as “really shitty for America.”

Adding to the turbulence, the crypto market liquidations totaled more than $1.1 billion this week. Ethereum led the altcoin selloff with $409 million in liquidations, followed by Bitcoin with $272 million.

Traders are also bracing for a massive Bitcoin options expiry worth $17 billion tied to its contracts on Deribit alone. A slightly bearish slant is indicated by the put-call ratio of 0.75.

Despite this, the Galaxy Digital CEO maintains that the token could change sentiment overnight if a dovish Fed Chair is appointed.

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans