GraniteShares 3x XRP ETF Can Trigger ‘Panic Buying XRP’ Says Expert

Highlights

- GraniteShares 3x XRP ETF filing comes following the success of existing 2x Ripple ETFs from ProShares and Teucrium.

- Pro-XRP lawyer Bill Morgan said the new ETF filing could trigger “panic buying” among investors.

- XRP price remains under pressure near the $2.85 support, as retail FUD grows.

On Tuesday, October 7, GraniteShares filed with the U.S. Securities and Exchange Commission (SEC) for a 3x XRP ETF. This will allow investors to take bigger leverage long and leveraged short bets for greater exposure. Pro-XRP lawyer Bill Morgan believes that this will trigger panic buying for XRP moving ahead. XRP price has been currently trading at the crucial support at $2.85, with analysts seeing potential upside.

GraniteShares to Bring 3x XRP ETF For Traders Seeking Higher Risks

Citing a strong demand for the 2x leveraged XRP ETF from ProShares and Teucrium, GraniteShares filed for a 3x XRP ETF. This development comes as the US SEC has to decide on six Ripple ETF applications this month, in October.

GraniteShares will introduce both long and short leveraged ETFs for all four cryptocurrencies, offering traders 3x the daily performance of the underlying assets. The proposed products would carry significantly higher risk-reward profiles compared to the currently available 2x leveraged funds.

Following this development, pro-XRP lawyer Bill Morgan stated: “I will continue panic buying XRP in the face of this terrible XRP ETF demand”. In recent times, the Ripple cryptocurrency has emerged as the most sought-after asset for leveraged crypto products, driven by robust retail investor demand.

Despite the uncertainty in SEC conditions, the 2x XRP ETFs have already attracted over $300 million in net inflows, underscoring sustained market interest. Data shows that the Teucrium 2x XRP ETF (XXRP) has accumulated over $440 million in assets since its launch in August 2025. Similarly, the newly launched REX-Osprey XRP ETF (XRPR) has already gathered more than $87 million in assets under management in less than three weeks.

All Eyes on the Ripple Cryptocurrency Movement

Amid the broader crypto market sell-off, the XRP price has been facing selling pressure and is testing an important support at $2.85 levels, after 4.5% drop last week.

Popular trader Peter Brandt said that if XRP loses the crucial support at $2.68, it can further slide to $2.2. So far, the bulls have managed to stay above these levels; however, they have been struggling to move past $3.0.

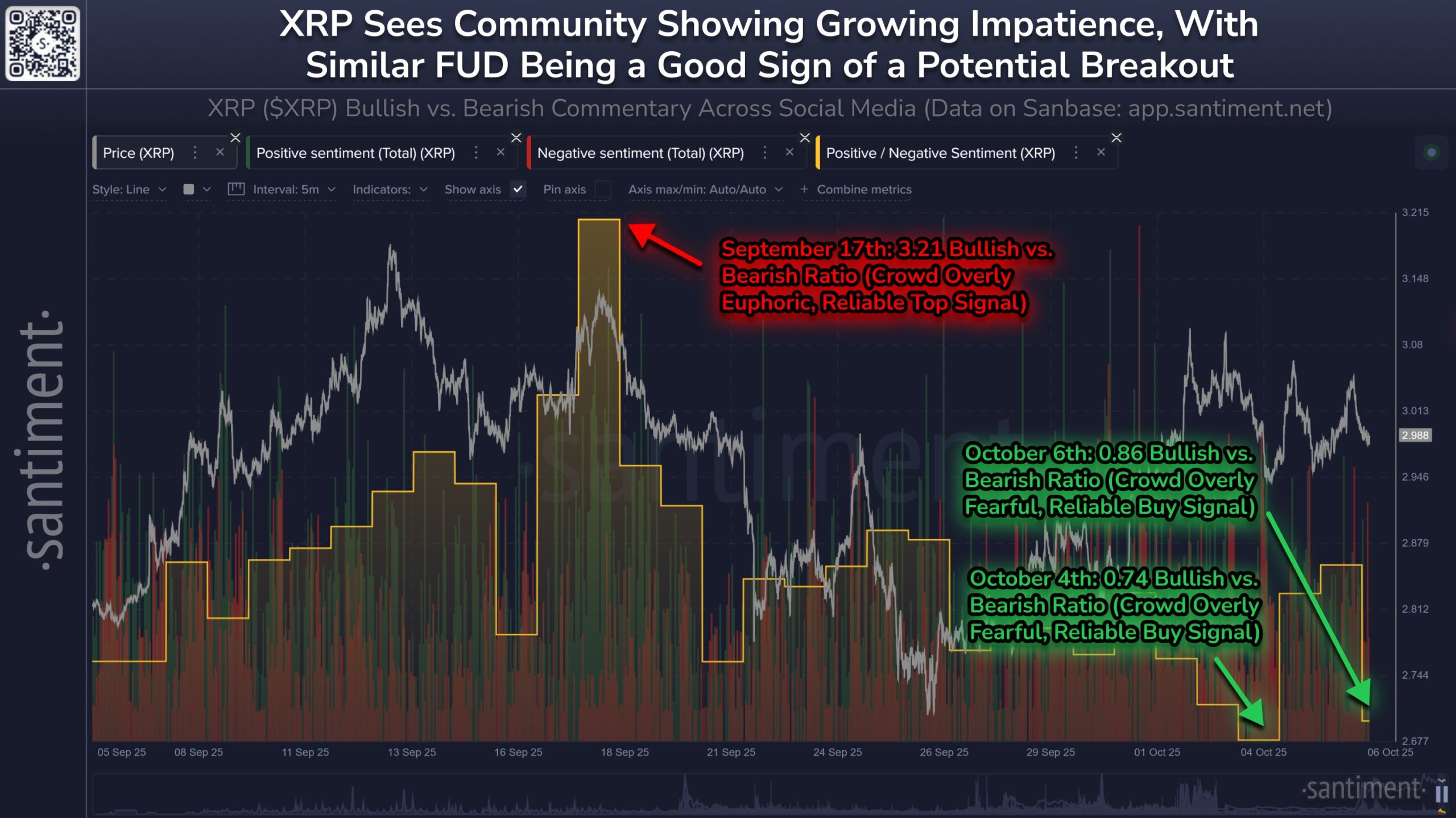

Blockchain analytics firm Santiment reported that XRP is experiencing its highest level of retail fear since the announcement of U.S. tariff measures six months ago. The firm noted that bearish commentary has outnumbered bullish sentiment on two of the past three days.

According to Santiment, markets often move contrary to retail trader expectations. This suggests that the recent spike in negative sentiment could precede a rebound in XRP’s price.

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Crypto Market Weekly Recap: BTC Waver on Macro & Quantum Jitters, CLARITY Act Deadline Fuels Hope, Sui ETFs Go Live Feb 16-20

- Robert Kiyosaki Adds To Bitcoin Position Despite Market Decline

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral