GameStop Acquires 4,710 Bitcoin, GME Stock Price Drops 10%

Highlights

- GameStop announced that it had purchased 4,710 BTC for its Bitcoin Treasury.

- This comes two months after the company revealed plans to raise $1.3 billion to buy BTC.

- The GME stock price surged over 5% following this announcement.

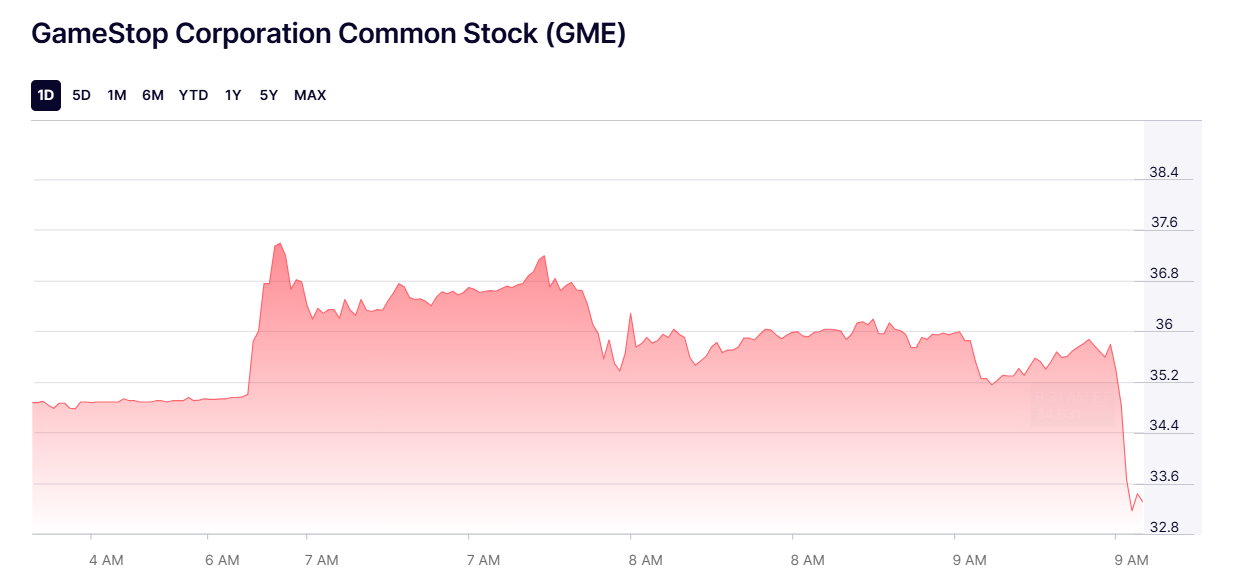

Retail company GameStop has made good on its plans to adopt a Bitcoin Strategy for the company. The company just announced its first BTC purchase, after agreeing to include the flagship crypto as a reserve asset. The GME stock price jumped almost 5% in pre-market trading, following this announcement, but has dropped 10% following today’s opening session.

GameStop Purchases 4,710 Bitcoin

In a press release, the retail company announced that it has purchased 4,710 BTC for its treasury. However, the company failed to disclose the average price at which it bought these coins.

Market commentator Reese Politics also noted that the company didn’t reveal the purchase price in its official 8-K filing with the US Securities and Exchange Commission (SEC). At the current Bitcoin price, these coins are worth around $512 million.

In March, GameStop revealed plans to raise $1.3 billion for its Bitcoin treasury, following the board’s decision to adopt the flagship crypto as a reserve asset. The company aims to follow Strategy and Michael Saylor’s playbook by becoming a BTC Treasury company.

Following the Bitcoin purchase announcement, the GME stock price surged over 3%, trading at around $36. The stock is up over 11% year-to-date (YTD) and up over 64% in the last year. However, the stock’s price has since dropped 10% following the opening of today’s trading session.

As CoinGape reported, the GameStop stock has surged following Keith Gill’s, also known as Roaring Kitty, move to change his X bio. Roaring Kitty had played a huge role in the 2021 GME short squeeze, which sent its price flying.

The company is also expected to benefit massively from its BTC exposure, with the stock’s price enjoying a similar performance to the one that the MSTR stock price has recorded since Strategy adopted the Bitcoin model.

In an X post, market expert Anthony Pompliano commented on the Bitcoin purchase, stating that this would send retail traders into a frenzy. Meanwhile, it is worth mentioning that with this purchase, GameStop is already the 13th public company with the largest BTC holdings, just above Semler Scientific, which holds 4,264 BTC.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs