Here’s Why Bitcoin Is Going Up Today

Highlights

- Bitcoin price soared past $66,000 today, amid a flurry of positive catalysts backing the surge.

- A whale recently accumulates nearly $400 million in BTC amid market dip.

- A prominent crypto market analyst predicts Bitcoin price to hit $91,000.

The Bitcoin price has noted recovery today, after witnessing a gloomy trading over the last 24 hours. The BTC price has dipped below the $65,000 mark from yesterday, reflecting the heightened volatile scenario in the market.

Meanwhile, amid this, the market participants are looking for potential reasons behind the recent surge in Bitcoin price.

Why Is Bitcoin Price Rising?

A flurry of factors could have bolstered gains in Bitcoin today. Here we explore some of the top reasons that may have contributed to the gains.

Bitcoin Whale Accumulation Boosts Sentiment

The recent fluctuations in Bitcoin price have provided a buying opportunity for BTC whales. Notably, some investors strategically purchase assets during times of market turmoil to book maximum profit. Given that sentiment, along with the long-term bullish outlook for Bitcoin price, several market watchers are taking the recent dip as a buying opportunity.

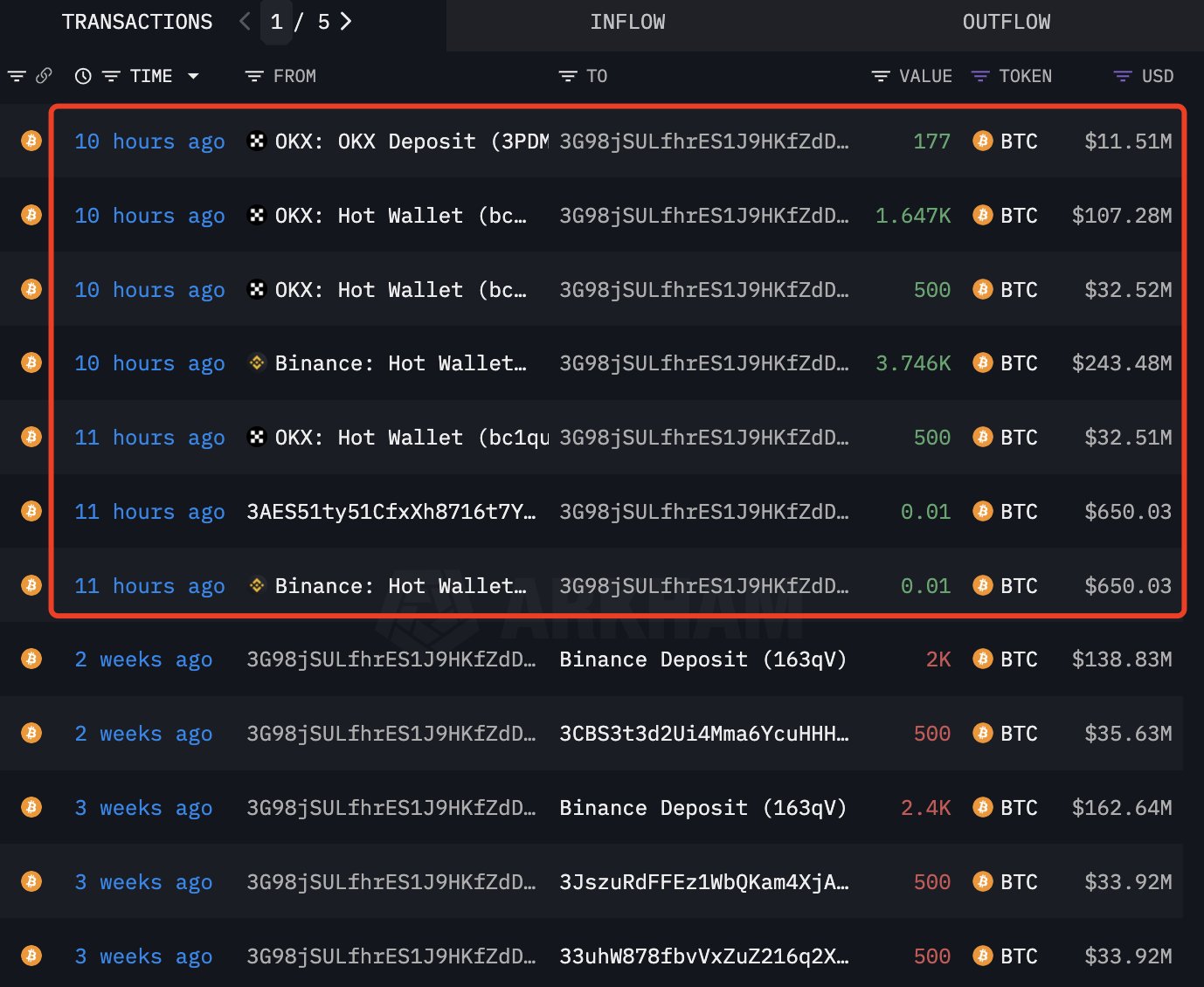

For instance, a recent report from the prominent on-chain transaction tracking platform, Lookonchain, showed that a smart whale has purchased BTC worth around $400 million. According to the report, a smart whale purchased 6,070 BTC worth $395 million amid the recent market dip.

Notably, this same whale has previously purchased 41K BTC worth $794 million during the 2022 bear market at an average price of $19,000. When the market recovered, he sold 37K BTC for $1.74 billion at an average price of $46.8K per BTC between the 2023 and 2024 bull market cycle, booking profits of about $1 billion.

Notably, the recent accumulation of $400 million marks his first purchase in over 1.5 years.

Also Read: Bitcoin Unrealized Profits Surge Above 120%, BTC Exchange Volume Tumbles, Signs of Concern?

Analysts Remain Bullish

A flurry of analysts has provided a bullish outlook for Bitcoin’s future trajectory. In addition, the launch of the U.S. Spot Bitcoin ETF along with the growing institutional interest in the crypto has also fueled market sentiment.

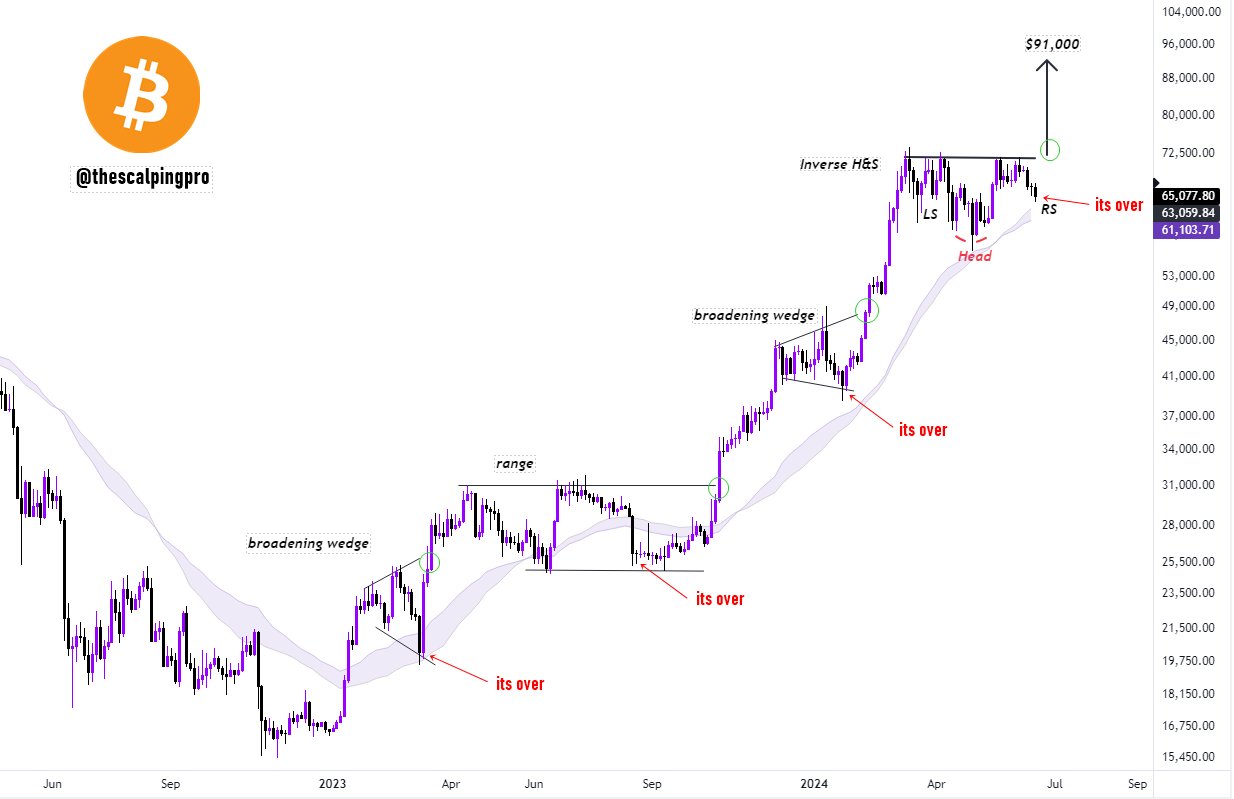

Recently, prominent crypto market expert Mags (@thescalpingpro) has shared a positive outlook for Bitcoin. In an analysis on X, Mags has cited the historical trend of Bitcoin price and predicted BTC to hit $91,000 soon.

In addition, another popular analyst Michael van de Poppe has recently said that Bitcoin has “likely bottomed” as it traded between the $63K and $65K range. This positive analysis seems to have boosted the market confidence, leading to a recovery in Bitcoin price.

Michael Saylor’s MicroStrategy Raises BTC Bets

MicroStrategy, led by Michael Saylor, has recently announced to offer of $700 million in convertible senior notes for investors. Notably, the company said that it would use the proceeds from this offering to buy more Bitcoin, sparking discussions in the market.

Notably, as the price recovers today, Whale Panda has further fueled discussions with a recent X post. In a recent post, Whale Panda said that the recent surge in BTC could be due to Michael Saylor getting “his $700 million”.

Bottom Line:

The recent recovery in the broader market, along with the BTC price surge has helped investors to shift their focus towards the flagship crypto. During writing, Bitcoin price soared 1.13% and crossed the brief $66,200 mark, reflecting the increasing confidence of the investors.

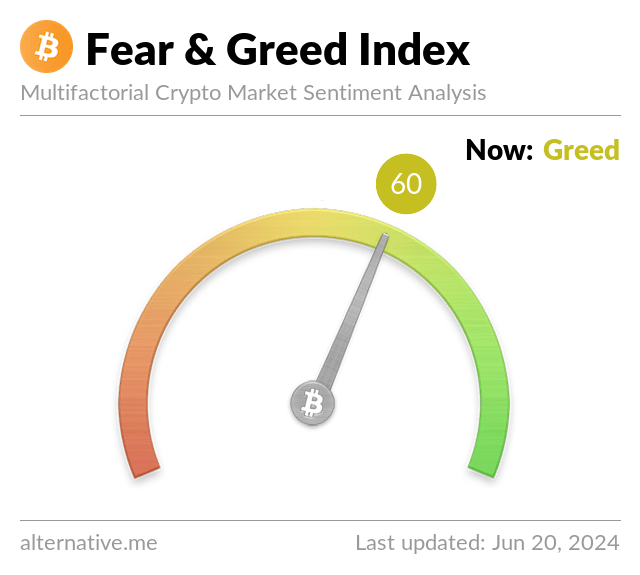

In addition, CoinGlass data showed that Bitcoin Futures Open Interest rose 0.42% over the last 24 hours and 0.81% in the 4-hour timeframe. On the other hand, the Bitcoin Fear and Greed Index stood at 60, suggesting a greed sentiment in the market.

Meanwhile, with the recent bullish remarks from the analysts, along with the greed sentiment hovering in the market, Bitcoin price may continue its upward momentum. However, investors should exercise due diligence, given the still-volatile scenario hovering over the market.

Also Read: Singapore Banks Under Scrutiny Sequel To Crypto Related Crimes

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs