Is the Sell-Off Just Starting? BlackRock Bitcoin ETF Sees Records $10B in Notional Volume

Highlights

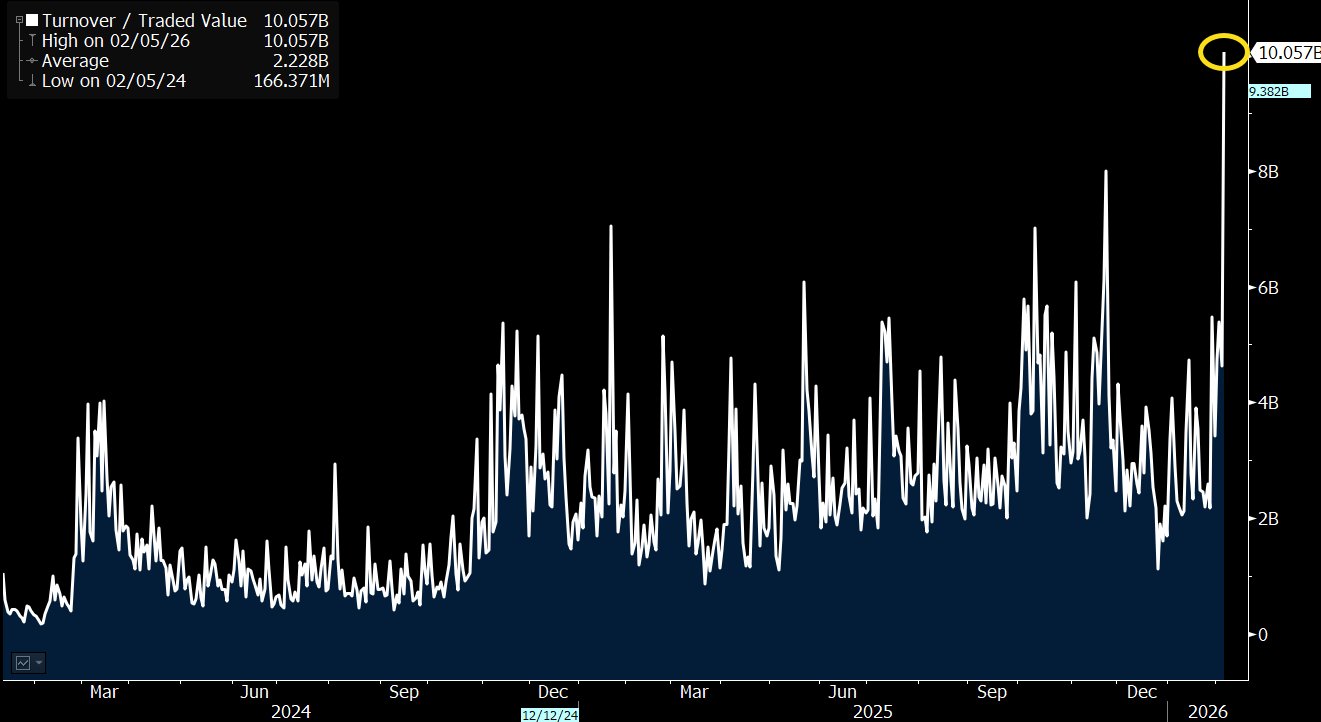

- BlackRock’s spot Bitcoin ETF posted a record $10 billion in notional trading volume.

- Analysts say the surge in volume alongside a price crash could signal late-stage capitulation.

- MARA Holdings also joined the sell-off trend, transferring over 1,300 BTC.

BlackRock’s Bitcoin ETF fund has seen a huge increase in its notional volume in spite of the crypto market decline. Experts are now speculating whether this could be the start of another wave of sell-off or the end of the capitulation.

Notional Volume Grows in BlackRock’s Bitcoin ETF

According to Nasdaq data, the asset manager’s spot exchange-traded fund on Bitcoin, IBIT, recorded a new high with over 284 million shares changing hands. This is equivalent to a notional value of over $10 billion

To put it in perspective, this volume blew the old record of 169.21 million shares traded on November 21 by 169%. This was brought about by the decline in the stock price of IBIT, which fell by 13%. This share price closed below $35 for the first time since Oct. 11, 2024, and this means that the stock lost 27% this year.

Bloomberg analyst Eric Balchunas has again pointed out, in a new X post, this new record volume for a BlackRock Bitcoin ETF, which is brutal.

“IBIT just crushed its daily volume record with $10b worth of shares traded as its price fell 13%, second worst daily price drop since it launched. Brutal,” he said.

The previous volume record of the fund of about $8 billion was achieved on Nov. 21, according to SoSoValue. The trust normally records trade volumes of a couple of billion dollars daily.

Meanwhile, the asset manager has been moving tokens to sell off some of their holdings amid the downturn. As Coingape reported, the firm moved about $170 million worth of tokens to Coinbase Prime for the purpose of offloading them. Consequently, the BlackRock Bitcoin ETF has been reporting outflows consistently in the past week.

High volumes and price crashes like this often imply that investors are selling their investment at a loss. It represents the top of the selling phase of the bear market. This could mean the beginning of a painful bottoming-out process.

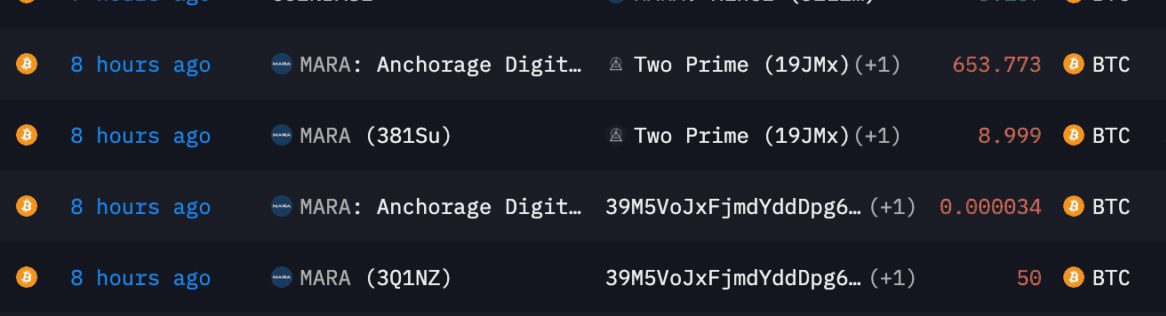

MARA Holdings Joins Crypto Sell-Off Trend

MARA Holdings is said to have made transfers of nearly 1,317 BTC, valued at $87.4 million, to different addresses. The largest transfer, valued at 653.773 BTC, equivalent to $43.4 million, has been made to an address associated with a digital asset management company named Two Prime, based on data obtained by Arkham.

The firm then followed up with a smaller transaction, sending 8.999 BTC, or approximately $597,000, to the same address. This follows the trend that is being seen in the BlackRock Bitcoin ETF. However, companies like Metaplanet maintained that they would still keep buying Bitcoin despite the decline.

The shares of the company dropped by 18% on Thursday on the Nasdaq exchange and closed at $6.7. The drop in BTC was 34%. The MARA move was made during the recent dips in the crypto market. The BTC dropped to as low as $60,000 on Thursday.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs