Just-In: The Merge Is Near, But Whales Are Bearish On Ethereum (ETH) Price

The crypto community’s sentiment is rising as the anticipated date of Merge comes closer and developers prepare for the PoS transition on September 15. However, the on-chain data shows that non-exchange whales seem to be selling their Ethereum (ETH) holdings ahead of the Merge.

Whales Bearish on Ethereum (ETH) Price Post-Merge

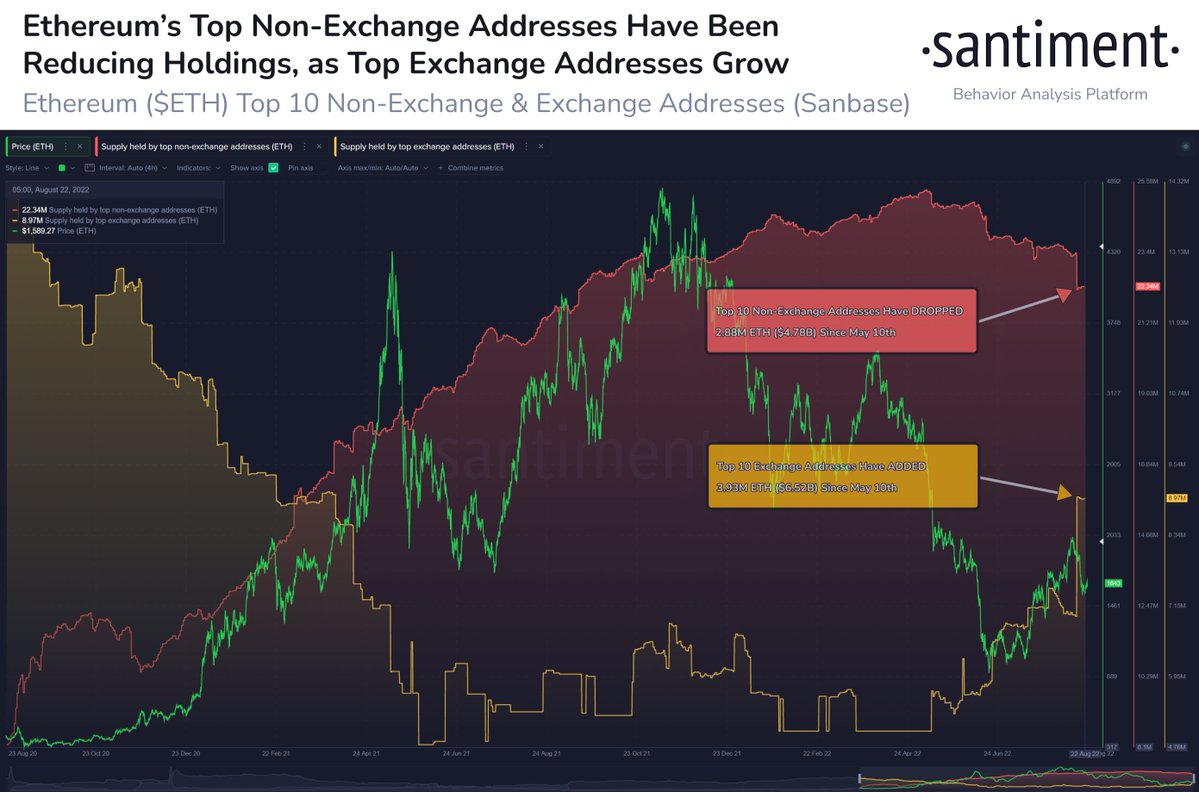

According to on-chain analytics firm Santiment, the Ethereum Top 10 Non-Exchange and Exchange Addresses data reveals the bearish sentiment of the top 10 non-exchange whales. Ethereum (ETH) supply held by the top non-exchange whales has decreased, while the supply held by exchange whales has increased in August.

Despite the rising excitement regarding the Ethereum Merge on September 15, top whales have reduced their holdings. The top 10 non-exchange addresses have sold nearly 3 million ETH worth almost $5 billion since May 10. Meanwhile, the top 10 exchange addresses have added 4 million ETH worth almost $6.52 billion since May 10.

It means the top whales are bearish on the Ethereum (ETH) price post-Merge. The deflationary nature of Ethereum post-Merge may be the reason behind the selling. In fact, Ethereum co-founder Vitalik Buterin has confirmed that the ETH price will be deflationary post-Merge. The Ethereum circulating supply will decrease due to the EIP-1559 burning mechanism.

Moreover, the Ethereum Merge is unlikely to lower gas fees, increase transaction fees, and enable staked Ethereum withdrawal. The clarity from the Ethereum Foundation surrounding the Merge has also led to a decline in the ETH price.

However, the preparations for the Merge have picked pace as Ethereum clients have released the execution layer and consensus layer updates. The releases will enable the Bellatrix upgrade on September 6 and the Paris upgrade on September 15.

ETH Price Risks Falling Below $1300

The Ethereum (ETH) price touched the $2000 level in mid-August, but the sell-off triggered a decline to the $1500 level. Currently, the ETH price is trading near $1,700, up over 3% in the last 24 hours. The developments and network activity have kept the price stable.

However, almost $2 billion in ETH options are set to expire post-Merge on September 30. As per Deribit options and futures exchange, the max pain price is $1600 and calls are dominating. As open interests (OI) are higher, the Merge is likely to impact the crypto market.

CoinShares’ chief strategist Meltem Demirors recently said the “Merge will not help ETH to scale up in price.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs