Injective (INJ) Rises 22% as Burn Auction Surpasses 6 Million Tokens

Highlights

- INJ spikes 22% in 24 hours, breaks $32 resistance after CPI data release.

- Over 6M INJ tokens burned, fueling recent price surge and market demand.

- INJ derivatives volume up 18.08%, indicating strong market interest.

The Injective (INJ) price has risen by more than 22% in the last 24 hours due to the slower-than-expected US CPI inflation rate and more than 6 million INJ tokens being burnt through the burn auction.

INJ Bullish Momentum and Market Sentiment

The price of INJ has been on the rise in the last 24 hours and is currently trading at around $32, a 24.86% jump from the intra-day low of $25. This steady increase in the price indicates that the market sentiment for INJ is positive and could be on an upward trend.

We are only getting started.

Together, let's rewrite history. pic.twitter.com/2QmUFgLCyv

— Injective 🥷 (@injective) June 12, 2024

During the rally, INJ’s 24-hour trading volume rose by 31.33% to $2,831,536,478 while the market capitalization soared by 20%. This rally shows that there is buying interest and demand for INJ stock, which supports the bullish case brought about by the 6 million INJ token burn.

Source: CoinMarketCap

The immediate resistance level for INJ is around $32.07, the day’s peak, which might act as a psychological barrier. If INJ can break and hold above this level, it could open the door for further gains.

On the negative side, the previous support level was at $28. 00 where the price was trading before the recent bounce up. This level could offer a floor to the buyers if the price reverses, which in turn, might prevent further selling.

Breakout from Prolonged Accumulation

The recent breakout of INJ from a two-month consolidation period that started in mid-April is significant. Moreover, the token had been trading in a narrow range around $29 before finally breaking out and pushing the price higher.

Another factor that has fueled the rally is the recent positive Consumer Price Index (CPI) news that has boosted the macroeconomic environment. This breakout is in line with technical analysis, which implies that there may be further upward movement.

Source: Coinglass

Consequently, the trading volume for INJ derivatives has risen by 18.08% to $903.64 million. This rise indicates increased market action and could be indicative of increased liquidity, which would lead to more robust and enduring bull rally. Furthermore, the open interest in derivatives has risen by 32.46% to $165.98 million. This indicates that fresh funds are flowing into the market, with traders opening new positions in anticipation of future price fluctuations.

INJUSD Technical Analysis and Projections

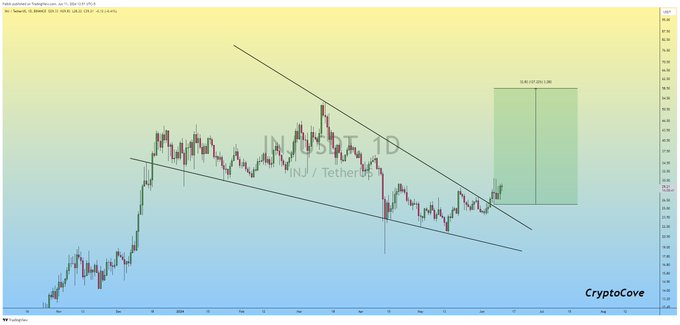

Crypto analyst Captain Faibik pointed to the significant breakout from a descending wedge pattern. INJ/USDT on Binance was trading above $29, and broke through the $29 level to signal further upside This breakout is supported by the recent price action with the target price of around $58.50, which is 127.22% higher than the current price.

Another analyst CryptoJack, also shared a bullish outlook, particularly forecasting that the token may double in price. He said INJ could enter a long position if it closes above $31, with the first target set at $52. The one-day chart also supports this outlook as INJ is nearing the $32 resistance level, with the next level at $52 if this level is broken.

Read Also: US Fed Meeting Announcements & Jerome Powell Speech Highlights

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- XRP News: French Banking Giant Taps XRPL for Euro Stablecoin With Ripple Support

- Kalshi Better at Predicting FOMC Rate Decisions, US CPI Than Fed Funds Futures: FED Research

- Congress to Revisit Crypto Market Structure Bill in Key Meeting Tomorrow

- Trump’s World Liberty Financial Partners With Securitize in Tokenization of Real Estate

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?