Huobi Founder to Launch $1B Ethereum Treasury Firm, Boosting ETH Demand

Highlights

- Li Lin and the group of investors have already raised $1 billion to set up the firm.

- The team is currently in talks to acquire a Nasdaq-listed shell company to facilitate this move.

- This could provide fresh demand for ETH, which is currently on a downtrend.

Crypto exchange Houbi’s founder, Li Lin, is reportedly planning to launch a $1 billion Ethereum treasury firm alongside a group of other investors. This move is significant because it could create new demand for ETH, which is currently in a downtrend alongside the broader crypto market.

Li Lin To Launch $1 Billion Ethereum Treasury Firm

According to a Bloomberg report, Li Lin has partnered with some of Asia’s earlier Ethereum backers to launch a new crypto trust that will buy and hold up to $1 billion of ETH for its treasury. The group of investors reportedly includes Fenbushi Capital co-founder Shen Bo and HashKey Group’s CEO Xiao Feng.

This group of investors is currently in talks to acquire a Nasdaq-listed shell company to set up the Ethereum treasury company. The group is said to have already raised $1 billion, including $200 million from Li’s investment firm, Avenir Capital, and $500 million from Asian institutional investors. The team could reportedly announce this initiative in the next two to three weeks.

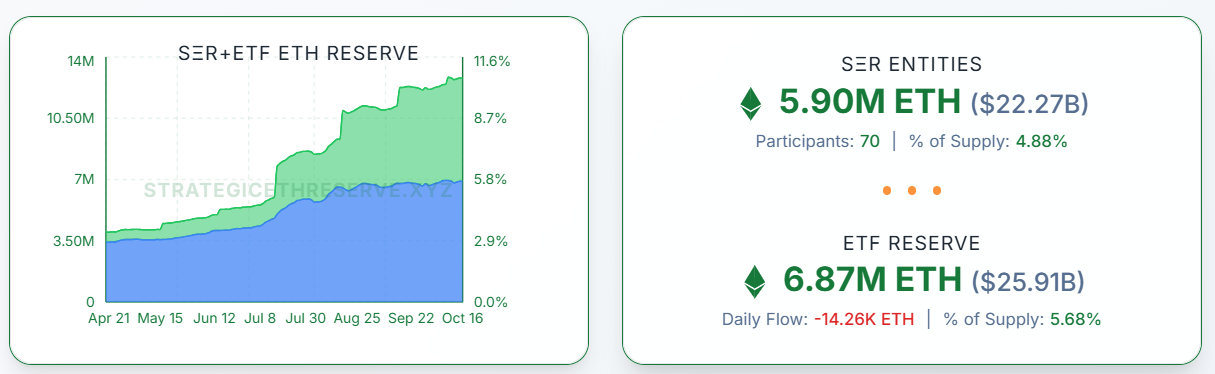

The proposed ETH firm will join the likes of Tom Lee’s BitMine and Joseph Lubin’s SharpLink Gaming, which already hold Ethereum as their primary reserve asset. Strategic ETH Reserve data shows that there are currently 70 companies that hold ETH on their balance sheet.

These companies hold a total of 5.90 million ETH ($22.27 billion), representing almost 5% of the coin’s total supply. Meanwhile, with plans to deploy $1 billion to set up this company, Li Lin’s proposed Ethereum treasury firm could rank as the fourth-largest public ETH holder, behind BitMine, SharpLink, and the Ether Machine.

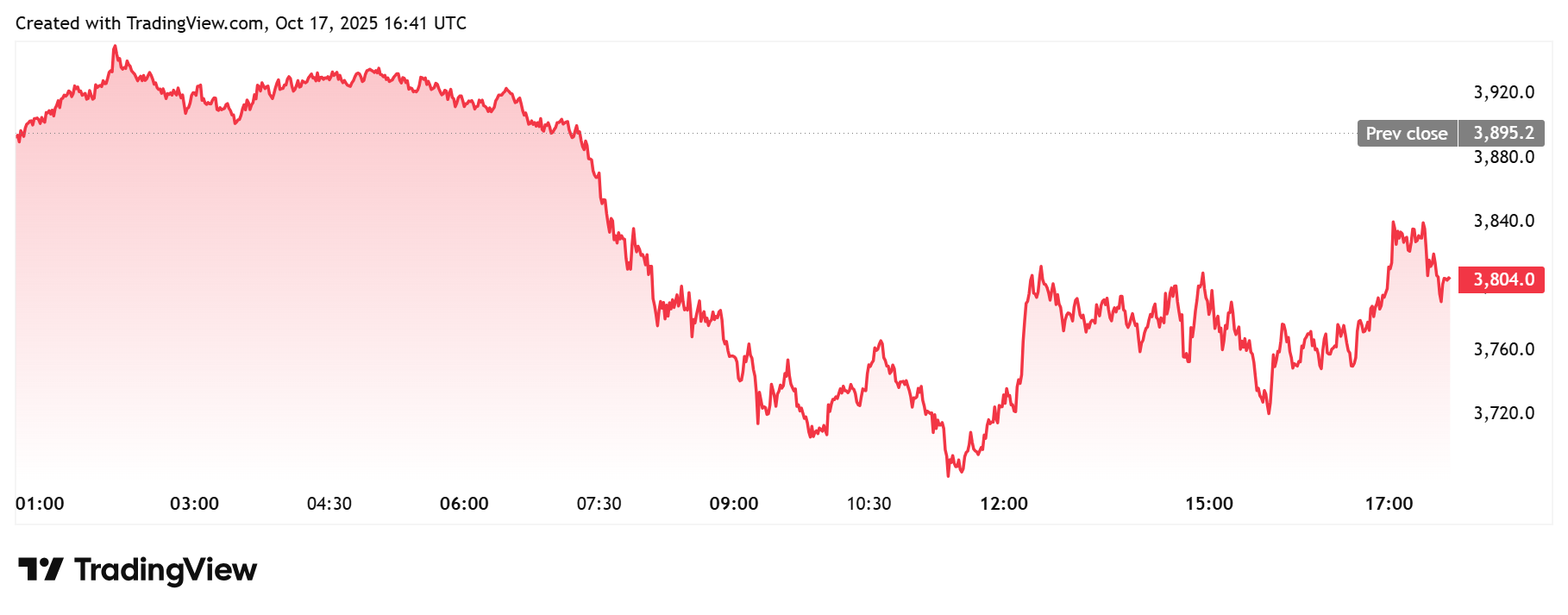

Furthermore, this development provides a bullish outlook for Ethereum, which is currently on a decline amid the ongoing crypto market crash. TradingView data shows that ETH is down over 2% and trading below the psychological $4,000 level.

Tom Lee’s BitMine and some other ETH whales are still accumulating amid this market crash. Tom Lee’s firm recently added just $400 million in ETH, while BlackRock also added more ETH yesterday, although other Ethereum ETFs saw outflows or zero flows.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Upgrades Agent Hub to Enable OpenClaw, Claude Code to Trade Crypto in Real Time

- Why Next Two Weeks Are Do or Die for Crypto Market?

- Breaking: Tom Lee’s BitMine Acquires 60,976 ETH As BMNR Stock Eyes Recovery

- Breaking: MSTR Stock Price Climbs As Michael Saylor’s Strategy Adds 17,994 BTC

- BREAKING: US Oil Prices Crash $15 in Two Hours as G7 Eyes 400M Barrel Release — Crypto Markets on Edge

- Is MSTR Stock Going to Rally $150?

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

Buy $GGs

Buy $GGs