Gold Prices Slump As Pfizer Files For Covid19 Vaccine Approvals, Will Bitcoin [BTC] Follow?

Pfizer Inc. the company which has claimed to develop a vaccine for the novel coronavirus with 95% accuracy revealed that they have passed the final safety tests and found no harmful side effects of the vaccine. They also revealed that they would be filing for an emergency authorization for distribution in the United States after the final set of tests were completed.

Bitcoin Breaks Co-relation With Stock Market

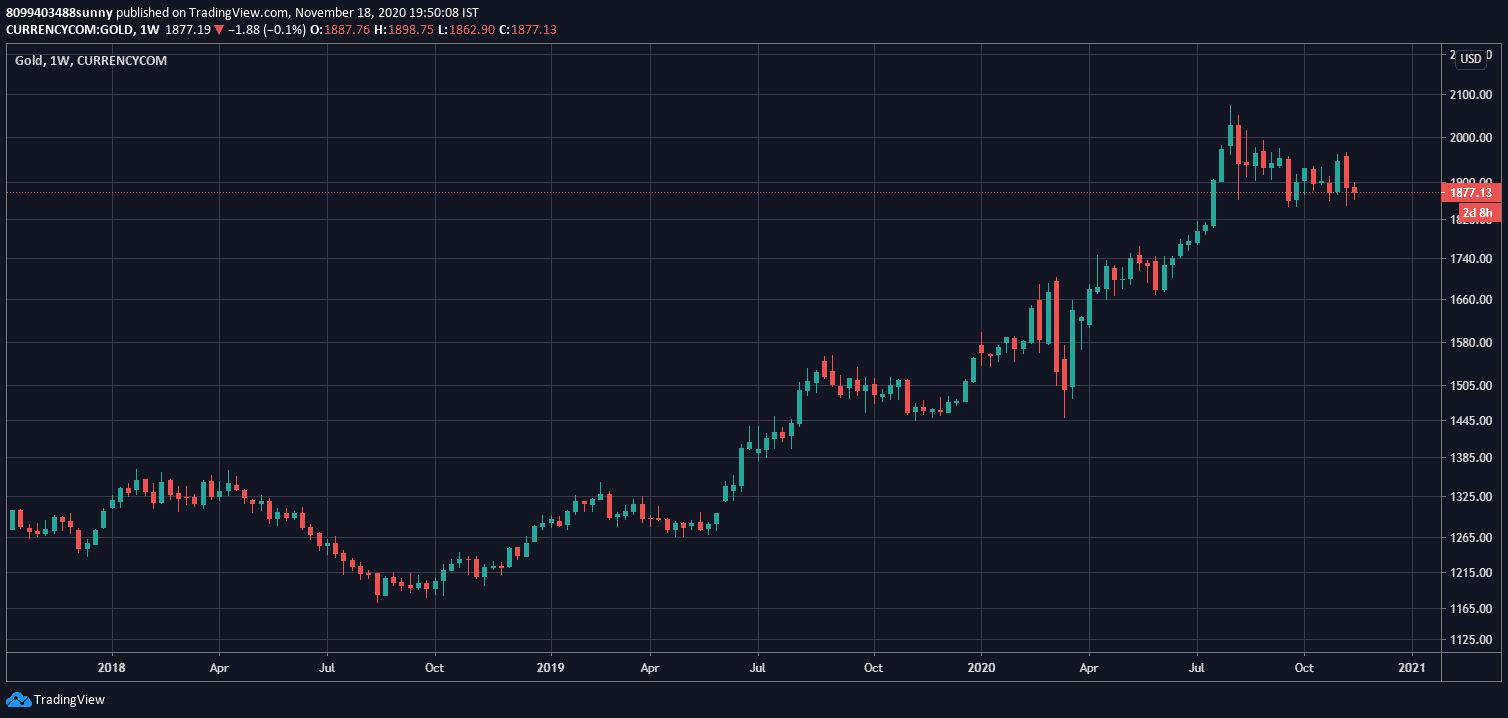

The news about Pfizer’s plan to file for authorization had quite a daunting effect on Gold’s price as it fell by 0.4% in the spot market and is trading at around $1876. The most noted decline came in the Gold Exchange Traded Funds (ETF) which shed 40 tons of metal ever since the news about the vaccine authorization went public.

Gold performed significantly well during the start of the pandemic and even touched record highs before starting to see a downhill price action. The decline in gold ETF suggests that the confidence of the institutional investors in the precious metal might be diminishing especially at a time when bitcoin is rearing past new yearly highs every other day.

Edward Moya, a senior market analyst at Oanda Corp believes that the reason behind gold’s continuous decline could be linked to the growing pandemic in the United States. He explained,

“Lockdowns are spreading across the U.S. and with no immediate signs that Congress is ready to break the stimulus stalemate, gold will continue to struggle to rise,”

Gold’s diminishing market value is only helping bitcoin to solidify its place as the store-of-value. The king coin has managed to break key resistance levels of $15,000, $16,000, $17,000, and $18,000 and is all set to go past its all-time-high price of around $20,000. During this mammoth rally over the past month, the top crypto asset has managed to reach its highest market cap of all time, as well as posted the highest 3-week close for the first time.

Bitcoin also broke its correlation with the stock market which was an Achilles heel for the top cryptocurrency as its market behaviors mimicked more of the stock market than a store of value assets.

I guess Bitcoin and the stock market isn't correlated anymore. pic.twitter.com/HYF3WaxHI9

— hodlonaut ????⚡???? ???? (@hodlonaut) November 17, 2020

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Circle Stock Jumps 35% on Stablecoin Boom, USDC Supply Soars 72%

- Democrats Convene US Senate Crypto Bill Meeting as a16z Briefs Republicans on CLARITY Act & AI

- After 820% Gains: Privacy Coins Evolve into Payment Rails

- Bitcoin Price Rebounds as Jane Street “10 am Dump” Pattern Stops Amid Lawsuit

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale