Crypto News: Bitcoin Price Hits $37,000; Blackrock Files Ethereum Spot ETF

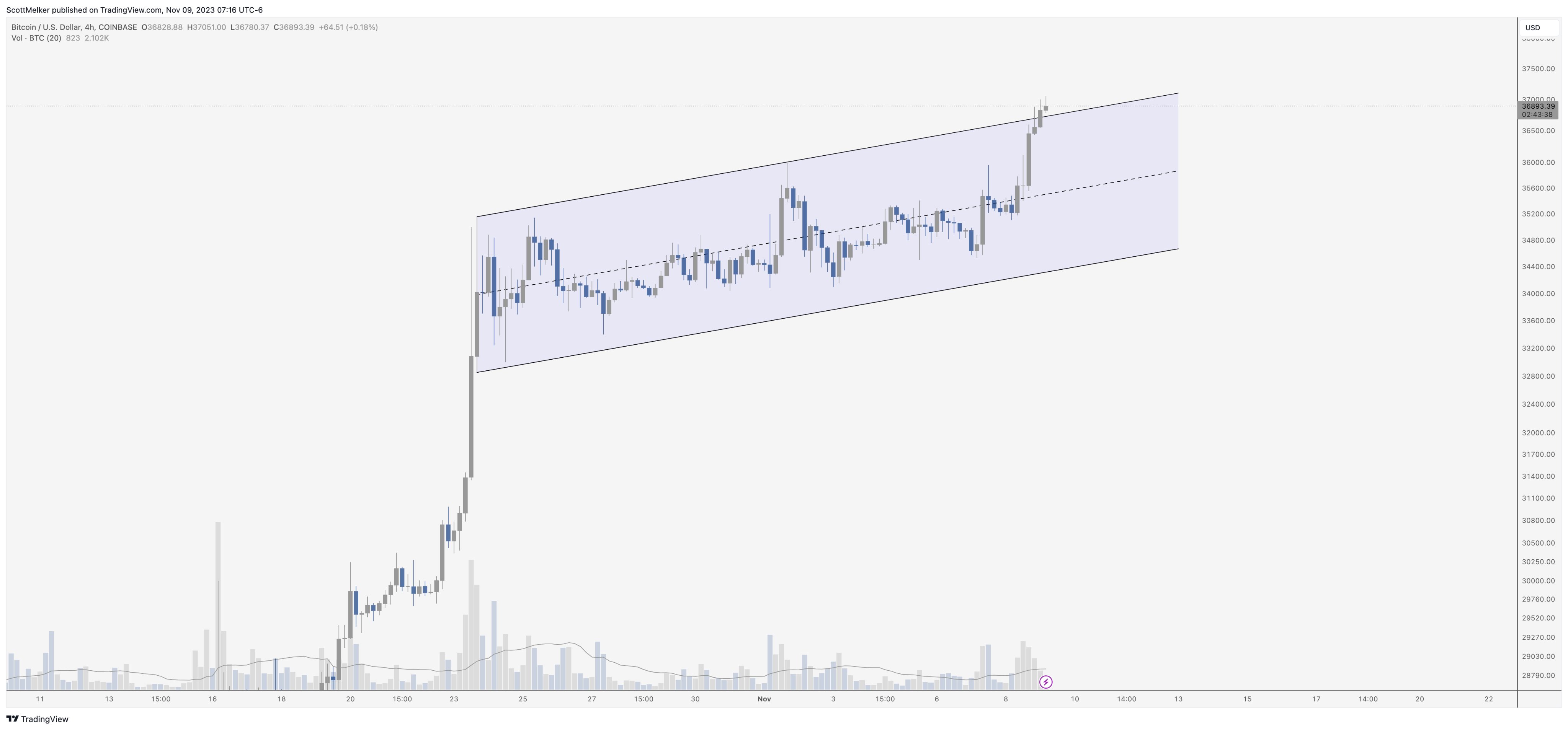

Bitcoin price has now surpassed the Terra-LUNA crisis level, touching a high of $37,150 on Thursday. BTC price retraces after hitting a high, with the price now moving near the $36,700 level as a result of shorts liquidation in the last 24 hours. In fact, Bitcoin is now only halfway away from reclaiming the 2021 high of $69,000, which analysts predict to happen next year.

Bitcoin Price Reaches $37,000

Bitcoin has completed its full recovery to the Terra-Luna crisis level exactly a year after the Sam Bankman-Fried’s exchange FTX filed for bankruptcy.

“With Bitcoin trading back above the level when the Terra stablecoin imploded, crypto traders have officially moved on from those psychological scars,” said Markus Thielen, head of research at Matrixport.

The crypto market has to overcome the steepest monetary tightening by the U.S. Federal Reserve in four decades, stringent industry regulations, and heightened scrutiny.

Bitcoin saw upside moves during the Santa Claus rally earlier this year, the banking crisis in March, and spot Bitcoin ETF hype. The Federal Reserve has also hinted at dovish rate hikes until next year, making institutional investors extremely bullish.

Meanwhile, Bloomberg Intelligence analysts James Seyffart and Eric Balchunas said “Even if approvals don’t arrive this month, we still believe there’s a 90% chance of approval by Jan. 10.” In October, Bloomberg’s analysts raised odds of spot Bitcoin ETF approval from 75% to 90% after Grayscale’s victory in the court case.

“The ETF expectation is the top of a growing list of catalysts, which gives the current rally further legs,” said Josh Gilbert, market analyst at trading and investing firm eToro. Besides the ETF trigger, bets that the US Federal Reserve is done with rate hikes for now and an upcoming Bitcoin-halving next year are also fueling the rally, Gilbert said.

Popular crypto analyst Michael van de Poppe has also made a somewhat bullish prediction. He said “Anything between $38,000-40,000 is pretty much resistance and I’m not expecting a breakout in one-go.” However, he sees Bitcoin reaching $45,000-50,000 pre-halving.

As reported by Coingape, world’s largest investment fund Blackrock has filed first Ethereum spot ETF in US for approval with SEC. It is to be noted that Blackrock has already filed for spot Bitcoin ETF earlier.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why Crypto Market Is Falling Today (March 8, 2026)

- Michael Saylor Hints at Another Strategy Bitcoin Buy Despite BTC and Broader Market Weakness

- How Low Could Shiba Inu, Pepe Coin and Dogecoin Fall? Key Support Levels and Liquidation Risks to Watch

- UAE Carries Out First Iran Strike As BTC Bulls Struggle to Defend Key Support

- Analyst Predicts Bitcoin Price Dip to $55K as ETFs See Outflows Amid Middle East Tensions

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

Buy $GGs

Buy $GGs