Hong Kong’s QMMM Stock Soars 1,700% Following Crypto Treasury Plan

Highlights

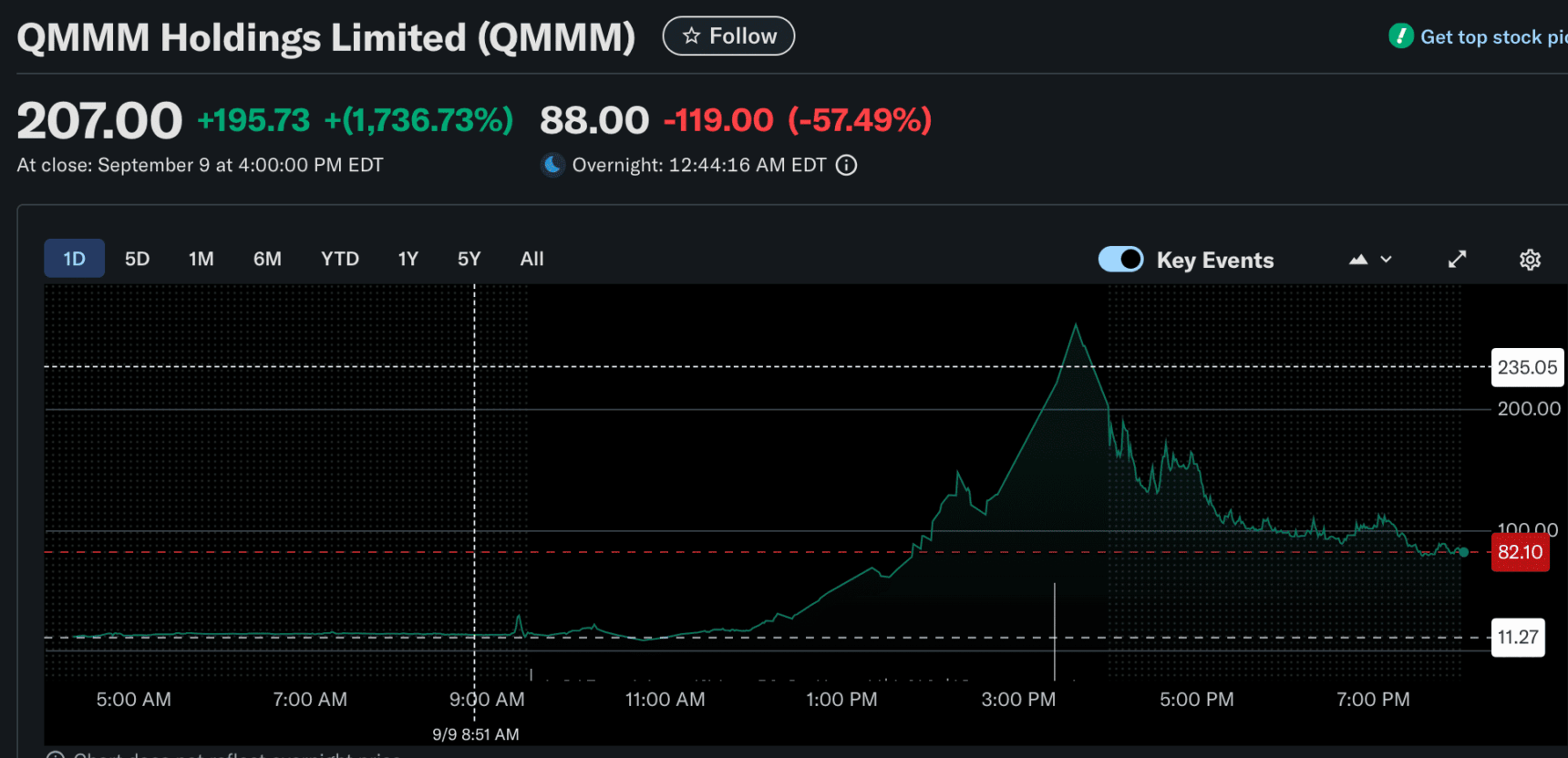

- QMMM Holdings’ stock surged over 1,700% in a single day, reaching a high of $207 before settling at $88 after hours.

- The rally boosted QMMM’s market cap to nearly $12 billion, just months after its $8.6 million IPO.

- The Hong Kong media firm announced a $100 million crypto treasury strategy, focusing on Bitcoin, Ethereum, and Solana.

Shares of QMMM Holdings recorded massive gains, surging by over 1,700% on Tuesday. This came after the Hong Kong firm announced plans to enter the cryptocurrency sector with a treasury strategy and blockchain-powered analytics platform.

QMMM Stock Skyrockets After Treasury Announcement

According to Yahoo Finance data, Hong Kong media-based company QMMM Holdings saw its shares soar by more than 1,700% during Tuesday’s session. The stock hit a high $207 before retreating to $88 in after-hours trading.

QMMM Holdings went public in June 2024, raising $8.6 million through its IPO. The company’s shares now command a market capitalization of nearly $12 billion.

The stock’s rise is even more striking when measured over the past year. It has recorded more than 3,260% growth as the firm expanded from its traditional advertising and avatar technology business into digital finance.

This rally is similar to events that occurred in Monday’s trading session. Eightco’s shares rocketed more than 3,000% after unveiling its own crypto treasury initiative.

Analysts, however, warned that sharp corrections, like the drop in after-hours trading, are not uncommon in such speculative surges.

QMMM Holdings Outlines Crypto-Focused Strategy

In a recent press release, the media firm announced a digital asset treasury initially targeting Bitcoin, Ethereum, and Solana, to reach $100 million. Additionally, Web3 infrastructure projects and long-term, premium crypto assets will be the portfolio’s primary focus.

The firm also unveiled a plan to create a decentralized marketplace for crypto analytics. They shared that the platform will be built using artificial intelligence, blockchain, and data services. The company aims to offer tools that process huge amounts of blockchain data through this platform. This would provide traders and institutions with valuable information.

Beyond trading support, the envisioned ecosystem will include automated agents capable of handling DAO treasuries, enhancing metaverse interactions, analyzing smart contracts for vulnerabilities, and even assisting with code development.

“Our entry into this space reflects both the accelerating adoption of blockchain and our determination to bridge the digital economy with real-world use cases,” said CEO Bun Kwai. “By combining AI, compliance, and ecosystem partnerships, we see QMMM becoming a leader in Web3 innovation.”

Many media companies are now starting to pivot into blockchain finance. In July, K Wave Media revealed it had raised $1 billion to build a Bitcoin-focused treasury, backed by financing from Anson Funds.

Similarly, Trump-linked Thumzup Media diversified its treasury beyond Bitcoin to include assets such as XRP and Dogecoin. This shows a growing adoption among media and entertainment firms seeking long-term exposure to digital currencies.

These actions demonstrate how crypto is increasingly acknowledged as a strategic growth driver as well as a balance-sheet asset. The media company could become one of Web3’s strongholds thanks to its $100 million crypto treasury plan.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs