Why July 5th is Important for Crypto Businesses and Investors in India

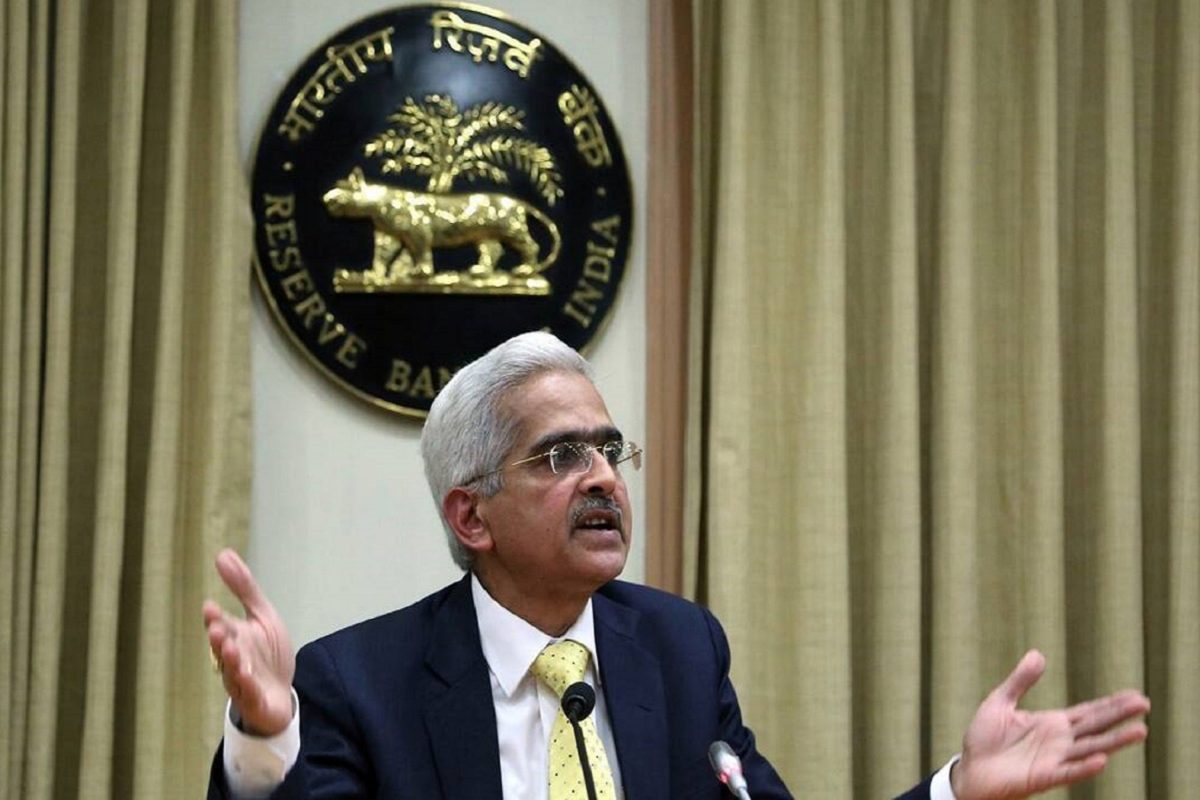

On April 05, the RBI had issued a notice directed all lenders to wind up bank accounts of cryptocurrency exchanges and also end other business relationships with them within three months. This sounded the death knell for the bourses.

Now as the deadline seems to be approaching which are now either being forced to reinvent their businesses or close down operations. It’s time to see the various options and efforts that have been taken till date by major exchanges in India

Supreme court decision still pending

Staring at the end of the road in India with the RBI notification, the virtual currency exchanges then took the legal route appealing against the RBI order at India’s supreme court. However, the apex court has still not provided any respite to the exchanges yet. “The petitioners shall be at liberty to submit a representation to the competent authority of RBI within two weeks hence which shall be dealt with in accordance with law,” read a May 17 order given by chief justice Dipak Misra. The next date now stands at 20 July 2018, which is 16 days after the ban gets implemented. All eyes would be now being on July 20.

Suggested article: Zebpay Issues circular, Rupee Withdrawals Could Stop

Exchanges intimate customers, turning towards cryptos-to Crypto trades

To prevent a complete shutdown of trading, Cryptocurrency exchanges have rampantly adding crypto-to-crypto trading pairs which never existed a few months ago. It is assessed that India has over 50 lakh active traders and this is only set to increase. As the government restricts down fiat trades, traders have started using over the counter solutions like LocalBitcoin. Though India has a large number of traders, it makes up less than 1% of daily volume. It is making it difficult for exchanges to add new clients as most do not have cryptocurrencies to add their accounts

Exchanges like WazirX, Pocketbits, Bitbns, Coinome, BuyUcoin, Coinsecure, Zebpay and Unocoin all have come forward and released an intimation circular to its customers sounding that they are unsure of how the future lies but have also assured the customers that their assets are safe and they will try doing everything possible to keep the businesses and sentiment in upswing.

Looking for a base abroad

If media is to be believed, exchanges such as Zebpay, Unocoin, CoinSecure, BuyUcoin and BTCX India, are looking to shift their headquarters abroad. Many exchanges have already started taking advice from their advisers and are working on various tax structures suitable to decide which country would be the best option for them. Most of the exchanges considering countries like Singapore, Delaware or Belarus.

Will State Bank of Sikkim come to rescue?

Will you call it an Indian way of “jugaad” innovation? Where there is a regulation there is way around. With most of banks and service provides stopping their businesses with Indian crypto exchanges as they fall under Reserve Bank of India’s purview, there is a bank that operates independently and is not governed by the country’s central bank- The State Bank of Sikkim.

Sikkim, India’s second-smallest state, had rejected to join India when the subcontinent won independence from the British in 1947. So, it was provided special status as per a 1950 treaty with India, according to which the kingdom had independence over much of its interior matters, except border security. However, following political turmoil, the then Prime Minister of Sikkim asked India to step in, agreeing to be a part of Indian Union in May 1975. The following plebiscite to abolish the monarchy validated this agreement. However, to this day, the bank, set up by the Royal Proclamation Order of the Chogyals in 1968, remains independent under the government of Sikkim. It still enjoys self-rule under Article 371-F of the Indian constitution.

But this too has challenges. To take advantage of State Bank of Sikkim’s autonomous status, both the exchanges and the traders will need to have an account with the bank and that would require a local resident proof and other documents.

All has been said and done and since we are a couple of days away from the “doomsday” its only time that will tell us what works for crypto businesses in India. If the circular is implemented by banks, then all eyes will be on the apex court decision that is going to come on 20 July 2018.

Will this step of RBI end the crypto craze in the country? Do let us know your views on the same.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs