Institutional Investors Selling Bitcoin (BTC) Holdings After FTX Crisis

The FTX crisis caused the crypto market to come under intense pressure, triggering selloffs in the broader market. Crypto influencers warned that FTX collapse may cause institutional investors to lose confidence and trust in the crypto market. On-chain data now reveals that institutional investors are indeed selling their Bitcoin (BTC) holdings after the FTX crisis.

Bitcoin Institutional Investors Losing Confidence in Crypto?

Crypto exchange FTX recorded massive outflows in crypto assets and FTX Token (FTT) selloffs after news of liquidity issues reached investors. FTX’s plans to seek help from investors and peers failed, which forced CEO Sam Bankman-Fried to file for bankruptcy and resign as CEO.

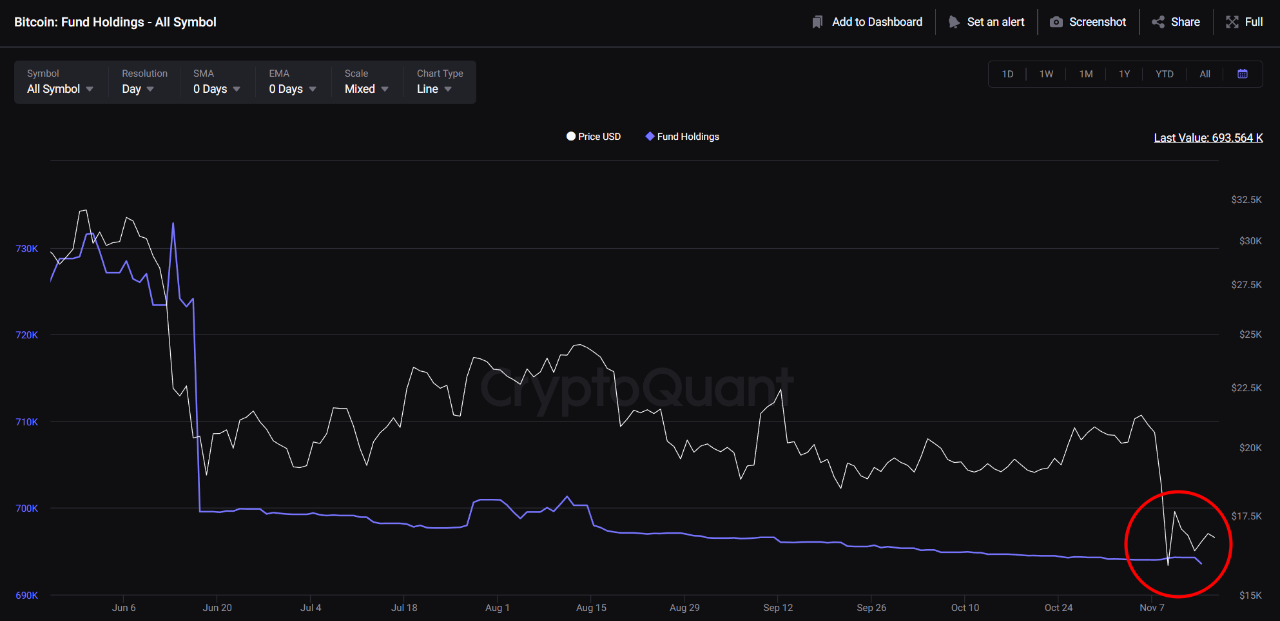

Institutional investors have also sold their crypto holdings after the FTX crisis. According to the Fund Volume Index, the transaction volume increased significantly during the FTX liquidity issues. The Fund Volume Index indicates that institutional investors sold their Bitcoin holdings.

Moreover, the Coinbase Premium Index indicates that U.S. instrumental investment fell -0.13% after the FTX crisis. Thus, institutional investors probably sold their Bitcoin holdings. This can be confirmed with the Fund Holdings Index, which shows a decrease in the total amount of coins holding digital assets.

Therefore, the recent crypto market crash in May and the selloff amid the FTX crisis impacted the sentiments of institutional investors. The crypto market will likely be sideways in the coming months, rather than a short-term reversal in prices.

Crypto experts suggest $13K-$14K as the important support and Bitcoin (BTC) may fall to the support level for preparing to rebound. However, if it falls below $13K, Bitcoin can touch $10K, which is an important volume profile.

BTC Price Risks Falling

Bitcoin (BTC) price hit a low of $15,682 amid the FTX crisis. After the bankruptcy, BTC continues to be under pressure and trades sideways.

As per CoinMarketCap, BTC price is trading at $15,682, down over 1% in the last24 hours. The 24-hour low and high for Bitcoin are $16,430 and $16,787, respectively.

Also Read: FTX Drainer, Alameda Research Withdrawing Millions In Crypto Assets

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- Will Crypto Market Crash as U.S.–Iran War Reportedly Imminent?

- Bitcoin Quantum Threat: CryptoQuant’s CEO Flags Risk of Losing Satoshi’s 1M BTC Stash to Hackers

- Crypto Regulation: Hyperliquid Launches Policy Group to Push DeFi Integration in U.S. Markets

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand