Breaking: Kraken Confirms BTC, BCH Receipt From Mt. Gox, Repayments Within Weeks

Highlights

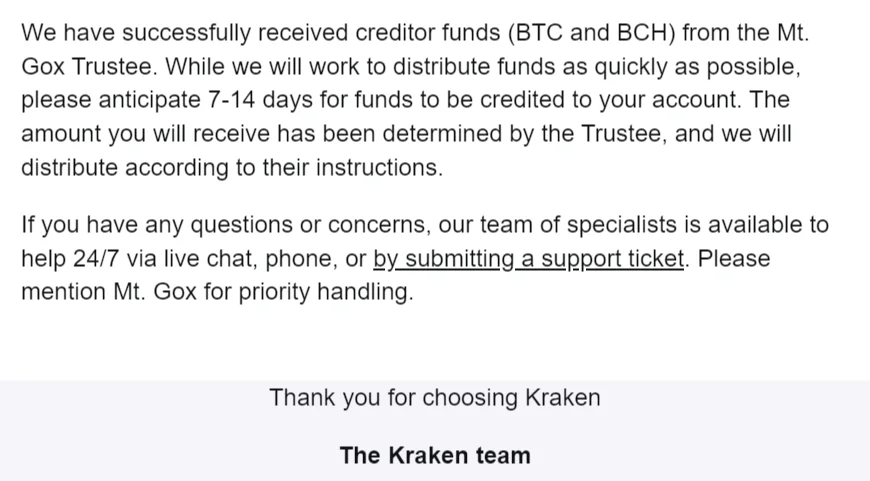

- Kraken sent email to Mt. Gox creditors to confirming receiving funds from Mt Gox Trustee.

- Crypto exchange will deposit funds to creditors within 7-14 days.

- BTC price currently trades at $63,800 defying Mt. Gox repayment.

Crypto exchange Kraken on Tuesday sent email to Mt. Gox creditors confirming that they have received funds from the beleaguered exchange trustee. Moreover, the estimated payments of Bitcoin (BTC) and Bitcoin Cash (BCH) will be completed in 7-14 days.

Mt. Gox Creditors to Receive BTC and BCH From Kraken

Several Mt. Gox creditors reported receiving emails from Kraken crypto exchange, stating it successfully received Bitcoin and Bitcoin Cash from Mt. Gox trustee. The exchange expects to transfer funds to creditors within 7-14 days. It means funds will be deposited into the user’s account by July end.

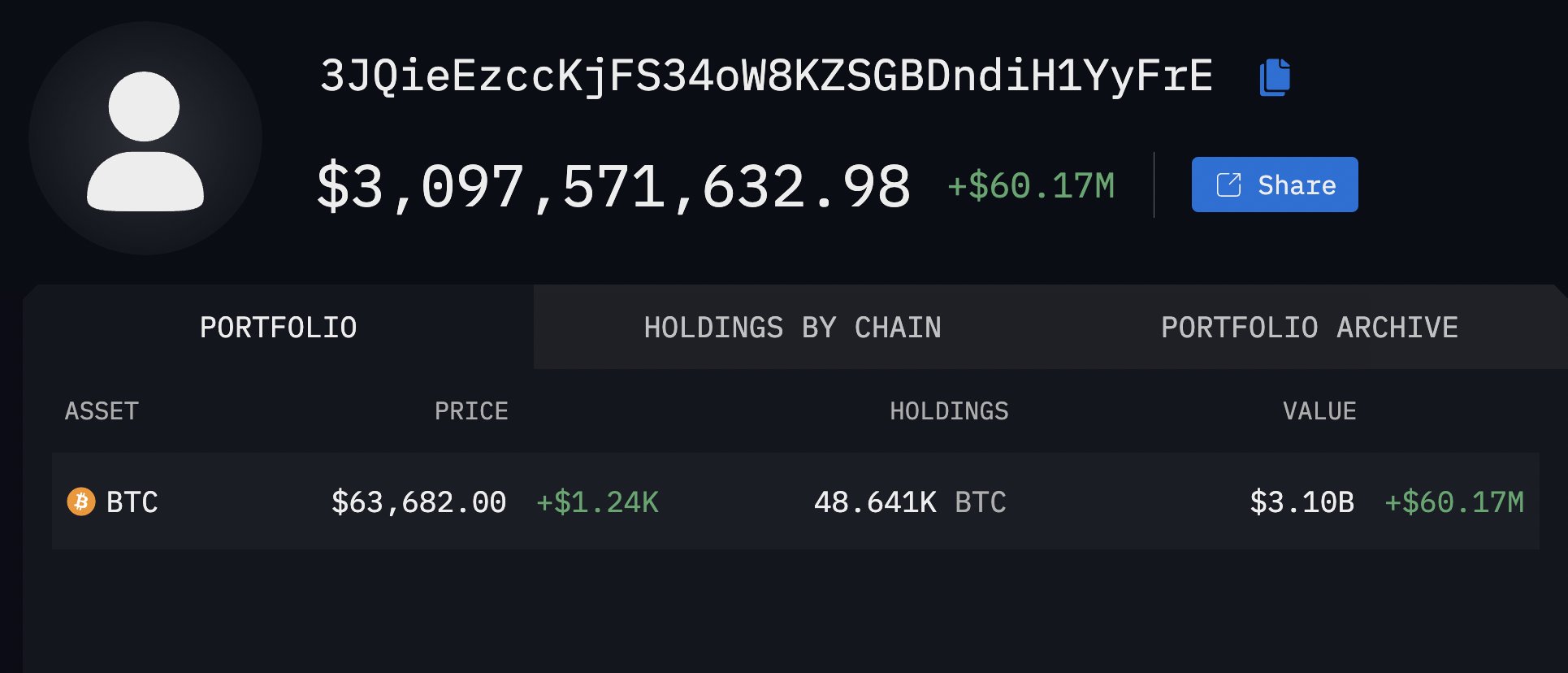

As CoinGape reported, Mt. Gox-linked wallet moved more than $6 billion in Bitcoin in two transfers to unknown wallets. It caused a sharp drop in BTC price, with crypto liquidations exceeding $210 million. As per on-chain data platform Arkham, Mt. Gox cold wallet transferred 48,641 BTC, valued at $3.07 billion, to a new address beginning with 3JQie…YyFrE, followed with another transfer.

In total, over the past few hours, Mt. Gox has moved 95,869.97 BTC to two separate addresses, amounting to a combined value of $6.06 billion.

Also Read: Ripple XRP Case Update – Ex-SEC Weighs In On Settlement, XRP Nears Bullish Cross

Bitcoin Bulls Upbeat Despite Liquidation Risk

Bitcoin bulls remain confident over further Bitcoin price rally. Traders started dumping positions on initial reports of Mt. Gox Trustee moving BTC and BCH to different wallet addresses. Kraken-linked address received 48,641 BTC ($3.10B) from Mt. Gox this morning, which remains unspent, as per Arkham.

BTC price jumped over 1% in the past 24 hours, with the price currently trading at $64,000. The 24-hour low and high are $62,487 and $64,989, respectively. Furthermore, the trading volume has shot up by 40% in the last 24 hours, indicating a massive interest among traders.

BTC futures and options traders are buying heavily, especially in the United States. Coinbase premium gap is once again rising as markets expect Fed rate cuts in September. CME futures open interest jumps over $10 billion. According to Matrixport, the upside momentum will continue for longer.

Also Read: Is Meme Coin Frenzy Back? Here’s What Data Signals

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs