JP Morgan Says Decline in Crypto Fund Inflows Can Trigger Next Bitcoin (BTC) Correction

On Sunday, December 20, the Bitcoin (BTC) price surged all the way to its new all-time high above $24,000. Bitcoin has been skyrocketing on the heels of massive institutional money pouring into the cryptocurrency. Especially, in Q4 2020, institutions have been buying a lot more Bitcoins through OTC deals.

Leading all the investments has been Grayscale’s popular cryptocurrency fund – the Grayscale Bitcoin Trust (GBTC). JPMorgan notes that it is imperative that institutional money continues to flow into GBTC for the BTC price to keep going ahead. Any dry-up of funds coming to GBTC can increase the chances of Bitcoin (BTC) price correction as per the JPMorgan strategists.

Grayscale Bitcoin Trust (GBTC) – The Top Performing Bitcoin Fund

GBTC has registered its biggest growth this year in 2020. From $2 billion assets under management (AUM) at the beginning of 2020, the Grayscale Bitcoin Trust (GBTC) manages more than $13.1 billion as of the latest update. Meaning GBTV has registered a growth of over 500% with a week left for 2020.

12/18/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $15.5 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/SZa61KZJFc

— Grayscale (@Grayscale) December 18, 2020

In a note last Friday, JPMorgan strategist Nikolaos Panigirtzoglou wrote that nearly $1 billion of funds are coming every month into GBTC. While one might call Bitcoin (BTC) “overbought” at the current price, the massive funds coming to the trust “are too big to allow any position unwinding by momentum traders to create sustained negative price dynamics,” noted the strategists.

They further added that any slowdown of funds coming to GBTC can lead to the BTC price correction similar to one in the second half of 2020. During this period, Bitcoin corrected 44$ from its peak price then in June 2020.

Growth of Other Bitcoin Funds

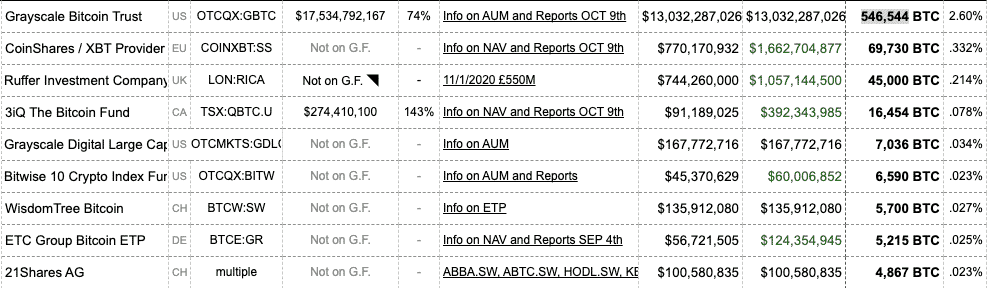

Undisputedly, the Grayscale Bitcoin Trust (GBTC) is the largest in the market currently holding 2.6% of the total BTC supply i.e. 546,544 Bitcoins. However, there are several other Bitcoin funds that have registered good growth this year. Some of the popular names include the 3iQ Bitcoin Fund, the Bitwise 10 crypto index fund, the Wisdom Tree Bitcoin Fund, and the CoinShare XBT Provider Fund.

Below is a snapshot of how much Bitcoins are held by the Bitcoin funds to get a relative market idea. The data is provided by bitcointreasuries.org.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs