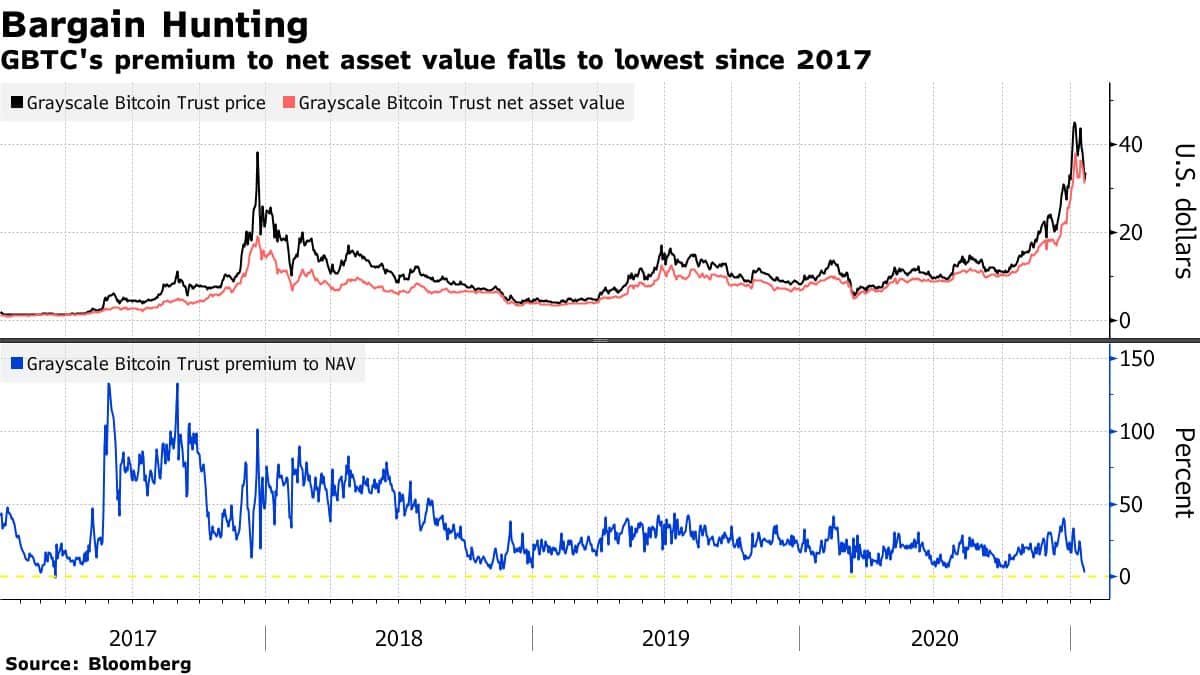

Grayscale Bitcoin Trust [GBTC] Premiums Drop to Lowest Since March 2017

As reported by Bloomberg, the Grayscale Bitcoin Trust [GBTC] premiums fall by 40% during recent crypto meltdown as GBTC itself fall by 15% WoW. For the first time since March 2017, fall in prices of GBTC [15%] has outpaced that of Bitcoin itself [13%] on the weekly timeframe.

Investors Might be Dumping Their Positions in Trust

GBTC has always traded at premium but during recent meltdown the value of GBTC has dropped by 15% in a week. As a result, GBTC premium has declined to just 2.8% compared to 40% in December 2020. Riding the bull run Bitcoin price surpassed $40,000 and as such GBTC premiums to its underlying holdings jumped significantly.

Recent Bitcoin price downfall led by Bitcoin Miner selling pressure and double spend FUD has caused panic among the investors. The drop in GBTC premiums may be reaction of investors dumping their position in trust.

Another important point is mentioned in the report by James Pillow, portfolio manager at Moors & Cabot as he points out that extreme premiums will decrease as more and more crypto focussed investment vehicles enter the market.

Bitcoin price has recovered well post meltdown as the BTC price gained 4.5% in last 24 hrs and was trading at $33,700 at the time of reporting. Another silver lining from the meltdown was that Bitcoin dominance almost showcased no significant drop thus retaining the investor trust in the cryptocurrency. The drop in Bitcoin price is resulting as a boon for many altcoins like $LINK and $DOT who are gaining significantly from drop in Bitcoin price.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Bill Eyes Late March Markup as Key Senate Roadblocks Begin to Clear

- U.S. Federal Reserve, OCC Approves Banks to Handle Tokenized Securities With New Capital Rules

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs