HYPE Token Jumps 24% as Hyperliquid HIP-3 Sees Record $793M Open Interest

Highlights

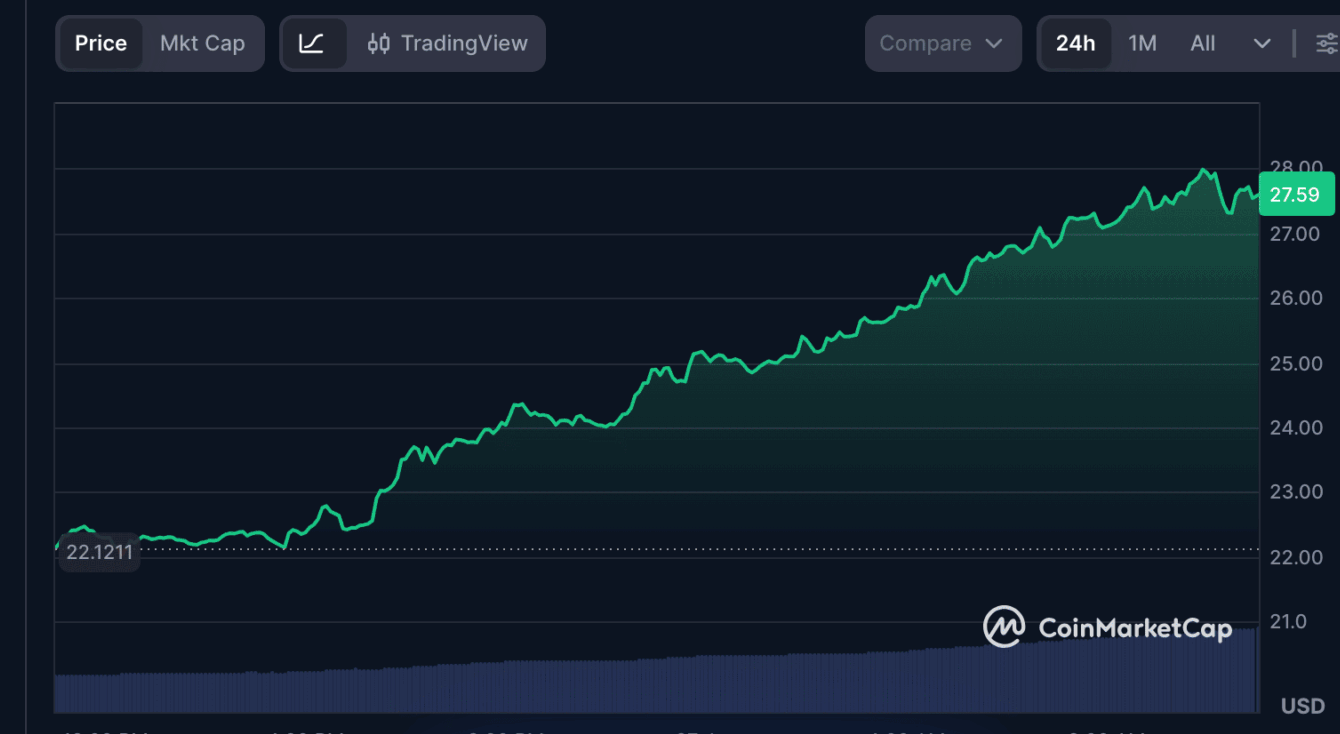

- HYPE token surged over 24% in the past day despie the dip.

- The rally is driven by record activity on Hyperliquid’s HIP-3 permissionless network.

- HIP-3 has processed over $25 billion in trading volume since its launch last October.

The HYPE token has recorded an impressive price surge even with the current market’s sluggish pace. This comes amid the massive surge in the open interest of the Hyperliquid platform’s HIP-3.

HYPE Token Surges as Hip-3 Sees Massive Open Interest Growth

According to data by CoinMarketCap, the token has recorded a surge of more than 24% in the last 24 hours. This beats the overall slow pace of the current market.

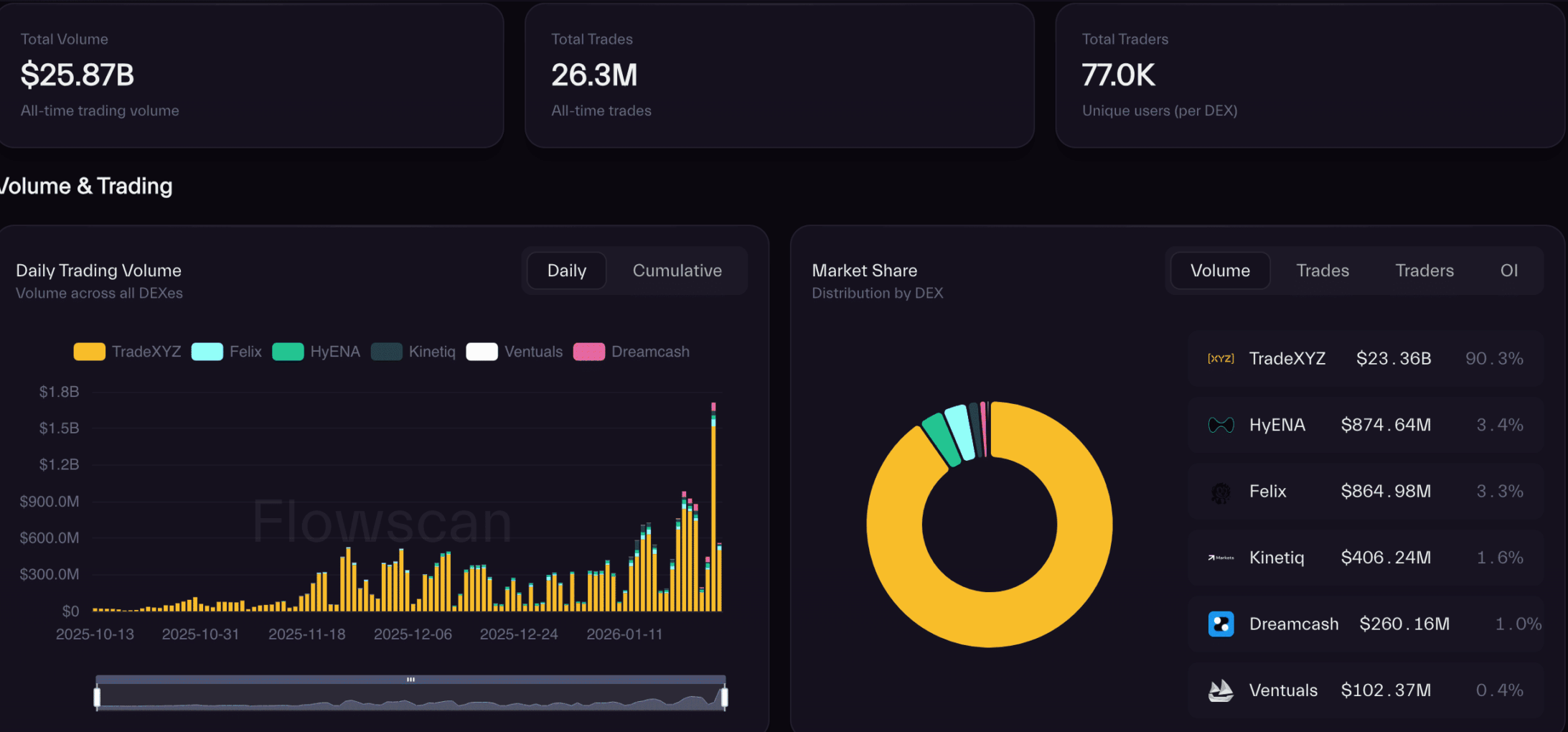

This is mostly attributed to the overall activity recorded on its newly launched permissionless network. The network’s open interest reached a new all-time high of $790 million thanks to commodities trading. The Hyperliquid team also shared in a post that OI has been hitting new highs every week, boosting the HYPE token’s momentum.

HIP-3 open interest reached an all-time high of $790M, driven recently by a surge in commodities trading.

HIP-3 OI has been hitting new ATHs each week. A month ago, HIP-3 OI was $260M.

— Hyperliquid (@HyperliquidX) January 26, 2026

As CoinGape reported, Hyperliquid’s HIP-3 platform went live in the market last October. It was launched to allow builders to deploy perpetual futures markets on the Hypercore without centralized approval.

The permissionless network has seen more than $25 billlion worth of trading volume since it launched, according to new data from Flow Scan. As seen from the data, $22 billlion out of this came from futures markets launched by TraderXYZ.

To add, the growing activity also comes as silver and gold continue see upward gains. BitGet recently reported that their daily trading volume surpassed $4 billion which is the largest for the exchange. They attributed this growth to the surge in trading of gold on its platform. This means the HYPE token could sustain its rally if this momentum continues.

Did Hyperliquid DEX Flip Binance?

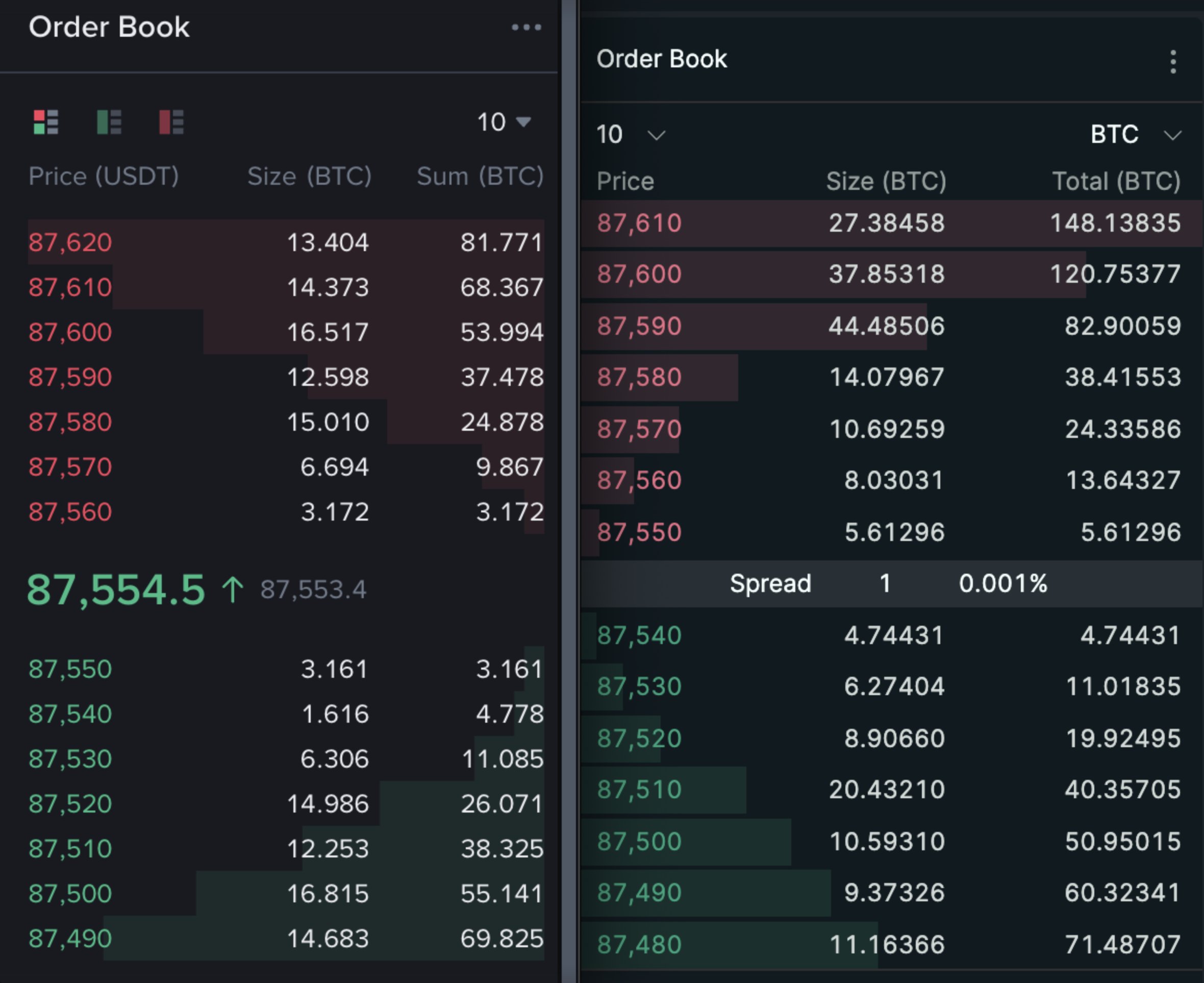

In a recent post, the platform’s founder, Jeff Yan, claimed that Hyperliquid has flipped Binance as the most liquid venue for crypto price discovery. He shared a side-by-side chart comparing both platforms.

“With HIP-3 teams leading the way, Hyperliquid has also grown to become the most liquid venue for perps on tradfi assets. Thank you to everyone’s hard work as we upgrade the financial system and house all of finance,” he said.

Notably, an expert responded stating that he is using a vague metric that doesn’t tell the full story of both exchange fundamentals. Whatever the case may be, the HYPE token has been the best beneficiary of these developments.

Some have also credited the Hyperliquid token burn as also responsible for the growth. The team made a burn proposal to its community last month. Investors were allowed to vote on the verdict.

No information on the stage of this has been shared by the team. The platform aims to maintain its position as the top platform in this space amid growing competition.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs