Here’s The Only Way MicroStrategy’s Bitcoin Strategy Can Lead To Bankruptcy

Highlights

- MicroStrategy's Bitcoin Strategy could only lead to bankruptcy if the Bitcoin price drops below $16,500.

- CryptoQuant CEO Ki Young Ju believes it is almost impossible for that to happen.

- MSTR's treasury operations have delivered a BTC yield of 72.4% year-to-date.

CryptoQuant CEO Ki Young Ju has revealed that there is only one way that MicroStrategy’s ‘Bitcoin Strategy’ could lead to bankruptcy for the software company. The company’s BTC strategy has led to massive success despite criticisms about how it accumulates more Bitcoin.

How MicroStrategy’s Bitcoin Strategy Could Lead To Bankruptcy

In an X post, Ki Young Ju indicated that MicroStrategy’s Bitcoin Strategy could only lead to bankruptcy if the Bitcoin price drops to $16,500. He explained that MSTR has $7 billion in debt and $46 billion in BTC holdings.

Therefore, based on Bitcoin alone, the company’s liquidation price is $16,500. The CryptoQuant CEO also explained why it is almost impossible for the company to go bankrupt, stating that this would only happen “if an asteroid hits Earth.”

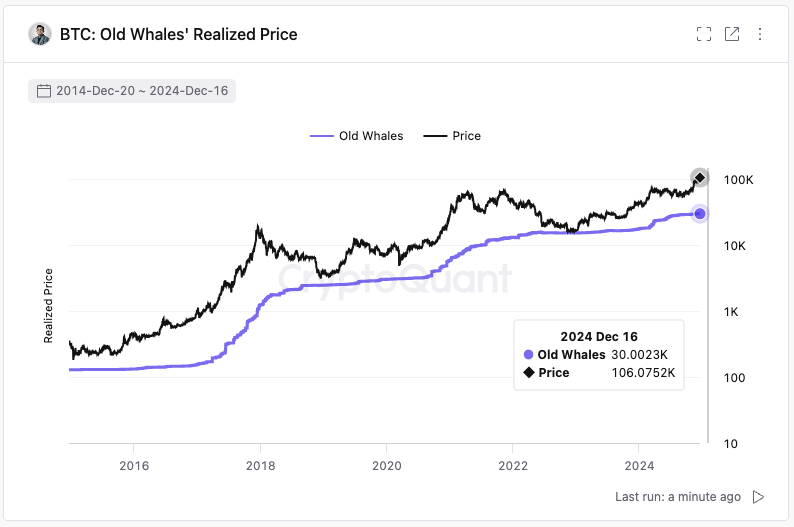

Ki Young Ju mentioned that since its inception, Bitcoin has never dropped below the cost basis of long-term whales, which currently stands at $30,000. In another X post, the crypto CEO noted that $16,000 was the last cycle’s bottom.

In this regard, Ki Young Ju believes that talking about this price target is like alluding to the $3,000 price level when the Bitcoin price hit $60,000. Basically, the crypto CEO is confident that the flagship crypto will never touch the $16,000 price level again. As such, he remarked that BTC dropped to $16,000 again after all the institutional adoption, ETFs, and MSTR buying, it is as bad as an asteroid hitting Earth.

MicroStrategy also looks to be confident that the Bitcoin price would never drop to such a level as it has continued to accumulate more BTC despite criticisms. The software company recently acquired 15,350 BTC for $1.5 billion, bringing its total Bitcoin holdings to 439,000 BTC.

Saylor Highlights Company’s Success

In an X post, MicroStrategy’s co-founder also highlighted his company’s success thanks to its Bitcoin Strategy. Saylor mentioned that MSTR treasury operations have delivered a BTC yield of 72.4% year-to-date (YTD).

Furthermore, this has led to a net benefit of 136,965 BTC to the company’s shareholders. At $107,000 per BTC, these Bitcoin profits equate to around $14.66 billion for the year. These shareholders have also witnessed a significant increase in the value of their MSTR shareholdings as MicroStaretgy’s stock is up over 540% YTD.

Saylor continues to advocate for other corporations and even governments to adopt Bitcoin. Recently, he laid a framework for the US to pay off its $36 trillion debt with Bitcoin.

- Bitcoin Quantum Threat: CryptoQuant’s CEO Flags Risk of Losing Satoshi’s 1M BTC Stash to Hackers

- Crypto Regulation: Hyperliquid Launches Policy Group to Push DeFi Integration in U.S. Markets

- XRP News: XRPL Activates Permissioned DEX Upgrade to Boost Institutional DeFi Adoption

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks