Gold Flash Crash: Would Gold’s Loss Be Bitcoin’s (BTC) Gain?

Gold, the lustrous metal continued its bearish momentum into the new week as its price flash crashed earlier today during the Asian session. The morning flash crash dipped Gold’s price to a nearly 6-month low, falling below $1,700/oz. The price has since recovered slightly and traded at $1,746 at the time of writing.

The traditional store of value is down 8% in 2021, and 14.87% from its all-time high of $2,040 in August 2020. Analysts believe high leverage trading is the cause of the current flash crash something the crypto market is often looked down upon.

Peter Bandit, the Forex guru attributed current price volatility in Gold to high leverage trading on Chicago Mercantile Exchange’s gold markets that offer 15:1 leverage. A few others blamed it on the drop in the US unemployment rate to 5.4% from 5.9%.

“The better jobs data sent the US dollar and US bond yields higher, never a good formula for commodities.”

The flash crash in gold’s price became the butt of all jokes in the crypto community due to the obvious comparisons between the two. Max Keiser, the known Bitcoin proponent didn’t miss the chance to take a pot shot Peter Schiff, the gold proponent.

.@peterschiff checks Gold price pic.twitter.com/m9P9MLEbuU

— BITCOIN MAXIMALIST (@maxkeiser) August 8, 2021

Bitcoin Looks to Consolidate on Gold’s Loss

The gold price has been on a downward trend throughout 2021, on the other hand, Bitcoin price has managed to shed its correlation with gold’s price further. The top cryptocurrency has also broken out of nearly three-month-long price slumber. It has also broken out of the $30K-$40K price range and looks set to move forward in the second leg of the bull run.

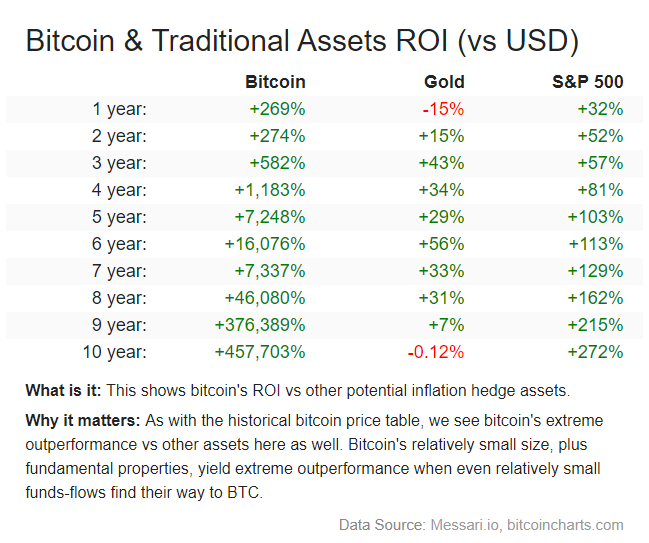

The top cryptocurrency is currently trading at $43,556 falling from a daily high of $45,246. BTC has managed to outperform every other asset despite losing a significant portion of its gains during the past three months. On the other hand, gold’s 10-year ROI went negative with the recent flash crash.

As the third wave of the pandemic approaches, Bitcoin and other crypto-assets might see another bullish surge while its arch-rival Gold continues to show a downward trend, losing investor confidence as a store of value.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: XRPL Set to Add Options Trading for Investors Amid Major Upgrade

- Is World War III Near? Bitcoin Price Drops As UK, France, Germany Consider Iran Action

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Arthur Hayes Sees 5x HYPE Token Rally as Oil Perps Pump on Hyperliquid Amid U.S.–Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs