India’s Central Bankers Ring Danger Bells On Crypto, Yet Again

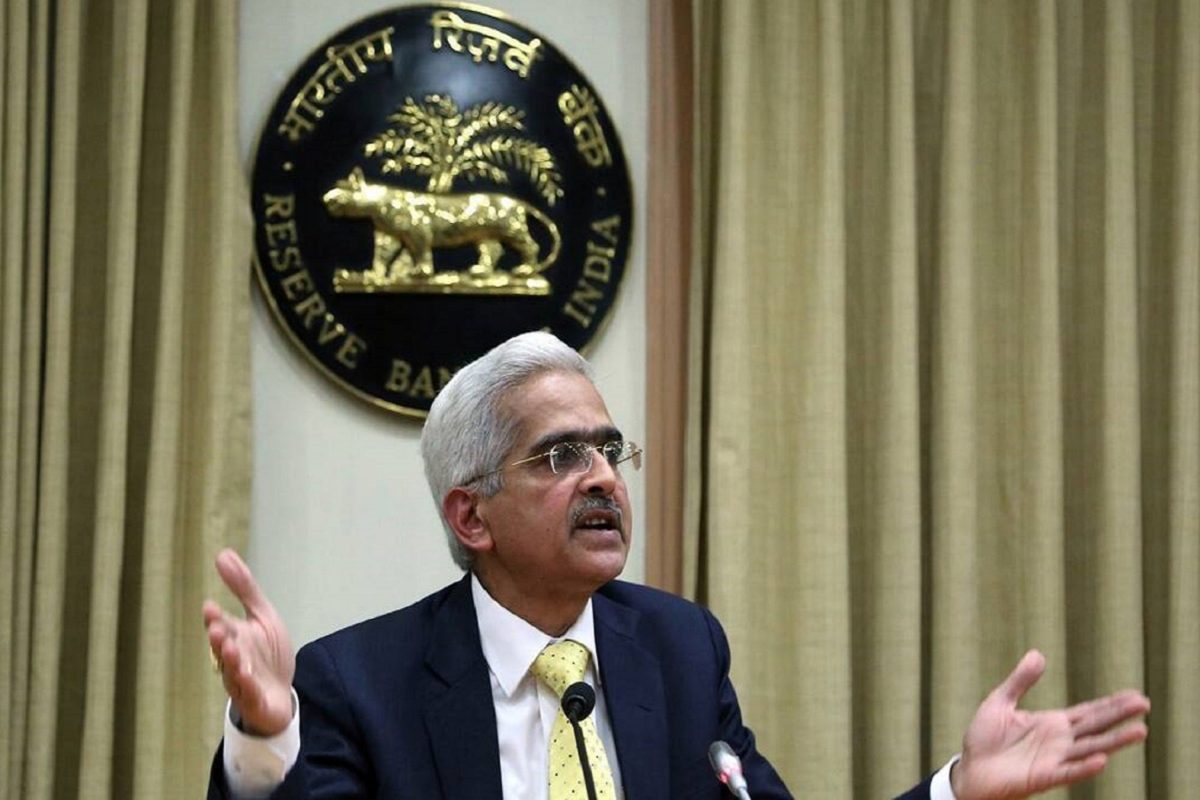

After reiterating the Reserve Bank of India’s (RBI) stance on cryptocurrencies last month, Governor Shaktikanta Das has in Thursday made a new comment. When the crypto market collapsed last month thanks to the Terra meltdown, Das made a similar statement.

Crypto Is ‘Clear Danger’

Investors were warned against volatility in crypto, he said at the time, when several investors lost money due to the crash. On Thursday, Das said cryptocurrencies are a dangerous territory to enter for investors due to their speculative nature.

The RBI Governor stated that the asset class is a ‘clear danger‘. He further said that we must be mindful of the emerging risks on the horizon.

“We must be mindful of the emerging risks on the horizon. Cryptocurrencies are a clear danger. Anything that derives value based on make believe, without any underlying, is just speculation.”

He indicated that the speculation in crypto is going on “under a sophisticated name.”

Cyber Risks Need Special Attention: RBI Governor On India Crypto Space

Das explained that technology’s potential to disrupt financial stability should be prevented. He however acknowledged that technology has supported the reach of financial sector and that its benefits must be fully harnessed.

“While technology has supported reach of financial sector & its benefits must be fully harnessed, its potential to disrupt financial stability has to be guarded against. As financial system gets increasingly digitalized, cyber risks are growing and need special attention.”

Speaking in the backdrop of the Terra crash last month, the RBI Governor explained the difficulties in regulating the space. Regulating cryptocurrencies is a difficult task as they have an underlying value, he said at the time.

Earlier, Das described the crypto space as a threat to macroeconomic and financial security. Cryptocurrency is privately created and it is a threat to our financial and macroeconomic stability, he said.

“Investors should keep in mind that they are investing at their own risk. The cryptocurrency has no underlying, not even a tulip, he added.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs