Hyperliquid Records Best Month Ever in Revenue Following HYPE ATH Surge

Highlights

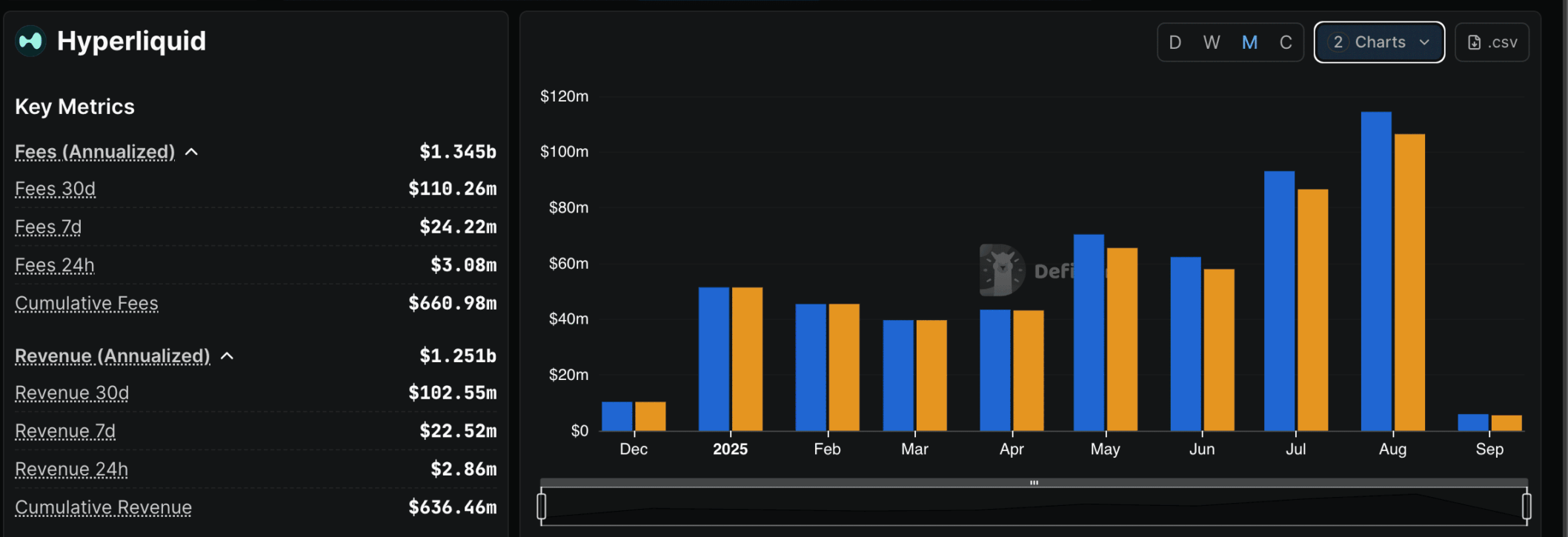

- Hyperliquid posted record monthly revenue of $106 million in August, a 23% increase from July.

- Trading volume surged to nearly $400 billion in perpetuals, pushing cumulative volume beyond $2 trillion since 2023.

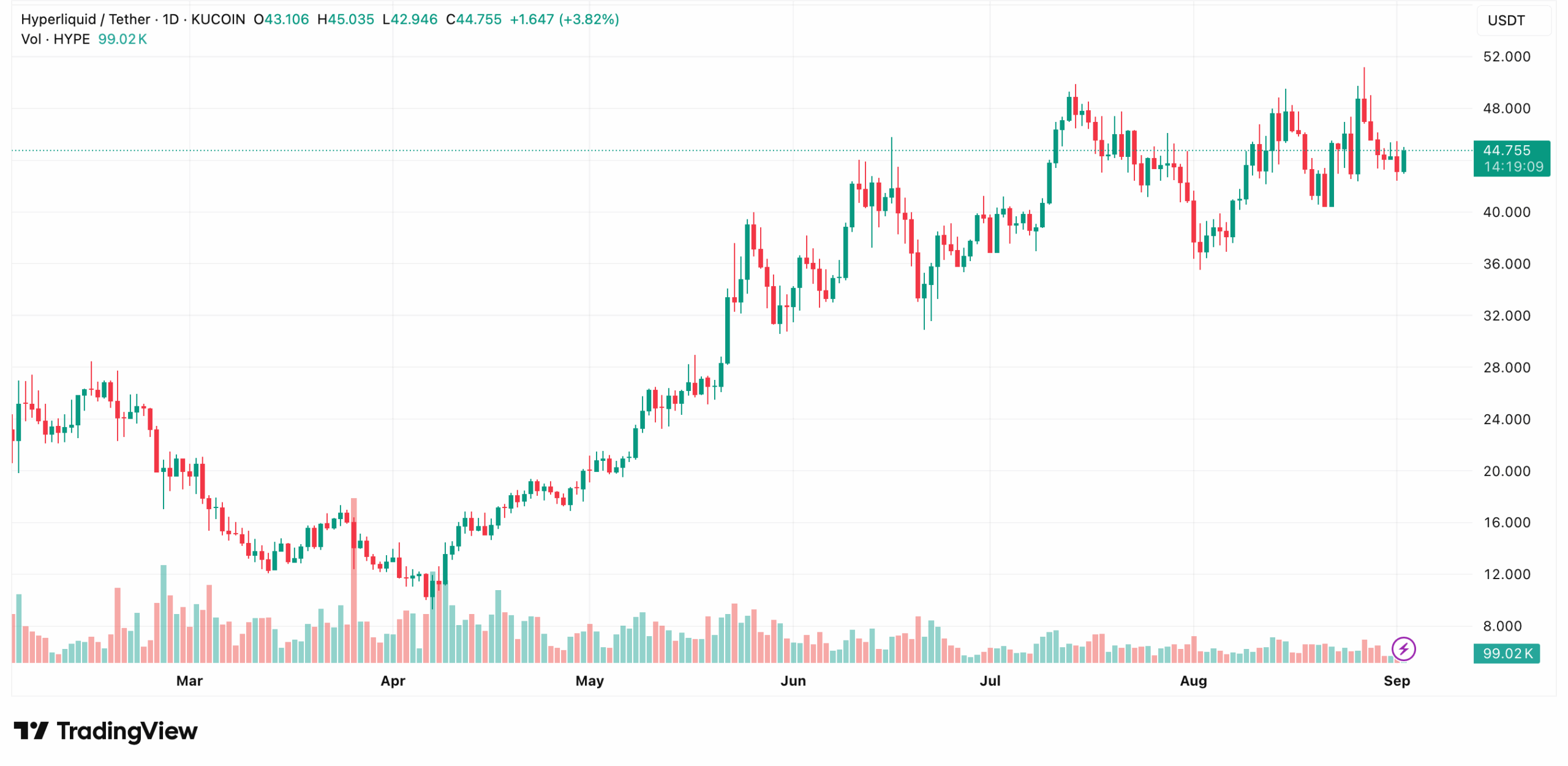

- HYPE price hit an ATH of $50.99 before retracing to $44, supported by whale accumulation and rising fees.

Hyperliquid has hit its highest monthly revenue and trading volume ever in August. This came after the HYPE price rallied to a new ATH.

Hyperliquid Records Highest Monthly Revenue

DefiLlama data shows that Hyperliquid posted its highest monthly revenue in August. It reached $106 million, a 23% increase from July’s $86.6 million. This surge can be attributed to its nearly $400 billion in perpetual trading volume.

A substantial portion of these earnings is funneled into Hyperliquid’s Assistance Fund. This fund automatically buys back HYPE from the open market. Since January, the fund’s holdings have increased from 3 million to 29.8 million tokens, valued at over $1.5 billion.

The growth comes mainly from the protocol’s Layer-1 blockchain, HyperEVM. This platform delivers high throughput and low-cost transactions. Hyperliquid has built a fully on-chain trading system that processes more than $8 billion daily by eliminating off-chain oracles and order matching. It has also surpassed $2 trillion in cumulative volume since its debut in 2023.

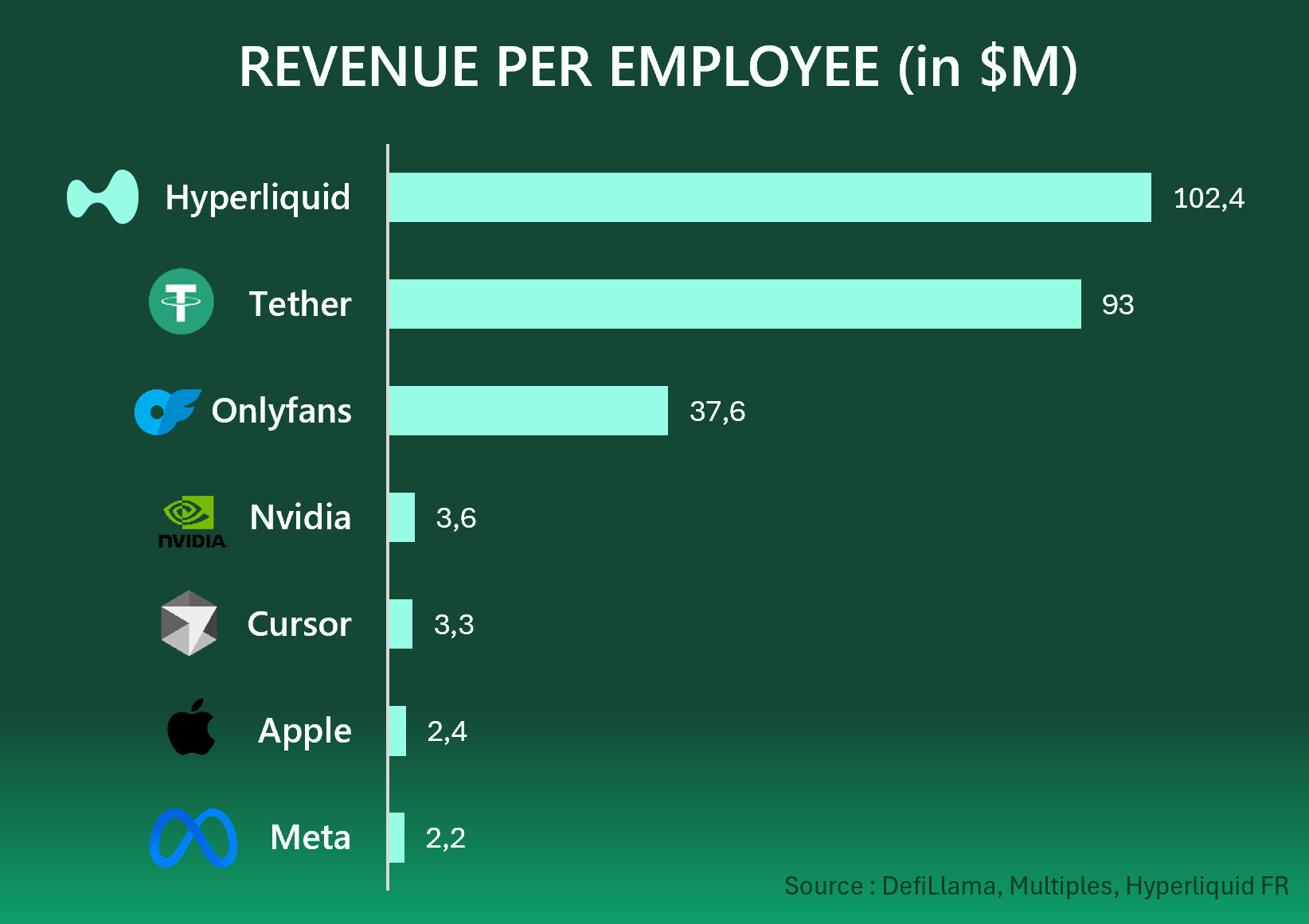

Furthermore, Hyperliquid’s revenue per employee ratio is higher than Tether’s, which is $93 million. Additionally, it exceeded OnlyFans’s $37.6 million, surpassing more established tech behemoths like Apple, Nvidia, and Meta. The platform is expected to generate $1.17 billion in annual revenue.

Hyperliquid also crossed another milestone with its Hyperliquidity Cluster. In 24 hours, the trading volume reached $3.4 billion, with $1.5 billion coming from Bitcoin alone. This makes it the second-largest platform globally for Bitcoin spot trading.

HYPE Price Rally Amid Rising Derivatives Activity

As CoinGape previously reported, HYPE reached a new all-time high, rising over 10% in just one day to $51.17. This increase was driven by whale accumulation and high trading fees. As of now, the token is trading at approximately $44, representing a 1% decline over the past week.

Building on its bullish narrative, BitMEX CEO Arthur Hayes projected a 126x upside for HYPE. Hayes argues that the stablecoin supply is expected to hit $10 trillion by 2028. He also shared that the platform could capture over a quarter of the associated trading volume. His analysis forecasts protocol revenues surging from $1.2 billion today to $258 billion within three years.

It is also worth mentioning that 21Shares recently launched the first regulated Hyperliquid exchange-traded product (ETP) on the SIX Swiss Exchange. The product offers structured access to the protocol, which already powers 80% of decentralized perpetuals trading.

Analysts say Hyperliquid is one of the most interesting protocols in the DeFi space. However, they warn that there is a significant risk to its value. Only one-third of Hyperliquid’s tokens are currently available, despite the company’s potential value of $50 billion. Upcoming token unlocks later this year may challenge its price stability.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- ZachXBT Names Axiom Exchange in Alleged Employee Crypto Insider Trading Investigation

- Bitcoin Falls as U.S. Jobless Claims Signal Labor Market Rebound

- Bitcoin News: CitiBank to Launch BTC Services in 2026

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs