Is Bitcoin (BTC) Correction Over? Will Bitcoin Price Hit All Time High In 2022

Bitcoin price jumped up by $2000 within just ten minute window today. Does this mean Bitcoin correction is over?Investors that held Bitcoin for over a year increased their balance over the past month, accumulating over 11.78 Million BTC.

Crypto market cap crosses $1.99 trillion as Bitcoin price posts double-digit gains

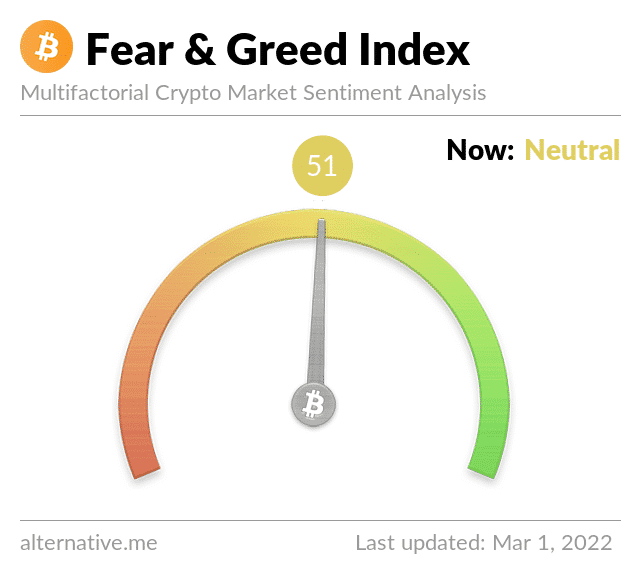

Bitcoin price jumped above $43,251, posting double-digit gains overnight. Bitcoin price has posted 14.4% gains, fueling a bullish sentiment among investors. The Fear and Greed Index, considered an indicator of investor sentiment towards Bitcoin, is neutral.

The index is considered a reliable indicator of demand from investors. A neutral outlook implies investors are no longer fearful and there could be a higher inflow of capital in Bitcoin.

Bitcoin On-Chain Analysis

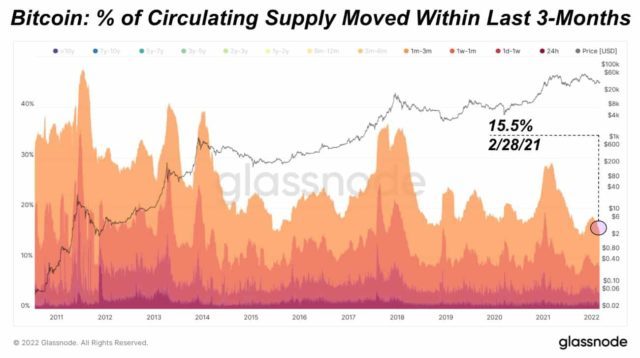

Interestingly, only 15.5% of Bitcoin’s circulating supply has moved in 2022, a large percentage remains stagnant. Historically, a shortage of circulating supply triggers a price rally in Bitcoin. Large wallet investors remained unfazed through the recent bloodbath and the recent recovery has turned retail investors bullish, fueling a bullish narrative.

Based on a recent survey by Finder, 33 experts have predicted that Bitcoin price would hit $76,360 by December 31, 2022. Bitcoin’s previous all-time high is 10% lower than the prediction.

Institutional investors eye new Bitcoin all-time high by end of 2022

Ganesh Kompella, co-founder of Tykhe Block Ventures, leading investment firm founded in Singapore believes that,

Bitcoin is in a multi-year process of higher highs and lower lows, with 2021 being a relatively quieter year in a backdrop of sideways accumulation. Lots of talk on whether Bitcoin is a ‘risk asset. It’s programmable money, and the substitution effect we may see over the next few years is not just gold to BTC, but also long-term bonds to BTC.

The ongoing Bitcoin price rally is not driven solely by large wallet investors, instead it is driven by holders of all wallet sizes. This makes the recovery different from the January 2022 Bitcoin price trend.

Increasing economic sanctions have hit the Russian economy hard, as private firms block transactions to Russian customers. Remittance firms have suspended services in Russia and the geopolitical crisis has fueled Bitcoin’s price rally. The short term optimism among traders could sustain Bitcoin price above $44,000.

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?