Google Searches And Social Activity For BTC $40K, AI, & Real World Assets Surge

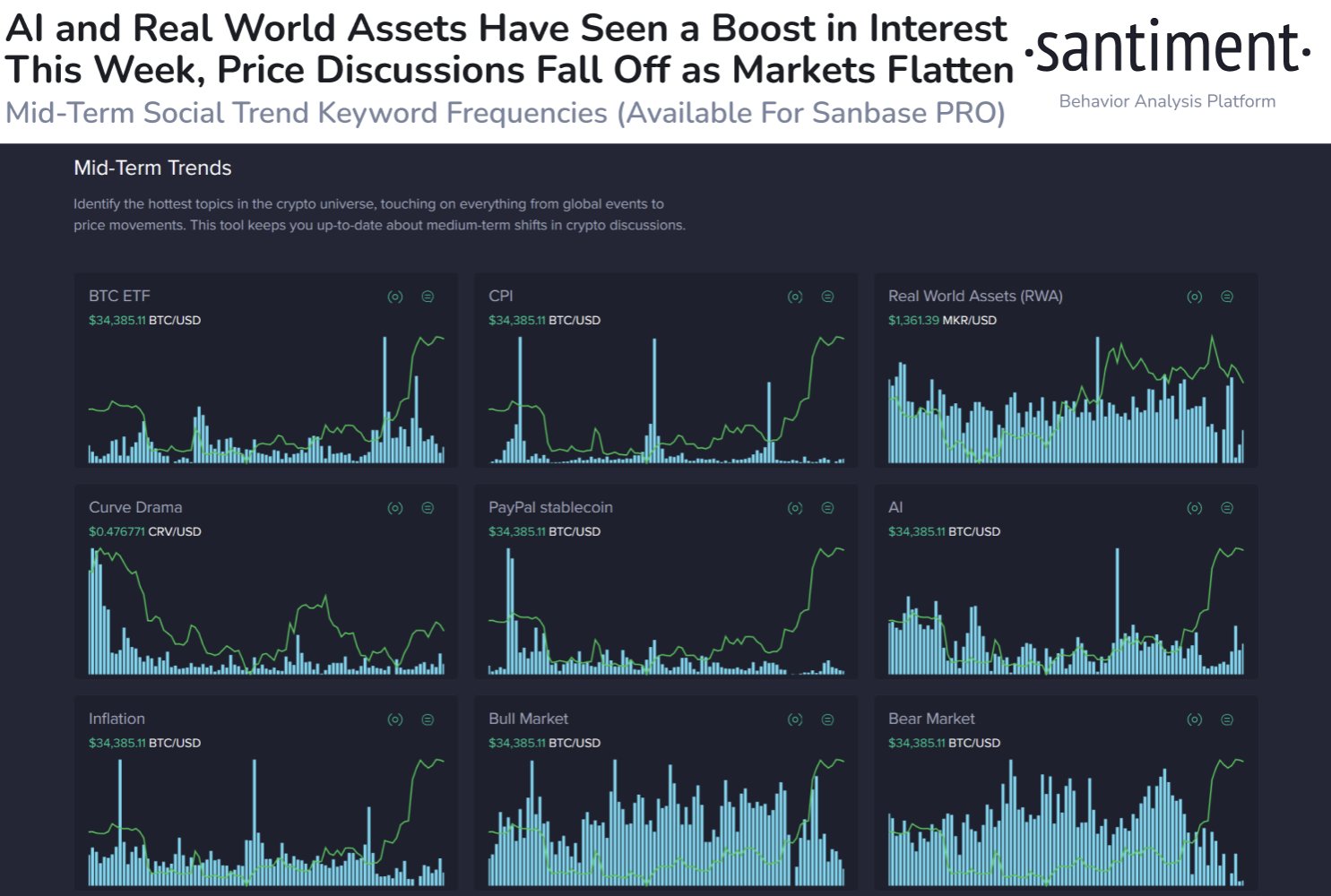

The global discussions revolving around the world of artificial intelligence and real-world assets have seen a sudden increase, according to data by Santiment. Furthermore, traders and investors are less inclined to discuss a bullish or bearish market. Market sentiment for BTC price of $40K may indicate a positive sign for investors.

AI and Real World Assets Emerging As A Hot Spot

With countries advancing towards fostering the growth and development revolving around the world of AI, market data unveils a boost in investors and traders discussing the futuristic possibilities of real-world assets and Artificial Intelligence. Moreover, the discussions revolving around the price of cryptocurrencies plunge following the volatility of the crypto market as the market flattens. However, BTC reaching $40k sentiment continues to grow.

Santiment’s data reveals a distinct trend implying that the search volume for Bitcoin exchange-traded funds (ETFs), a significant indicator in the cryptocurrency space, remains comparatively subdued despite BTC’s price appreciation.

In stark contrast, search volumes for various other topics such as the consumer price index (CPI), PayPal stablecoin, Curve drama, bull market, and bear market exhibit significantly lower levels of engagement when compared to discussions about AI and real-world assets. This data underscores the growing significance of AI and real-world assets as emerging hot spots in the global financial landscape.

Also read: XRP and Solana Continue to Rally Defying Crypto Market Consolidation

Investors and Traders Drifting Towards AI

In addition to the ongoing buzz around AI and real-world assets, AI-based crypto tokens are also witnessing a significant surge in prices. CoinGape Media recently reported that prices of AI-based tokens, such as OCEAN, INJ, and FET, skyrocketed as the Bitcoin price rally took a breather.

Furthermore, with leading tech giants across the globe, such as Google, Microsoft, and Anthropic, investing in AI while also fostering the growth and development of AI have catapulted investors into rethinking their investment options. With the recent global shift of companies towards AI and real-world assets, the surge in AI-related discussions appears to have overpowered the crypto prices landscape.

Also read: Binance’s Terra Luna Classic (LUNC) Burn Reaches 40 Billion

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

Buy $GGs

Buy $GGs