Here’s Why Curve Finance, Uniswap Witnessed Massive Spike in Volume

There is not a single dull day in DeFi.

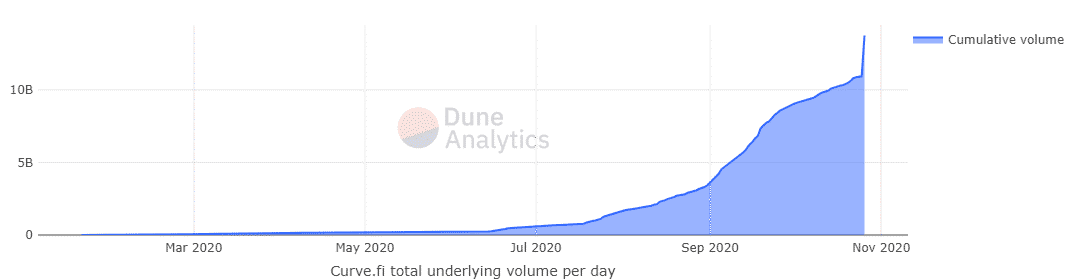

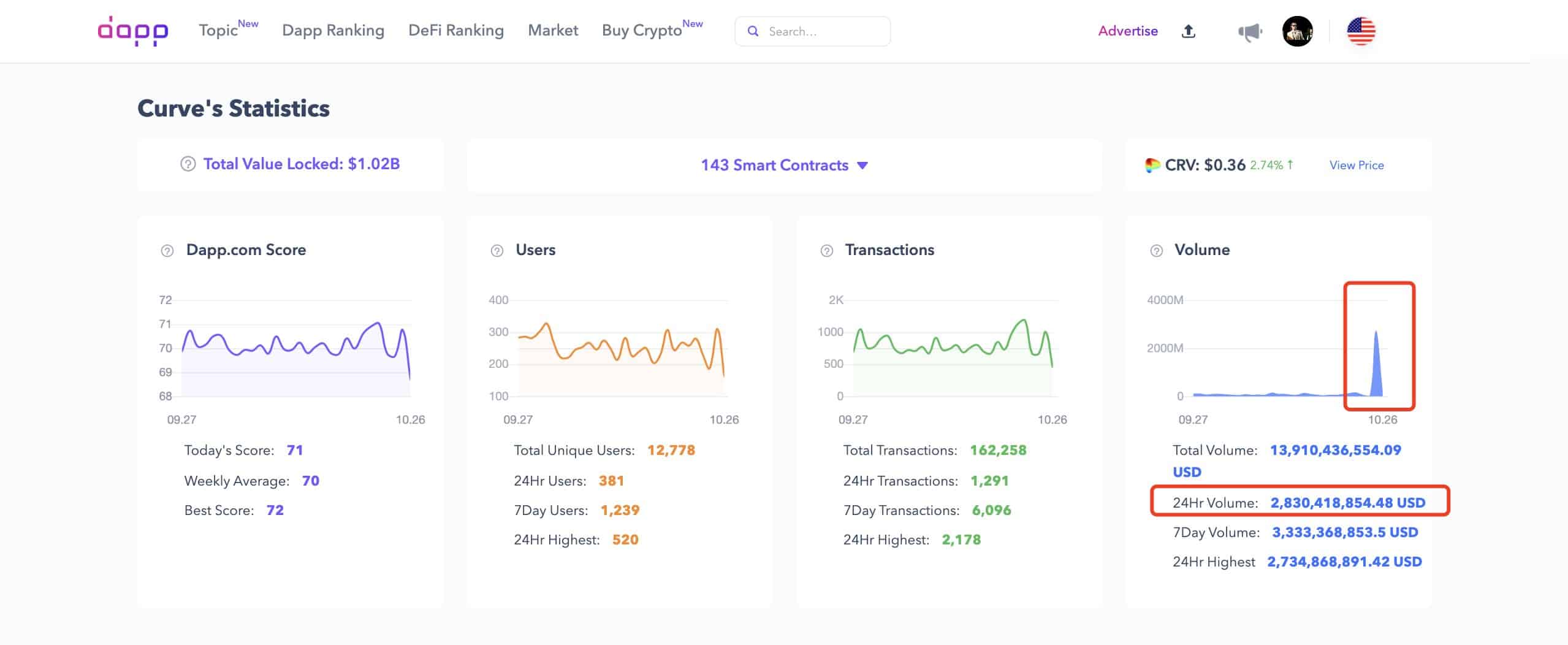

The decentralized finance [DeFi] space has been known for wild swings be it in terms of token’s price, or trading volume. In the latest development, Automated market maker Curve Finance saw its daily trading volume spike massively to a fresh all-time high after maintaining a steady upward trajectory. This was noted in the charts compiled by Dune Analytics which noted a sharp surge with respect to its cumulative volume. According to Dapp.com’s charts, the trading volume figures reached a whopping $2.8 billion.

This was followed by Curve’s native toke CRV surge of 12.76% over the last 24-hours which drove its value to $0.390, at press time. It is important to note that the price of the other DeFi tokens, in general, was rather sluggish and uneventful. To top that, CRV has not been performing very well of late. In fact, its price fell drastically after hitting an ATH of $11.49. Hence, CRV’s abrupt price rise was quite unexpected.

Not an Isolated Event

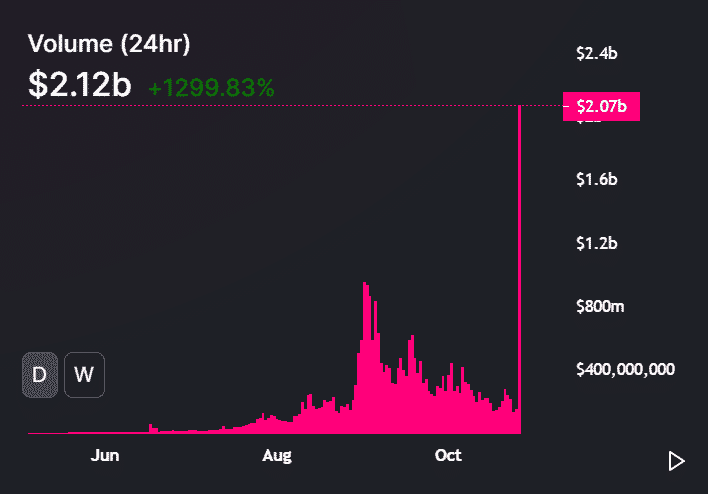

This was, however, not an isolated event. Uniswap’s trading volume also surged to a never-before-seen level of $2.7 billion as it surpassed its previously established peak of $953 million in the first week of September by more than180%. So what exactly happened? The entire episode is connected with the recent security breach in another popular [or rather infamous] DeFi protocol, Harvest Finance.

Long story short, an attacker reportedly exploited about $24 million from Harvest Finance pools and swapped it for renBTC and then finally to Bitcoin. Prior to this, the entity in question is said to have taken a flash loan in a bid to manipulate prices on Curve Y Pool to drain USDT and USDC many times. This was notified by the platform, which stated that the breach was an “economic” attack and was carried out via the Curve Y pool. This, in turn, triggered a stretch in the price of the stablecoins in Curve out of proportion and depositing and withdrawing a large amount of assets through Harvest.

Similarly, the trading volume on Uniswap also went through the same, as the Harvest Finance attacker ran the stolen funds through the platform.

No hacker.Just a simple* $24M (0x53f) juicy arb on @harvest_finance

$50M USDC flash loan @UniswapProtocol

Swap $11M (USDC/USDT) @CurveFinance

~61M on fUSDT Vault

Swap $11M USDT/USDC yUSDT

Withdraw $61M with $0.5M profit

Repeat & clean into @TornadoCashhttps://t.co/nFTuyU3s6w pic.twitter.com/2oXQ2PsY32— Julien Bouteloup (@bneiluj) October 26, 2020

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs