Gemini Multisig Wallet Bags $113M In SHIB, PEPE, ETH, & This Crypto

Highlights

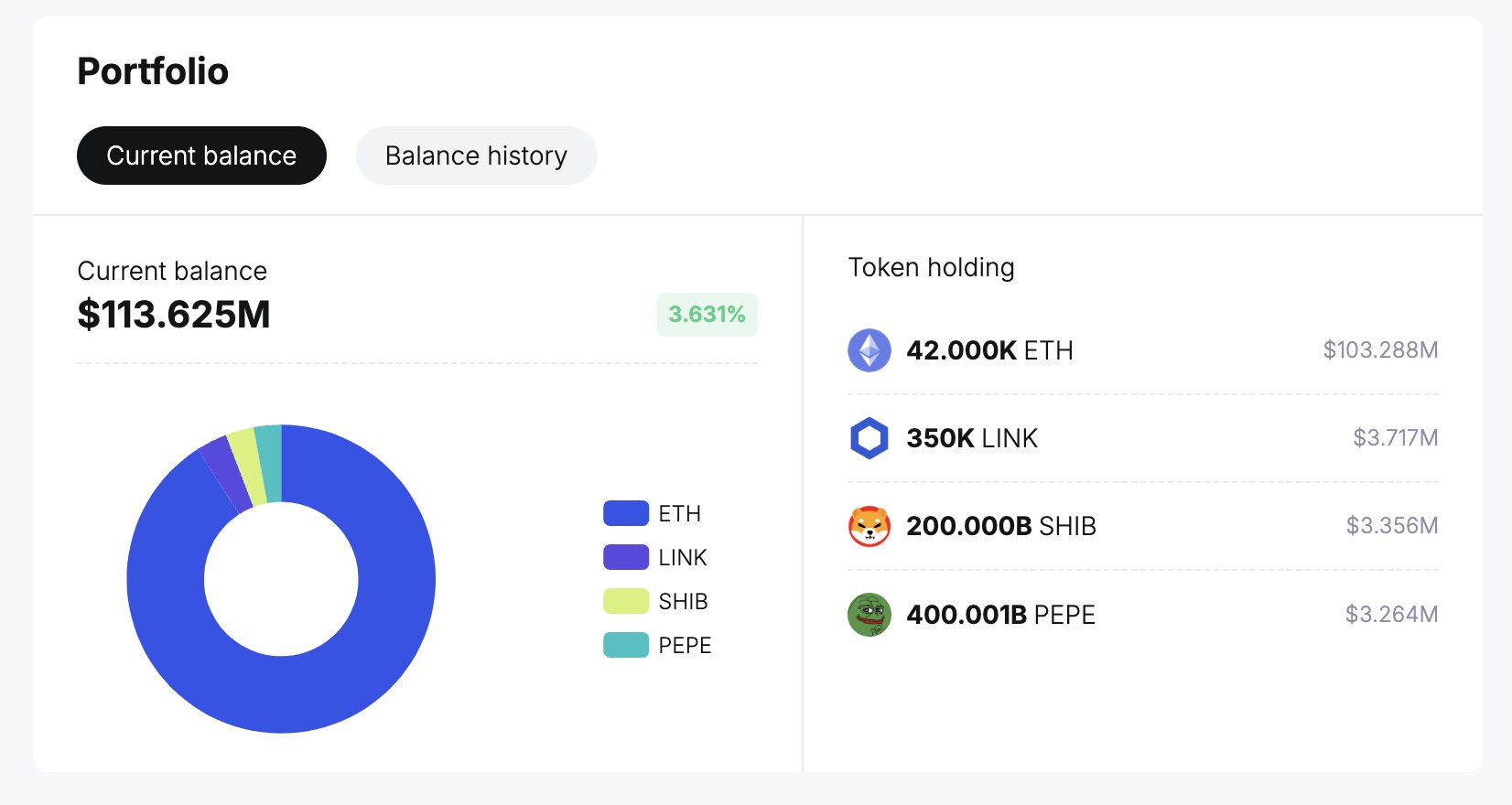

- Gemini multisig wallet invests $113M in SHIB, PEPE, ETH, and LINK, sparking market speculations.

- The trader made his highest bet on Ethereum, spending over $103 million on the crypto.

- The heavy bets have sparked discussions over its potential impact on the crypto prices in the coming days.

A newly created Gemini multisig custody wallet bets big on four crypto recently, sparking market speculations. The wallet created just 18 days ago, spent more than $113 million to accumulate Ethereum, SHIB, PEPE Coin, and LINK crypto. This massive investment has also fueled discussions over the potential impact of the move on the crypto prices ahead.

Gemini Multisig Wallet Bets Big On These Altcoins

According to a recent X post by the leading on-chain analytics firm, Spot On Chain, a newly created Gemini multisig wallet invests heavily in four top altcoins. The report showed that the multisig custody wallet bets $113.625 million to acquire a substantial amount of Ethereum, Shiba Inu, Chainlink, and PEPE coin.

A closer look into the report showed that the trader has invested the most amount in Ethereum. He has spent $103.8 million to bag $42K ETH, sparking market optimism. Besides, he accumulated 350K LINK tokens, worth $3.77 million, showcasing his confidence in the altcoins sector.

On the other hand, the wallet also appears to be shifting its focus towards the top meme coins. Notably, he has added 200 billion SHIB and 400 billion PEPE, valued at around $3.39 million and $3.29 million, respectively, into his portfolio.

Meanwhile, these diversified bets indicate that the trader might be bracing to book profits with the anticipated volatility in the coming days. For context, the crypto investors turned cautious amid the soaring anticipation over the upcoming US Election 2024 and the US FOMC this week.

Besides, the higher volatile scenario in the meme coins sector often aids the investors note significant profits due to their massive price swings. Simultaneously, the wallet could also continue to accumulate more of these altcoins in the coming days, which could potentially boost the prices of these crypto.

SHIB, PEPE, ETH, And LINK Prices To Rally?

Following the accumulation news by the Gemini multisig wallet, Shiba Inu price today rose by 1.10% to $0.00001703, with its trading volume soaring 31% to $283.3 million. However, SHIB Futures Open Interest fell 1.15% during writing. Meanwhile, a recent Shiba Inu price analysis reveals key conditions that could send the meme coin to $1 in the coming days.

Simultaneously, PEPE Coin price traded near the flatline at $0.000008263, and its trading volume jumped 37% to $602.45 million. PEPE Futures Open Interest also stayed near the flatline, indicating muted market interest. Additionally, a recent PEPE price analysis indicates that the frog-themed coin could mirror Dogecoin’s 2021 rally, sparking market interest.

Talking about the Ethereum price, the second-largest crypto by market cap was up by 0.63% to $2,469. However, Ether Futures Open Interest was down 0.5% to $13.46 billion. Despite that, a recent Ethereum price report hints at a potential rally for the crypto to $6,000.

However, despite these developments, LINK price today was down nearly 3% to $10.64. The plunge or muted trading in these altcoin prices indicates that the investors might be staying on the sideline, seeking more clarity over the market trends in the coming days.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs