Google Search for Bitcoin Coronavirus Takes over Halving – Is it Priced Already?

‘Bitcoin halving’ being ‘priced-in’ is a short-term trend caused to due to hyped sentiments. Google trends data along with price reactions suggest that halving might be an overly hyped incident. Moreover, now with the safe-haven angle in picture, the interest on ‘Bitcoin Coronavirus‘ has taken over halving.

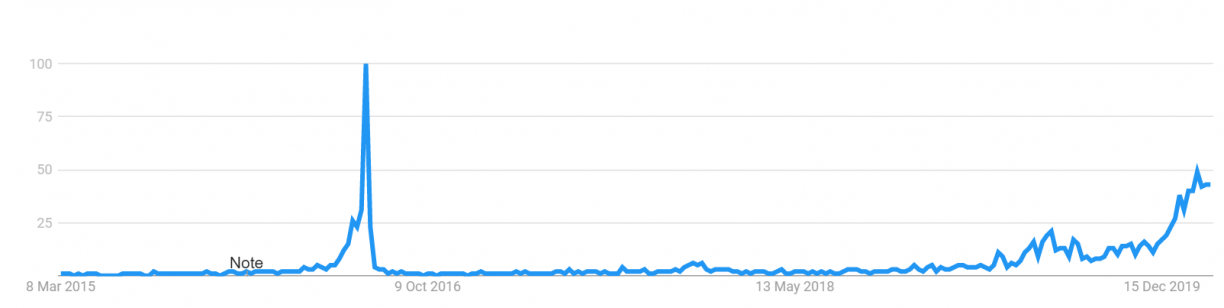

The five year chart of google trends along with price action suggests that while sentiments and online search kept reached it’s peak during ‘halving’ – July 9, 2o16 and dropped almost instantly in the next few weeks. Moreover, the price had already taken a bearish turn weeks before the halving.

Co-incidentally, the small spike in the trend before the moonshot rise coincides with the price peak. Hence, after a certain point, there was an inverse correlation between online sentiments and price.

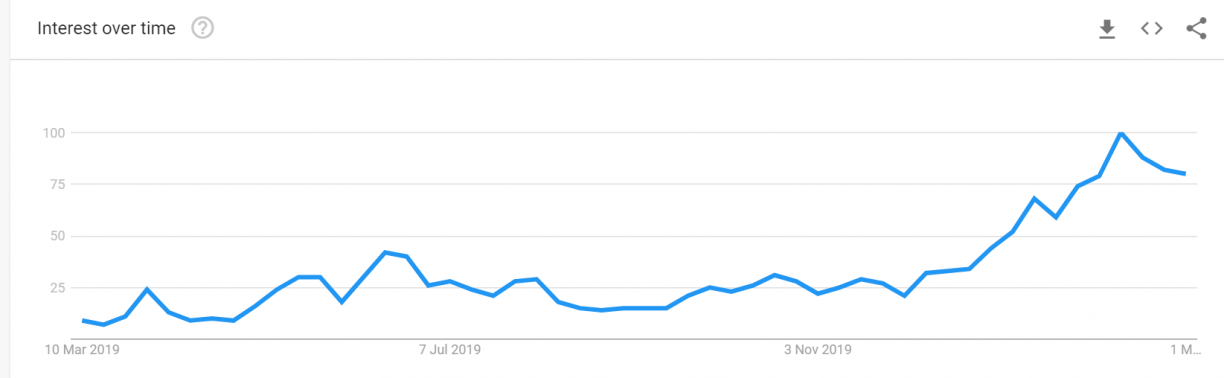

The ‘google trend’ for the keyword ‘Bitcoin Halving’ seems to be dropping again, which suggests that the bull run in the halving might have priced in.

Google Trends for ‘Bitcoin Halving’ Keyword

Coronavirus Fear Takes Over Halving Interests

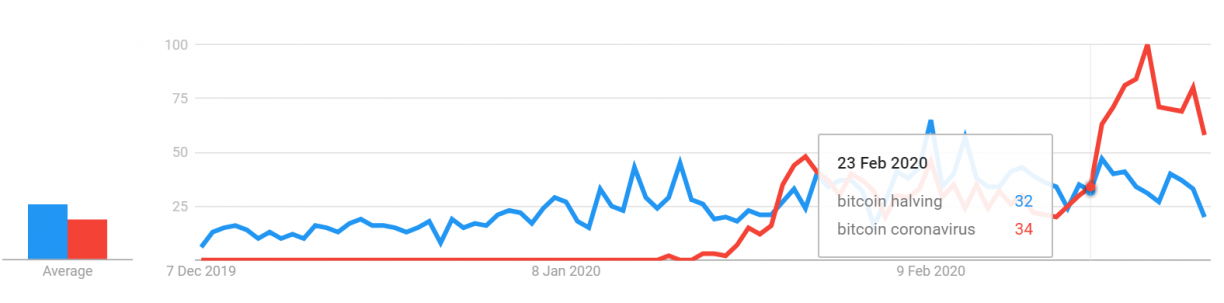

However, a lot of it has to with the fact that the market has now begun to look at the impact of coronavirus on Bitcoin. The organic search interest took over ‘Bitcoin halving’ during the last week of February and is currently leading.

Nevertheless, the over-all average for Bitcoin Halving is greater than the latter.

Moreover, the interest on both the keywords is now seeing a fall this week. While the price has been moved above $9100 after reaching lows below $8500, bulls still face resistance around $9500 and then $10,500 before new highs can be breached.

As for Bitcoin halving being priced, much of it has to do with FOMO and hysteria in the short term. Nevertheless, the periodic nature of it’s occurrence has built significant trends in the crypto-markets.

The price, on the other hand, is usually dominated by futures and perpetual swap market in the short term, and adoption in the long-term.

The recent legalization of Bitcoin in South Korea, coupled with the positive news from India shunning crypto restrictions are strong positive ques for long-term price.

The daily funding rate for Bitcoin on BitMEX has fallen back to 0.03% after reaching to highs around 0.36% in the first two week of February. Looks like, the trader sentiments might be subsiding as well.

Could fresh buyers push this one above resistances? Please share your views with us.

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card