Bitcoin Price Down 20%: Can BTC Slip To $70K Soon?

Highlights

- Bitcoin price slipped more than 20% from its ATH of $109K.

- As BTC continued its fall, experts warned over further dip ahead for the crypto.

- If Bitcoin starts recovering, the market pundits have highlighted key price levels to watch ahead.

Bitcoin price has continued to bleed today with its value falling by more than 20% from its recently reached all-time high. However, the current movement of the flagship crypto hints that the storm is not yet over and another wave of disappointments might be there for the investors. So, let’s see what experts are saying and how low BTC can go amid the bear-dominating phase.

Bitcoin Price Slips 20%: More Dip Ahead?

Bitcoin price lost 16% over the last 30 days while declining 11% in a week. Besides, it bleed nearly 20% from its recent ATH of $109,114.88. This reflects the investors’ waning risk-bet appetite and fading market interest in the digital assets space. Notably, this is also evidenced by the massive outflow in the US Spot Bitcoin ETF over the past few days, with $754.6 million recorded on February 26.

Meanwhile, BTC value today slipped about 3% from yesterday to $86,147 with its one-day trading volume declining 12% to $70.33 billion. Notably, the crypto has slipped to as low as $82,131.90 in the last 24 hours while touching a high of $89,223.08. Besides, CoinGlass data showed that Bitcoin Futures Open interest also fell 6% from yesterday, reflecting the gloomy market sentiment.

More BTC Dip: Key Levels To Watch

The experts remain cautiously optimistic despite the brewing storm in the broader digital assets space, as evidenced by the recent crypto market crash. A flurry of market pundits also sees this latest Bitcoin price plunge as a healthy correction, which might attract more investors to enter at a lower price.

For context, in a recent X post, renowned market expert Michael van de Poppe said that BTC must hold the $87K mark for a strong recovery. However, he also noted that failing to hold this level could trigger a massive selloff which might drive the BTC price to $70K. Despite that, Poppe noted that the BTC price correction is “great” for the investors to buy at a “25% discount from the recent high.”

Bitcoin Price To $70K Imminent?

It’s difficult to precisely predict how low can the flagship crypto go if the bears continue to dominate. However, as per the market trends and experts’ comments, it appears that BTC might find its next support at nearly $70,000. Having said that, it is very likely that the crypto might slip to the level ahead.

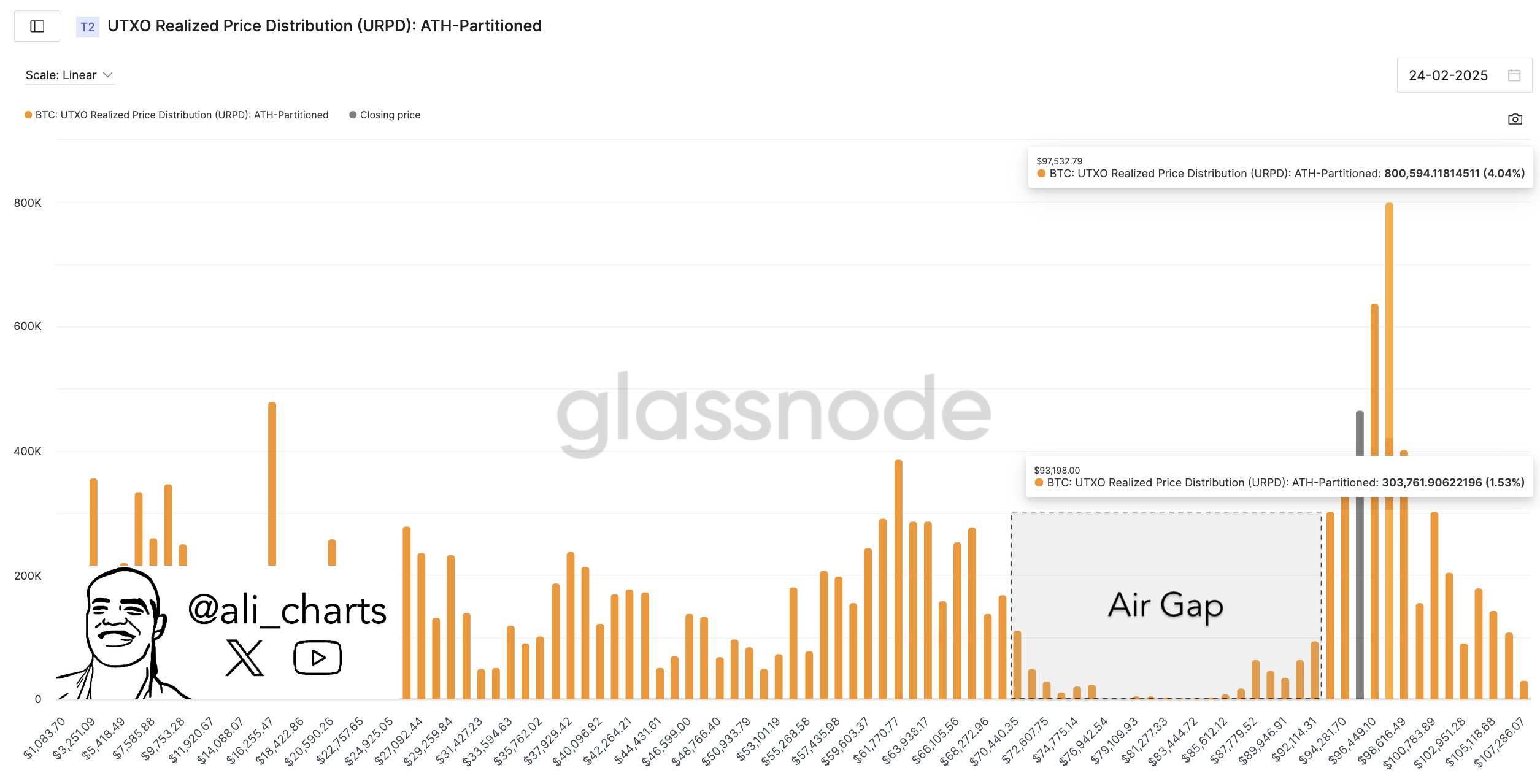

Meanwhile, echoing a similar sentiment to Michael van de Poppe, another expert Ali Martinez recently said that BTC below the $93,198 mark will find its support at $70,440. Considering that, it seems that BTC price might slip to the 70 territory if the investors continue to stay in the sideline.

Simultaneously, a recent BTC price prediction also hints at a correction to $70K by the year-end. So, investors might trade cautiously amid the volatile market scenario. But what if the flagship crypto starts recovering?

BTC Recovery Possible? Here Are The Price Levels To Watch Then

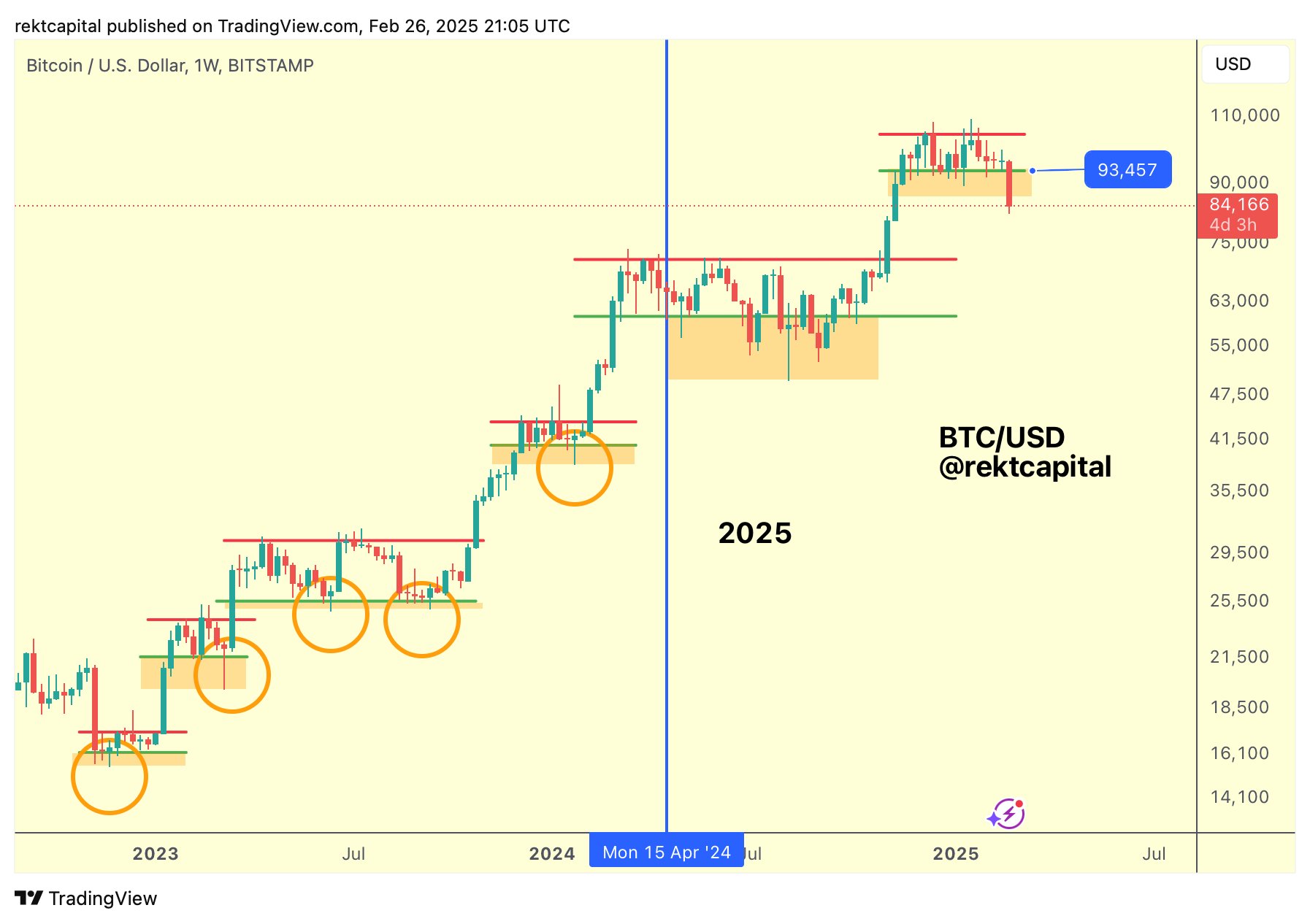

Despite the recent market downturn, experts remain optimistic about Bitcoin price’s long-term prospects. Analyst Rekt Capital notes that Bitcoin is closing in on filling the CME Gap created between $78,000 and $80,700 in November 2024. Additionally, a new CME Gap has formed between $92,700 and $94,000, which could lead to a relief rally and a potential revisit of the $93,500 price point.

Other experts, like Rose Premium Signals, predict even more ambitious targets for BTC price, with a potential long-term price of $130,000. With Bitcoin having filled nearly every CME Gap since mid-March 2024, a price recovery may be on the horizon. As the market watches for signs of a turnaround, investors remain hopeful that Bitcoin will regain its upward momentum.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs