Here’s Why Bitcoin (BTC) Price Is Falling After Spot Bitcoin ETFs: CryptoQuant

Bitcoin price loses steam after the spot Bitcoin ETFs’ approval and listing on exchanges, falling over 15% from $48,969 to $40,297. In a paradigm shift, trading volumes dropped significantly on crypto exchanges..

Moreover, there’s a narrative in the market over Grayscale Bitcoin Trust (GBTC) selling Bitcoin holdings, but CryptoQuant team asserts it’s not actually the case. They also predict a short-term correction.

Bitcoin Selling By Holders

CryptoQuant head of research Julio Moreno, said it’s a wrong narrative circulating in the market that the current Bitcoin price correction is due to GBTC selling Bitcoin holdings.

Grayscale Bitcoin Trust (GBTC) sold about 60K bitcoins, but other 10 spot Bitcoin ETFs such as BlackRock, Fidelity, Bitwise have a combined net purchase of about 72K bitcoins. It indicates that the inflow is indeed increasing, with trading volumes exceeding billions.

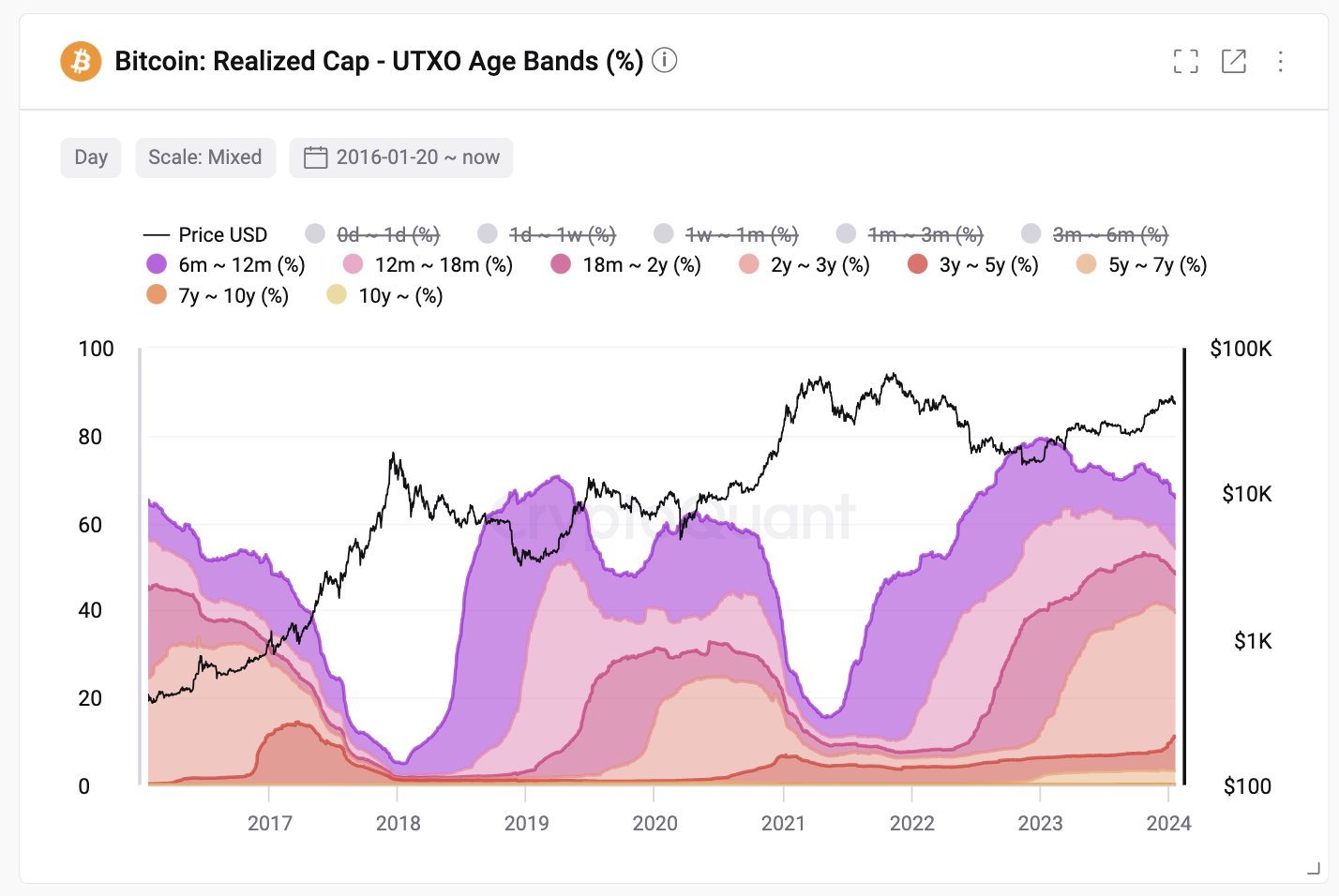

The Bitcoin selloff has come from holders including short-term traders and whales. They capitalized on the “sell-the-news” event to book profit of the recent rally.

“Several On-chain metrics and indicators still suggest the price correction may not be over or at least that a new rally is still not on the cards. Short-term traders and large Bitcoin holders are still doing significant selling in the context of a risk-off attitude. Additionally, unrealized profit margins have not fallen enough for sellers to be exhausted,” as per CryptoQuant insights.

Popular analyst CredibleCrypto noted that definitive data is proving that ETF flows are net positive at +5,000 Bitcoin bought per day since launch, which is 10 times the effect of the upcoming halving. However, recent “PA doesn’t seem to reflect that. This literally proves that there are other, more significant factors at play that have a greater influence on PA in the short/mid term.”

Read More: Spot Bitcoin ETFs See Inflows of $33.1 Million on Day 6

BTC Price To Witness Short-Term Correction

CryptoQuant founder and CEO Ki Young Ju in a post on January 20 revealed that Bitcoin in distribution phase is not fully distributed to retailers. He warns about a short-term correction in BTC price, after a 15% correction in the last few days.

However, he added that this long-term bull market cycle will continue until Bitcoin is fully distributed to retailers. The long-term outlook remains positive.

BTC price jumped 1% in the past 24 hours, with the price currently trading at $41,659. The 24-hour low and high are $40,297 and $42,134, respectively. Furthermore, the trading volume has decreased by 16% in the last 24 hours, indicating a decline in interest among traders.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs