Bitcoin Price Rally to Continue As Per Historical Trends : Bloomberg

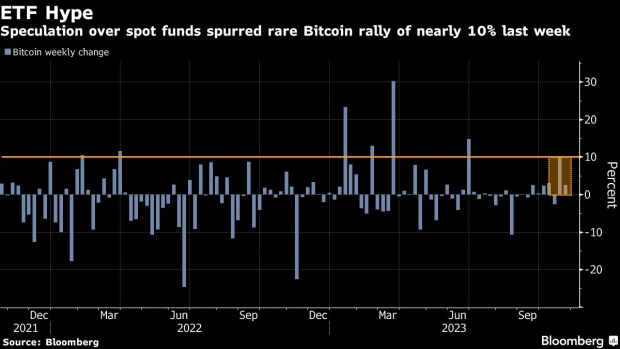

The Bitcoin price surged past $34,500 with significant momentum, driven by the anticipation of a Bitcoin ETF approval from the U.S. Securities and Exchange Commission (SEC) later this year. Both traditional and crypto analysts are forecasting a continued uptrend for BTC, supported by bullish momentum. Over the past week, BTC’s price has risen by over 10%, largely due to increasing demand from institutional investors and whales.

History Suggests Further Upside In Bitcoin

In the past five years, weekly gains of at least that amount led to a 10% average increase in the value of Bitcoin over the next month, according to Bloomberg data. The crypto market cap jumped 2% in 24 hours amid rising anticipation of a spot Bitcoin ETF approval this year. Bitcoin and altcoins continue upside momentum, with Ethereum rising more than 3%.

Asset managers such as BlackRock and Fidelity Investments are racing to offer a spot Bitcoin ETF in the US. Some believe a Bitcoin ETF approval will bring massive inflows into the crypto market.

“The drums seem to be beating louder that a Bitcoin ETF will be approved by year-end, which would be supportive for the token in the medium term as it will likely bring more institutional players into the space,” said Tony Sycamore, a market analyst at IG Australia Pty.

Bitcoin finds support from the U.S. Federal Reserve officials’ dovish stance on further rate hikes. The Fed comments hint at cooling inflation, reducing the need for another interest rate hike. In addition, inflows in crypto funds week-over-week indicate rising demand of BTC by institutional investors.

Caroline Bowler, chief executive officer at crypto platform BTC Markets Pty predicts “Volatility in Bitcoin has the potential to escalate further.”

Also Read: Bitcoin Shorts Are Piling Up As the BTC Price Shoots Past $30,000, What’s Next?

BTC Price Inches Toward $31,000

BTC price jumped 3% in the last 24 hours and 10% in a week, with the price currently trading at $30,700. The 24-hour low and high are $29,720 and $30,951, respectively. Furthermore, the trading volume continues to increase, with 20% in the last 24 hours.

Popular crypto analyst CredibleCrypto predicts a monthly close above $30k-$32k to bring a rally. Meanwhile, some are concerned about the monthly resistance level at $35k or the bearish OB that starts at $37k. However, he believes it’s the best time to go long in BTC.

Crypto analysts said the real upside momentum starts above $31,000. The chart patterns and indicators reveal bullish continuation.

Also Read: BlackRock CEO Larry Fink Bullish On BTC, Says Bitcoin’s Value Equals Human Freedom

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?