Here’s Why Crypto Market Faces $325 Bln Loss

Highlights

- The global crypto market cap lost more than $325 billion since Friday morning.

- Bitcoin price fell nearly 8% today and hovered near the $87K mark.

- Top altcoins like Ethereum, Solana, XRP, and others, saw losses exceeding 10%.

The crypto market is in turmoil, with its total market cap plunging by $325 billion since last Friday. Bitcoin’s price took a sharp 8% hit, dropping to the $87,000 mark. Leading altcoins like Ethereum, XRP, and Solana saw losses exceeding 12%.

So, here we take a quick look at the potential reasons that may have dampened the investors’ sentiment.

Why Is Crypto Market Falling?

A flurry of factors might have contributed to the recent crypto market collapse. A combination of liquidity issues, macroeconomic trends, and technical sell-offs appears to be behind the latest downturn.

According to The Kobeissi Letter, a leading global capital markets commentary platform, crypto markets erased $100 billion in just one hour today without any major headlines. The platform pointed out that around $150 billion in liquidations occurred in 24 hours, dragging almost all cryptocurrencies down.

Even the meme coin sector, which had been booming, saw a steep decline. Notably, CoinGlass data showed that $1.49 billion has been liquidated in the last 24 hours amid the broader digital assets market crash. As of writing, the global crypto market cap stood at $2.9 trillion.

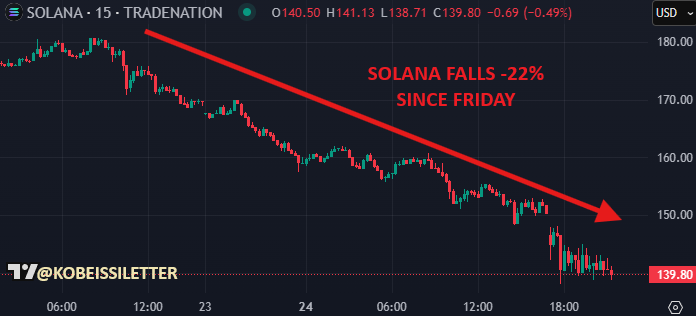

Solana’s Downfall Triggered Selling Pressure

Solana was one of the key players in the recent crypto frenzy, especially with meme coins driving its rapid surge. However, as memecoin hype started fading, Solana price suffered a drop of around 20% in a week. Initially, this decline remained isolated from Bitcoin, but it later spread across the market.

Adding to the market-wide sell-off, the S&P 500 also began losing ground on Friday. Bitcoin, often correlated with broader financial markets, followed suit. Once Bitcoin broke below the $98,000 support level, panic selling intensified. As of writing, BTC price was down about 8% and hovered near the $87K mark.

Citadel’s Crypto Pivot and the Bybit Hack Impact

Interestingly, the sharp decline came just hours after a report that the $65 billion financial giant Citadel Securities is exploring the crypto space as a liquidity provider. However, instead of boosting market sentiment, the news triggered a “sell-the-news” reaction.

Another major blow came from the Bybit hack, which cybersecurity firm Arkham Intelligence described as the “largest financial heist in history.” The hack exceeded $1 billion in stolen assets, more than doubling the infamous $611 million PolyNetwork breach in 2021. Such security incidents erode investor confidence, leading to more panic-driven exits from the market.

Crypto Market Pullback: Normal Correction or Bull Run End?

Ethereum’s weakness has added more strain to the broader crypto market. The recent wave of selling appears to be a mix of technical pullbacks and declining liquidity. However, analysts suggest that such corrections are part of a healthy market cycle.

For context, in a recent X post, popular market expert “il Capo Of Crypto” hints at a “strong bounce” in the market. These comments indicate that despite the short-term selloff, the crypto market is likely to witness a strong comeback in the coming days.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- JPMorgan Projects Bullish Crypto Market in H2 Following CLARITY Act Approval

- Hong Kong Moves Closer to Crypto Tax Cuts Amid Stablecoin Regulatory Framework

- Popular Analyst Willy Woo Predicts Major Bitcoin Price Crash, Bear Market Bottom Timeline

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs