How Low Could Solana Price Drop By The End Of December?

Highlights

- The Solana price could drop to the 200 EMA at $167 before the year ends.

- Crypto analyst Fred said that decision time is approaching for SOL and the crypto risks dropping to $162.

- Solana is still expected to break its current ATH.

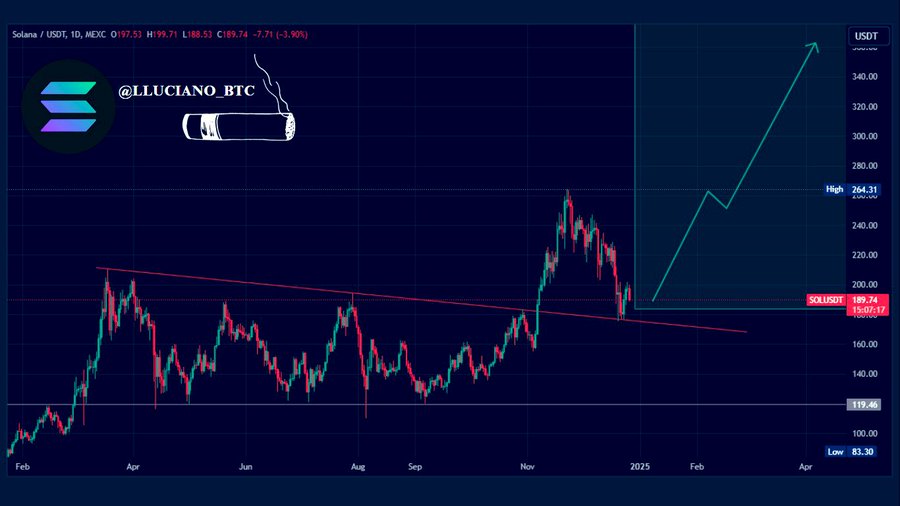

The Solana price has witnessed a significant correction since it reached its current all-time high (ATH) of $263 in November. This price correction is expected to continue in the short term as a crypto analyst has provided a target that Solana could drop before the year ends.

How Low Solana Price Could Drop

In an X post, crypto analyst Crypto Sensei suggested that the Solana price could drop to as low as $167 by the end of December. This came as the analyst asserted that Solana is now going straight for that 200 Exponential Moving Average (EMA) touchdown.

The analyst’s accompanying chart showed that this 200 EMA is at $167. Based on the chart, the price drop could also happen before the year ends. Such a price correction would further erode Solana’s year-to-date (YTD) gains of around 85%.

In an X post, crypto analyst Fred also suggested that the Solana price is also at risk of dropping further before the year ends. The analyst stated that SOL is approaching decision time.

The analyst’s accompanying chart showed that the top crypto could drop to as low as $162 if this downtrend continues. However, despite a potential downtrend, the crypto analyst remarked SOL still has enough gas for another rally of over $300 over the next couple of months.

More Room For Growth

Despite the bearish outlook for the Solana price, the top crypto still undoubtedly has enough room to run to the upside, as Fred mentioned. Several analyses indicate that SOL could break its current ATH by next year.

Asset manager VanEck predicted that Solana would hit $500 by next year, a price rally that they believe will happen thanks to scalability and DeFi and NFT adoption in the SOL ecosystem.

Bitwise provided a more bullish outlook for the Solana price. The asset manager predicted that SOL will rise to as high as $750 next year as more “serious” projects move into its ecosystem.

With the market trading sideways at the moment, crypto analyst Lucky believes this is an excellent opportunity to accumulate more SOL. He remarked that the crypto is in a buying zone. The analyst added that he anticipates Solana could reach between $400 and $500 in this cycle.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

Buy $GGs

Buy $GGs