GBTC Share Price Tanks As the Bitcoin Fund Trades At Record Discount

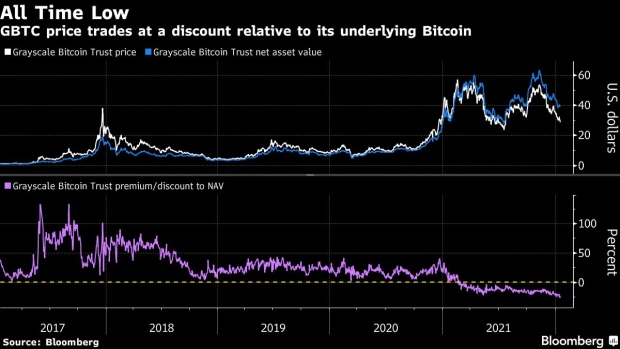

The world’s largest Bitcoin fund – the Grayscale Bitcoin Trust (GBTC) – has suffered a major hammer blow amid the crypto market rout. The Grayscale Bitcoin Trust (GBTC) has been trading at a steep discount of 17% year to date.

As of now, GBTC has $27 billion in assets under management. This is a staggering 30% discount from Bitcoin’s all-time high levels in November 2021. Furthermore, the recent Bitcoin (BTC) sell-off has a more pronounced effect on the GBTC share price (OTCMKTS: GBTC).

The GBTC share price is trading at a record discount level to the underlying Bitcoin. Also, the stock is down 19% so far in 2022. The GBTC share price has corrected a staggering 50% in the last three months. In a report accessed by Bloomberg, Brent Donnelly, president of Spectra Markets said:

“GBTC keeps breaking hearts as the discount widens. GBTC is basically a binary bet on a physical ETF at this point. Tempting but tempting the way value traps can be tempting.”

GBTC’s correlation with Bitcoin is falling to an even greater degree. While Bitcoin (BTC) price surged 1.6% on Tuesday, January 18, GBTC tanked 6.4% the same day.

Converting GBTC to A Spot Bitcoin ETF

Last year in October 2021, Grayscale Investment LLC applied to the U.S. Securities and Exchange Commission (SEC) for converting the GBTC into a spot Bitcoin ETF. This move will probably help Grayscale to assure more cash inflows from institutions.

However, the SEC seems to be hellbent on disapproving a spot Bitcoin ETF citing investor protection concerns. On Wednesday, January 19, SEC Chair Gary Gensler said that crypto exchanges will be a prime focus of the crackdown for the securities regulator. Speaking in a virtual conference, Gensler said:

“I’ve asked staff to look at every way to get these platforms inside the investor protection remit. If the trading platforms don’t come into the regulated space, it’d be another year of the public being vulnerable.”

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise