Bitcoin Price Can Start Rally Above $30000, Says BitMEX Founder Arthur Hayes

The crypto and stock markets are typically highly impacted by the US Treasury Dept issuing treasury bills to refill its Treasury account balance as it drains US dollar liquidity from financial markets. However, BitMEX co-founder Arthur Hayes revealed the impact is not as critical as expected and risk assets like Bitcoin price will start to rally soon.

Arthur Hayes Bullish On Bitcoin Rally

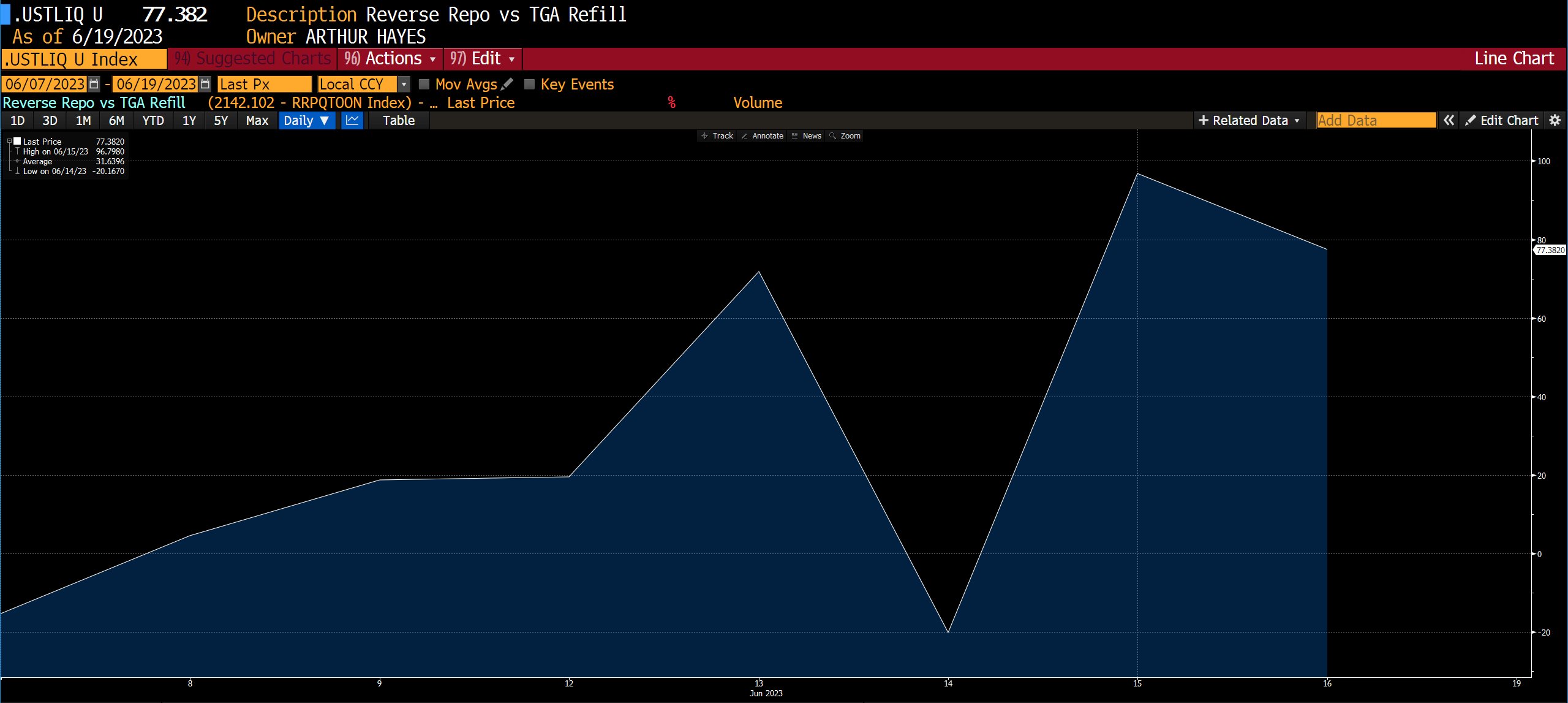

BitMEX co-founder Arthur Hayes on June 20 said the Treasury General Account (TGA) refill is not impacting risk markets as the US dollar net liquidity stands at $77 billion. He believes the TGA refill by the US Treasury Dept is nothing to worry about.

Arthur Hayes plans to buy crypto as the net liquidity index remains “positive.” If the index goes “negative,” he will slow down or stop his purchases. He predicts that US Treasury will slow down T-bills or debt issuance once the TGA balance is more than $450 billion.

TGA balance during the debt ceiling deal was below $40 billion, now it is $250 billion. The US Treasury is building its account balance without impacting financial markets and US dollar liquidity.

He has created a custom US dollar liquidity index to track how TGA refill will affect the US dollar liquidity. “I look at values of RRP and TGA as of their last print before the debt ceiling bill was signed on June 3rd. If RRP is falling that is +ve for $ liq, if TGA is rising that is -ve for $ liq. I look at the net of the two.”

Also Read: Fidelity Investments Reportedly Filing BlackRock-Type Spot Bitcoin ETF, Acquire Grayscale

Crypto Market Rebound Is Clear

The crypto market continued upside momentum after the uncertainty surrounding US SEC lawsuits against Binance and Coinbase eased.

Bitcoin continues to move upside after rebounding from the expected $24,800 support level. Bitcoin price jumped above $27,000 today as a result of fresh buying from whales. BTC price currently trades at $26,796, up 2% in the last 24 hours.

Meanwhile, ETH price remains stable near $1750, up 0.50%. The 24-hour low and high are $1705 and $1750, respectively. Key events this week will impact Bitcoin and Ethereum prices.

Also Read: Terra’s Do Kwon, Former CFO Found Guilty By Montenegro Court

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

Buy $GGs

Buy $GGs