How To Trade This Week As $9.3 Billion in Crypto Options Set to Expire

Highlights

- Crypto traders brace for volatility as over $9.4 billion in crypto options are set to expire on Friday.

- The US PCE inflation release, Fed's preferred measure to gauge inflation, is also set to release on the same day.

- Bitcoin price set to pullback on rising pressure, but can prepare for massive rally expected after bitcoin halving.

The crypto market celebrated the fourth Bitcoin halving on April 20, but Bitcoin and crypto prices didn’t see a significant rally or major upside. Traders are actually awaiting the first crypto market expiry after the Bitcoin halving, which is also a monthly expiry and can cause more volatility. Deribit reported over $9.4 billion in crypto options are set to expire this Friday.

$9.3 Billion in Crypto Options Expiry

The overall optimism after the Bitcoin halving remains bullish and investors hold Bitcoin price above $66,000. As crypto market sentiment by the Fear & Greed Index indicates an uptick in sentiment, with an increase in sentiment from 57 (neutral) to 72 (greed), the market participants are waiting for some headwinds to disappear before taking new positions.

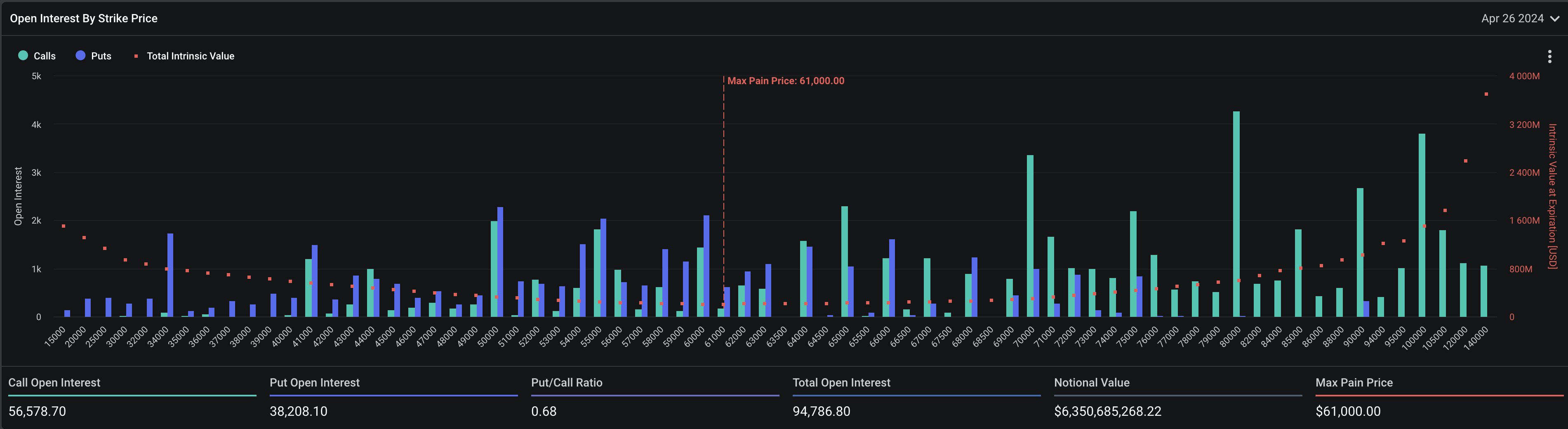

Over 96k Bitcoin options of $6.2 billion in notional value are set to expire on Friday. The put-call ratio is 0.68, indicating a rise in put options recently as monthly expiry approaches. The max pain point is $61,000, below the current price. The market can expect huge volatility with a pullback in price expected on the expiry day.

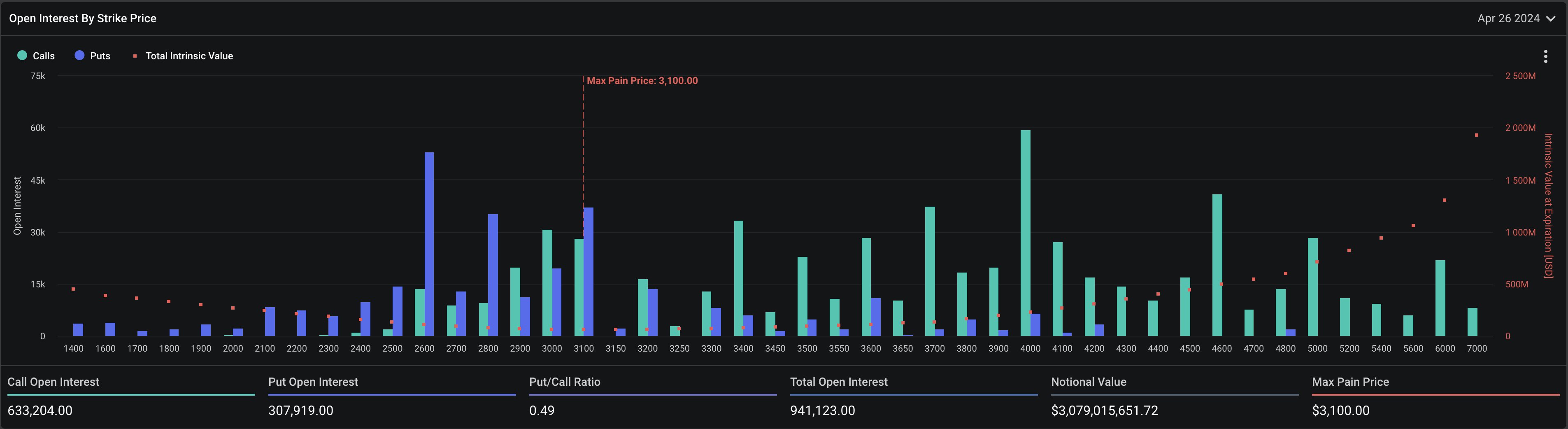

Moreover, 990k Ethereum options of notional value $3.1 billion are set to expire, with a put-call ratio of 0.51. The max pain point is $3,100, with the ETH price currently trading above the max pain point at also higher than the current price of $3,152.

The trades in the last 24 hours indicate an increase in put open interest with a put/call ratio of 0.84. The price could witness a decline to max paint point.

Notably, Deribit in a post on X revealed that realised volatility has surged as BTC Volatility Index (DVOL) saw a sharp increase as crypto options expiry comes near.

Furthermore, on-chain analyst IT Tech has warned about potential liquidation in the short-term due to high leverage. He said the CVD Perp shows more selling orders have been filled, while CVD Spot is showing some early signs of demand. This will set a potential recovery in BTC price for a massive rally.

Also Read: Glassnode Founders Predicts Bitcoin Climbing Back to $72K Soon

Bitcoin Price Performance

BTC price action remains volatile in the past 24 hours, with the price currently trading near $66,500. The 24-hour low and high are $65,864 and $67,148, respectively. Furthermore, the trading volume has decreased slightly in the last 24 hours.

Total Bitcoin futures open interest across crypto exchanges has increased by over 1% in the past 24 hours, with the buying mostly coming in the last few hours. The BTC futures OI of 480.07K are worth $31.96 billion.

A new whale accumulated 500 BTC worth $33 million amid consolidation for potentially taking BTC price to $70,000. However, U.S. PCE inflation data is also set to release on Friday, keeping the trading activity flat.

US dollar index (DXY) fell slightly under 106, but still high as compared to earlier weeks. Also, the US 10-year Treasury yield (US10Y) has jumped to a 6-month high of 4.636%, putting pressure on Bitcoin price.

Also Read: Dogwifhat (WIF) Price Skyrockets Over 20%, Here’s Why

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs