Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut

Highlights

- Hammack warns that inflation is still too high to justify a Fed rate cut.

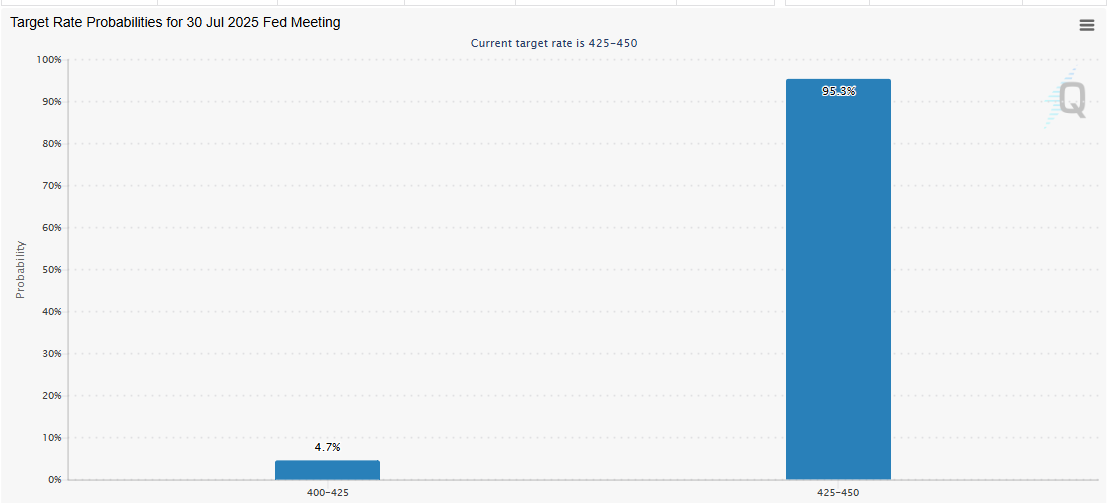

- Fed rate cut unlikely in July as odds fall below 5%.

- Trump, Waller push for rate cut, but Cleveland Fed suggests caution on timing.

Federal Reserve Bank of Cleveland President Beth Hammack has said inflation is still too high to justify a Fed rate cut. Her remarks come amid push from US President Donald Trump for Powell and the FOMC to cut rates.

Clearer Inflation Progress Needed Before A Fed Rate Cut

In a FOX interview, Hammack emphasized the need to assess how new policies are impacting inflation before supporting any quantitative easing (QE). Her comments suggest resistance to a cut at the upcoming July 30 meeting.

While market participants are eager for lower rates, Hammack made it clear that inflation control remains the central bank’s top priority. She believes acting too soon with a Fed rate cut could reverse recent progress on price stability.

Hammack’s wait-and-see approach aligns with that of Fed Chair Jerome Powell, who is reportedly considering resignation. Powell has continued to reiterate that it is best to wait and understand the impacts that the Trump tariffs could have on inflation.

Economic growth remains steady, but policymakers are focused on sustained improvement in inflation data. Hammack’s message reflects the need for more convincing evidence before endorsing a rate cut.

Markets Price In Delay In A Cut As Odds Drop Below 5%

CME FedWatch data shows that the Fed is unlikely to cut interest rates at the July 30 FOMC meeting. There is a 4.7% chance that the FOMC will cut rates, while there is a 95.3% chance that interest rates will remain unchanged. Investors now see an interest rate cut as more likely in the later part of the year.

This comes despite Fed Governor Christopher Waller’s statement that raised the possibility of a July Fed rate cut. Waller stated that the Fed is too tight and should consider a rate cut this month.

Earlier, US President Donald Trump also called for an interest rate cut of at least 300 basis points. The president claimed that the Federal Reserve’s delay is costing the nation huge losses.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs