How Will Bitcoin Price Perform As Oil Jumps 5% Ahead of FOMC Meet This Week

Highlights

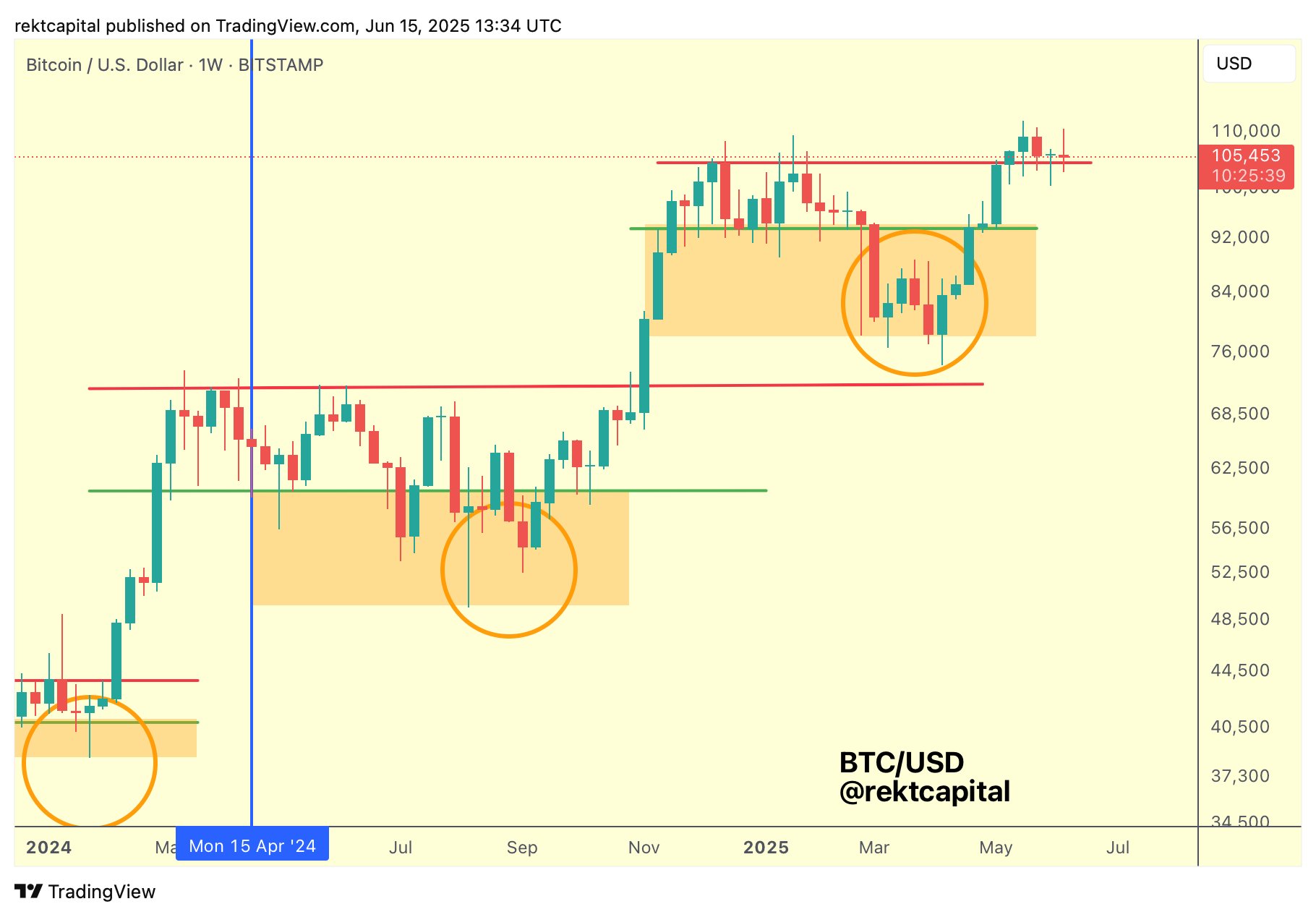

- Bitcoin price holds firm above the top its re-accumulation range hinting strong bullish sentiment.

- Analysts anticipate potential market impacts from rising oil prices, which could hit $130 per barrel.

- Meanwhile, gold has reached a record high of $3,433 per ounce amid rising geopolitical tensions.

Bitcoin price has been showing strength, holding firmly above $106,000, despite the geopolitical escalation in the Iran-Israel conflict, while oil prices tend to surge further. All eyes will be on the crucial FOMC meeting this week and the Fed rate cut decision. On the other hand, Gold price has hit a record high of $3,433 per ounce, earlier today.

Bitcoin Price and Risk-ON Assets Under Radar Before FOMC Meeting

Following last week’s crypto market volatility and massive liquidations, Bitcoin price and altcoins have formed a strong base over the weekend while the Iran-Israel conflict unfolds. Crude Oil WTI is already up 5% in the US futures market, with several market analysts predicting it to reach $100 by year-end. Over the past 10 days, Brent crude has jumped from $66 to $74 amid war-like conditions in the Middle East.

With Iran controlling 3.5% of the global oil supply, some analysts at JPMorgan also expect the oil price to rally to more than $130 per barrel. A surge to $130 per barrel could drive the US Consumer Price Index (CPI) inflation to nearly 5%, doubling current levels. This would likely delay any anticipated interest rate cuts by the US Federal Reserve, writes The Kobeissi Letter.

Analysts are also highlighting a potential shutdown of the Strait of Hormuz as the most severe outcome. This would further disrupt the global oil supply and amplify global economic instability while putting pressure on risk-ON assets.

Currently, the Bitcoin price is trading 1.16% up at $106,688 with a 14% upside in its daily trading volumes, now shooting above $40.5 billion. Popular analyst Rekt Capital explained that BTc is holding well above the accumulation range top of $104,400. A weekly close above this hints at bullish sentiment.

All Eyes on BoJ and FOMC Meeting

With Japan’s bond market collapsing, all eyes are currently on the Bank of Japan’s (BoJ) policy meetings ahead this week. Amid uncertainties surrounding the Trump tariff policies, the BoJ is likely to postpone the rate hike to Q1 next year, as per the latest Reuters report.

The Bank of Japan (BOJ) continues to advocate for tighter monetary conditions, while the US Fed chair Jerome Powell has also refused to announce any immediate rate cuts. The Federal Reserve has maintained elevated interest rates throughout the year to combat inflation. Moreover, Powell has refrained from cuts due to concerns that President Donald Trump’s tariffs could drive up consumer prices. However, 40% of traders are still pricing in two Fed rate cuts by the end of 2025.

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- Tokenized Stock Market Gains Boost as Kraken and Binance Launches New Products

- Peter Schiff Casts Doubt on Bitcoin Rally Ahead of Trump’s SOTU Speech

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card