How Iran’s Central Bank Acquired $507M in Tether’s USDT to Support the Rial

Highlights

- Iran central bank built $507M USDT reserves to stabilize the rial outside banking.

- Elliptic traced USDT flows through TRON, UAE dirhams, and later cross-chain bridges.

- Tether blacklisted wallets, freezing millions as blockchain transparency exposed flows.

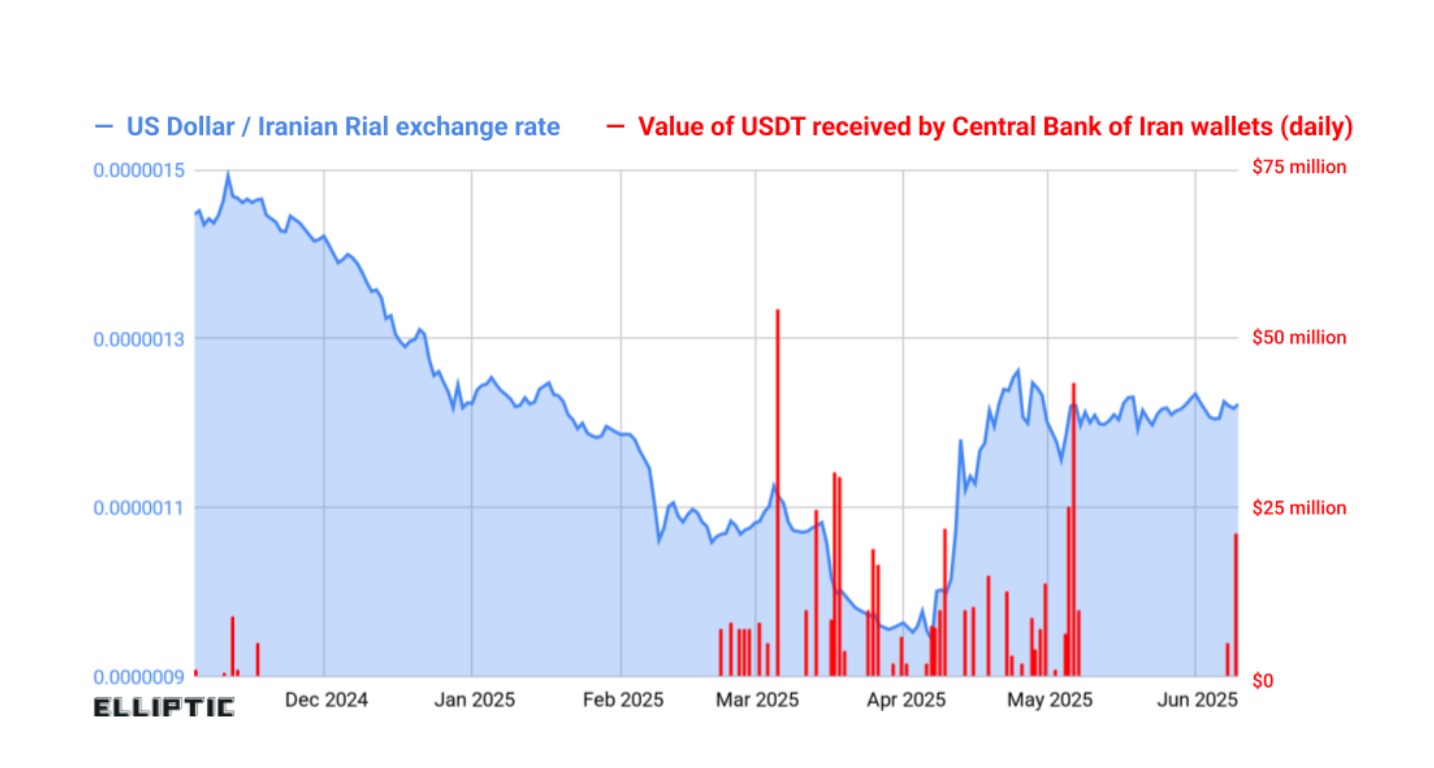

Iran’s central bank acquired at least $507 million in Tether’s USDT in April and May 2025, according to Elliptic. The purchases came from Iran, the UAE, and public blockchains, using payments in Emirati dirhams. The activity involved the Central Bank of Iran and aimed to stabilize the Rial while bypassing restricted banking channels.

How Did Iran Accumulate the USDT?

According to Elliptic, researchers traced wallets linked to Iran’s Central Bank through transaction patterns and documentation. Payments moved in AED, then settled on TRON, building a sizable stablecoin reserve.

Based on these findings, Elliptic mapped a broader wallet structure tied to Iran’s Central Bank. The identified wallets accumulated at least $507 million in USDT. However, Elliptic stressed that this figure shows only wallets attributed with high confidence.

This growing stockpile formed during the Rial’s weakness. Reports cited the Rial halving in value within eight months. As a result, the central bank appeared to seek faster access to dollar-linked assets outside traditional channels.

Interestingly, this development comes just weeks after CoinGape reported that Iran was accepting crypto payments for weapon sales. The country’s official defense export agency had offered advanced weapons systems in exchange for digital assets.

Move From Local Exchange to Cross-Chain Routes

Initially, most USDT flowed to Nobitex, Iran’s largest crypto exchange, as per Elliptic. Nobitex allowed users to hold USDT, trade cryptoassets, or sell tokens for rials. This routing suggested direct injection of dollar liquidity into Iran’s domestic market.

However, the pattern changed in June 2025. USDT transfers moved from the top layer -1 network TRON to Ethereum through a cross-chain bridge. Funds passed through decentralized exchanges, other blockchains, and centralized platforms, extending through late 2025.

This shift followed a major Nobitex security breach. On June 18, 2025, hackers stole $90 million in cryptoassets. The pro-Israel group Gonjeshke Darande claimed responsibility and destroyed the assets by sending them to inaccessible wallets.

Sanctions, Transparency, and Wallet Freezes

Elliptic reported that Iran’s USDT use aimed to address two constraints: currency collapse and trade settlement barriers. Routing USDT to Nobitex aligned with efforts to support the Rial through market operations. Meanwhile, later cross-chain activity suggested attempts to manage funds beyond local exposure.

Despite these efforts, blockchain transparency kept transactions visible. Public ledgers on TRON and Ethereum allowed investigators to trace flows. As a result, enforcement actions followed at key control points.

Tether blacklisted several wallets linked to Iran’s Central Bank on June 15, 2025. That action froze about 37 million USDT. Separately, on January 11, 2026, TRM Labs reported Iran’s IRGC moved nearly $1 billion in crypto between 2023 and 2025.

Meanwhile, Iran’s central bank built a large USDT reserve through identifiable wallets, cross-chain transfers, and exchange routing. Elliptic traced the accumulation, movement, and later disruption of these funds through blockchain data. Enforcement actions, including wallet blacklisting and freezes, later exposed and constrained parts of this structure.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs