Just In: DeFi Dev Corp Launches Japan’s First Solana Treasury Company, SOL Price Reacts

Highlights

- Nasdaq-listed DeFi Dev Corp has partnered with Superteam Japan to establish DFDV JP.

- This is Japan’s first Solana-focused digital asset treasury.

- Following the announcement, SOL rose by nearly 4%.

DeFi Dev Corp has announced the creation of Japan’s first Solana Treasury firm in partnership with Superteam Japan. In reaction, the SOL price recorded gains amid positive sentiment.

DeFi Dev Corp Expands Solana Treasury Footprint in Asia

In an official press release, Nasdaq-listed DeFi Development Corp confirmed the launch of DFDV JP, a Solana treasury in Japan. This was finalized in partnership with Superteam Japan.

This marks its second major expansion in Asia following the rollout of DFDV KR in South Korea. The company described the initiative as part of its broader “Treasury Accelerator Program.” This is designed to help institutions establish and manage Solana-based digital asset treasuries.

“We’re excited to partner with Superteam Japan to launch the first Solana Digital Asset Treasury in the country,” said Parker White, COO & CIO of DeFi Dev Corp. “Japan remains one of the most forward-thinking regions for blockchain innovation and digital asset regulation.”

Under the Treasury Accelerator model, the firm provides strategic and technical support to help firms adopt Solana treasury systems. This includes validator infrastructure, balance sheet seeding, and ecosystem integration.

The partnership with Superteam Japan uses its local knowledge and community connections. Superteam hosted “SuperTokyo,” the biggest Solana event in Japan, and worked with banks like Minna Bank and Fireblocks on stablecoin projects.

Superteam Japan’s Country Lead, Hisashi Oki, called the collaboration a “defining milestone” for the country’s blockchain sector.

“By working with DeFi Dev Corp, we’re opening a clear gateway for Japanese investors and enterprises to participate directly in Solana’s growth,” he said.

The launch follows the company’s last reported SOL purchase. The Solana treasury firm added 196,141 tokens at an average price of $202.76 each. This purchase increased the company’s total holdings to 2,027,817 SOL, now valued at approximately $427 million.

Momentum Builds as SOL Price Breaks Key Levels

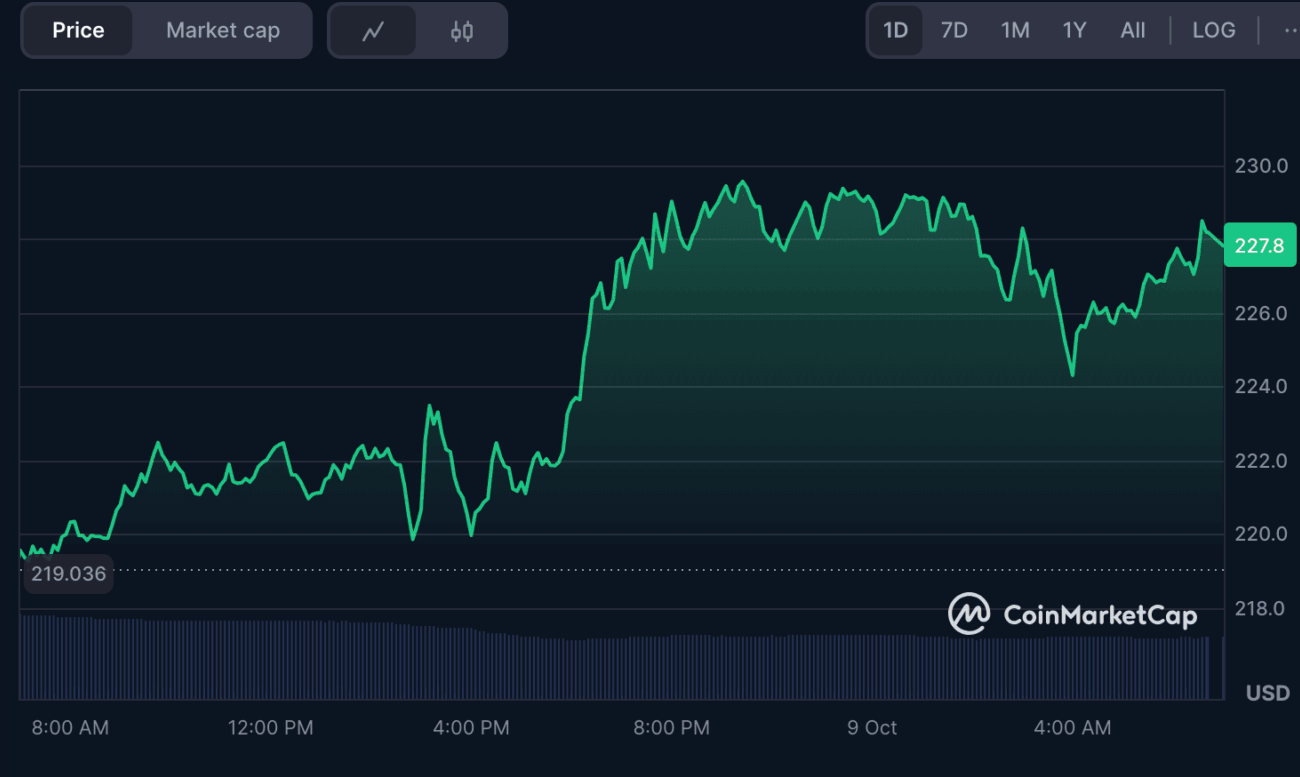

According to CoinMarketCap data, the SOL price rose by 3.56% to $227.40 in the last 24 hours, outperforming the broader crypto market’s 0.69% gain.

Analysts say that if SOL holds above $229.49, bulls could target $238.56. However, failure to maintain support at $222.17 could trigger a short-term correction to $214.84.

Adding to the bullish setup, Bitwise amended its Solana ETF filing to include staking provisions and lower fees. The final decision deadline is October 16, but experts anticipate that the SEC will approve multiple SOL-based ETFs this week.

Lark Davis, founder of Wealth Mastery, shared that institutional appetite for Solana is rapidly increasing, stating that the SEC approval for a Solana ETF appears increasingly likely.

Notably, Solana ETPs attracted $706 million in weekly inflows. This is a record high that has pushed total assets under management (AUM) for Solana ETPs above $5.1 billion, more than double the previous record set in July.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Upgrades Agent Hub to Enable OpenClaw, Claude Code to Trade Crypto in Real Time

- Why Next Two Weeks Are Do or Die for Crypto Market?

- Breaking: Tom Lee’s BitMine Acquires 60,976 ETH As BMNR Stock Eyes Recovery

- Breaking: MSTR Stock Price Climbs As Michael Saylor’s Strategy Adds 17,994 BTC

- BREAKING: US Oil Prices Crash $15 in Two Hours as G7 Eyes 400M Barrel Release — Crypto Markets on Edge

- Bitcoin And XRP Price Prediction As US Oil Prices Fall Sharply- Will This Spark a New Bull Rally?

- Is It a Good Time to Buy XRP As Price Falls 64% From All-time High

- Will Crypto Market Crash This Week? Analysts Predict Timeline for Volatility

- Gold Price Prediction Ahead of March 18 FOMC Meeting

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

Buy $GGs

Buy $GGs