Bitcoin (BTC) Bottomed? Whale Enters Long Position After The CPI Release

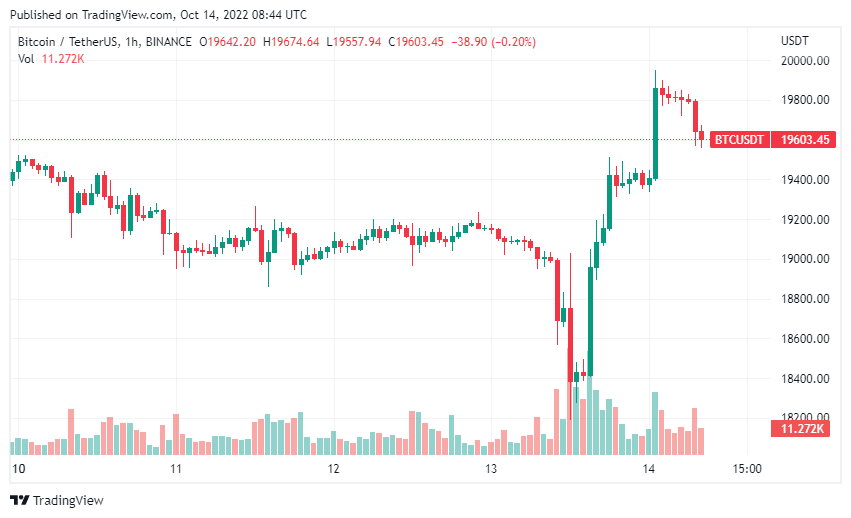

Bitcoin price tanked to $18.3k after the CPI data for September comes in higher than expected at 8.2%. However, the BTC price recovered hours after the CPI release, continuing gains on Friday. As per data, a Bitcoin whale has entered long positions on Binance and Bitmex futures exchanges at the same time.

Bitcoin (BTC) Price Soars Amid Whale Accumulation

Bitcoin price recovered in correlation to the U.S. stock market on Thursday, hours after the higher-than-expected CPI data release. While the CPI for September comes in lower than July and August, the core CPI rises to a 40-year high.

Interestingly, a Bitcoin whale entered long positions on the Binance and Bitmex futures exchanges as the BTC price fell to $18.3k. The move is expected to have come as a result of the U.S. Energy Information Administration reporting a significant increase in crude oil inventories.

The broader crypto market rebounded due to gains in the Bitcoin (BTC) price. However, it is not a spot purchase that could have strengthened Bitcoin bulls. Nevertheless, the Bitcoin whale purchase is enough to bring an additional rebound in the short term until profit in futures markets.

Meanwhile, indicators such as taker/buyer sell ratio, supply in loss, and adjusted SOPR suggest time enter long-position. However, traders must pay attention to open interest (OI) and derivatives reserve and netflow to confirm their entry.

Has the Bitcoin Bottomed Out?

Bitcoin price has now recovered many times from the $18.3k level, suggesting a bottom around $18,500. Whales took another opportunity to buy Bitcoin (BTC) at lower levels to bring a rally. Also, users can track whales moving large amounts of BTC during capitulation events using the Bitcoin Exchange Inflow Mean indicator.

However, the BTC price is still below the psychological level of $20,000. Until the price moves above the level to confirm a bullish movement, the Bitcoin price is under pressure.

At the time of writing, Bitcoin price is trading at $19,608, up 3% in the last 24 hours. The BTC price still struggles to surpass $20k, reversing from the strong resistance level. Traders should keep track of the U.S. Dollar Index (DXY) and sentiments surrounding Bitcoin to enter at low levels.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Analyst Predicts Bitcoin Price Dip to $55K as ETFs See Outflows Amid Middle East Tensions

- Ethereum Co-founder Sparks $157M Sell-Off Fears as ETH Struggles Below $2k

- Analyst Predicts XRP Price Could Fall to $1 as XRP ETFs Record Net Weekly Outflows

- U.S.-Iran War: Trump Threatens to Hit Iran ‘Very Hard’ Today as Bitcoin Faces New Selling Pressure

- Crypto Market Weekly Recap: US-Iran War Steer Crypto Prices, Kraken Gets Fed Master Account, Tokenization Push March 2-6

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

Buy $GGs

Buy $GGs