Breaking: Hong Kong Virtual Asset Consortium Considering Terra Luna Classic (LUNC)

Hong Kong rating agency Hong Kong Virtual Asset Consortium (HKVAC) to consider including Terra Luna Classic (LUNC) in its digital asset index. The Hong Kong rating agency announced the initial list of cryptocurrencies for its large market cap index, but it also plans to announce other indexes to include more cryptocurrencies in its supported list.

Terra Luna Classic in Hong Kong Virtual Asset Consortium Index

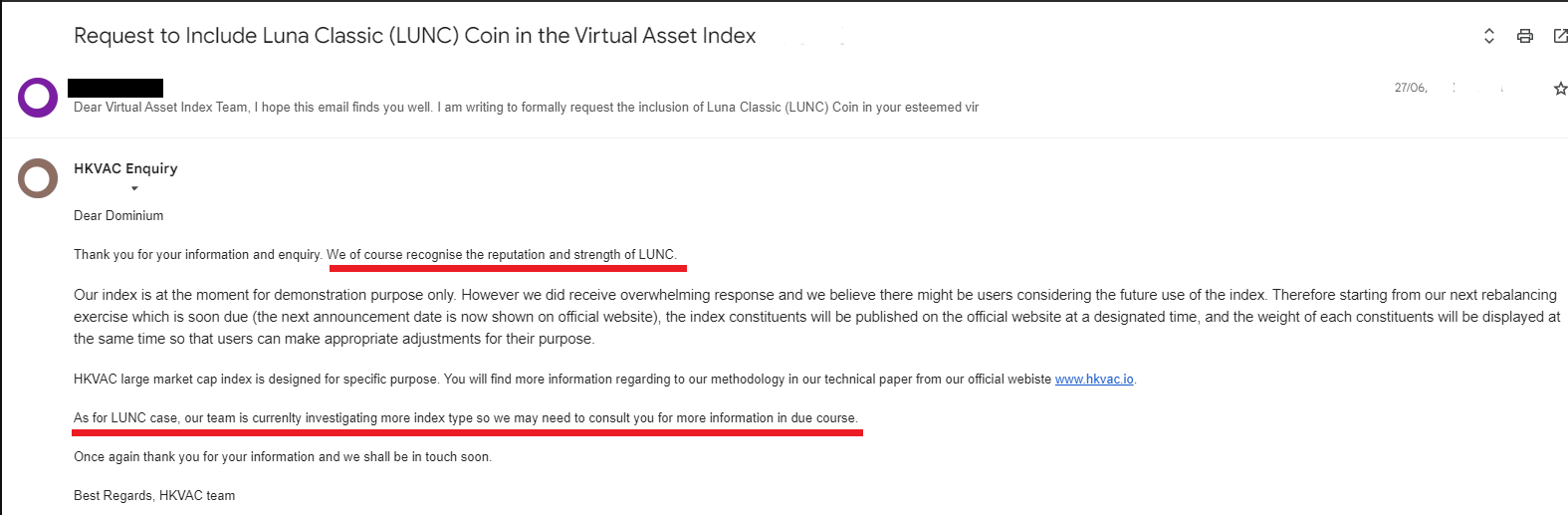

Terra Luna Classic community member sent a format request to Hong Kong Virtual Asset Consortium to include Terra Luna Classic (LUNC) in the digital currency index.

The HKVAC team responded by saying it acknowledges the reputation and strengths of Terra Luna Classic, as well as connections with crypto exchange Binance. The HKVAC large market cap index is created for a specific purpose and index constituents will be published on the official website on July 14. Moreover, the HKVAC team is considering more index types and will consult the Terra Classic community for more information.

“Our index is at the moment for demonstration purposes only. However, we did receive overwhelming response and we believe there might be users considering the future use of the index.”

The inclusion of Terra Luna Classic (LUNC) will boost the community efforts to revive the project. Currently, developers are working on USTC repeg, increasing LUNC staking, and boosting token burn to reduce circulating supply after a major upgrade that brought the chain in parity to Terra 2.0 and other Cosmos chains. However, the chain is still behind as compared to other Cosmos chains as well as the latest upgrades.

Also Read: Terra Classic To Burn 900 Mln LUNC Reminted From Binance, Total Burn 65 Bln

LUNC Price Fails to Hold Above Support

LUNC price fell 4% in the last 24 hours, with the price currently trading at $0.000087. The 24-hour low and high are $0.0000873 and $0.0000919, respectively.

As per CoinGape Markets, a breakdown below the support of $0.000090 will accelerate the selling pressure and plunge the altcoin 10% to hit the next significant support of $0.0000822.

Also Read: FTX CEO John Ray Begins Talks on Restarting & Renaming Crypto Exchange

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise