Leading Asset Manager CSOP Says Bitcoin To Hit $100K Soon

Highlights

- Ding Chen, CEO of CSOP Asset Management, says Bitcoin price can rally to $100K soon due to Trump's support.

- CSOP Bitcoin Future Daily (-1x) Inverse Product to increase interest in the Hong Kong market.

- Crypto market research firms retains bullish outlook on Bitcoin despite uncertainty.

Asia’s leading asset management firm CSOP Asset Management CEO Ding Chen believes Bitcoin price can hit $100K very soon, agreeing with traders who think Donald Trump-fueled BTC price rally will be far larger. Meanwhile, Trump is to give a speech at the Bitcoin Conference this week, with rumors of a groundbreaking announcement such as BTC strategic reserve.

CSOP Predicts Bitcoin To $100K Likely Under Donald Trump

Ding Chen, CEO of CSOP Asset Management Ltd, in the latest Tiger Money podcast of Bloomberg Intelligence, talked about launching the Asia-Pacific region’s first inverse crypto exchange-traded fund (ETF). She also discussed the burgeoning crypto ETFs market, Bitcoin and crypto market, and Asia’s outsized returns.

CSOP Asset Management recently announced Asia’s first inverse Bitcoin ETF in Hong Kong, allowing investors to profit from Bitcoin price fall. She said the major reason behind launching CSOP Bitcoin Future Daily (-1x) Inverse Product was the lack of options for clients to take negative positions or short Bitcoin.

She agrees with traders anticipating BTC price to rally towards $100K faster amid Donald Trump’s pro-crypto strategy. Donald Trump will also attend the Bitcoin 2024 Conference in Nashville, Tennessee on July 25-27. Moreover, pro-Bitcoin JD Vance’s selection as vice president by Trump also triggered positive sentiment in the crypto market.

Also Read: Mt Gox Transfers Over $3 Billion In Bitcoin, BTC Liquidations Mount

BTC Price Recovery Path To $100K

Spot Ethereum ETF launch turned out to be less effective in bringing a rally in BTC price and the crypto market. Bitcoin ETFs saw first outflow of $78 million after 12 consecutive inflows. Still, BlackRock saw $72 million in inflows, indicating interest among institutional investors.

Blackrock’s iShares Bitcoin Trust has garnered $19.0 billion in inflows year-to-date, making it the fourth most successful ETF this year. With inflows continue to rise, Bitcoin is outperforming all other asset classes with more than 57% year-to-date gain, reported 10x Research.

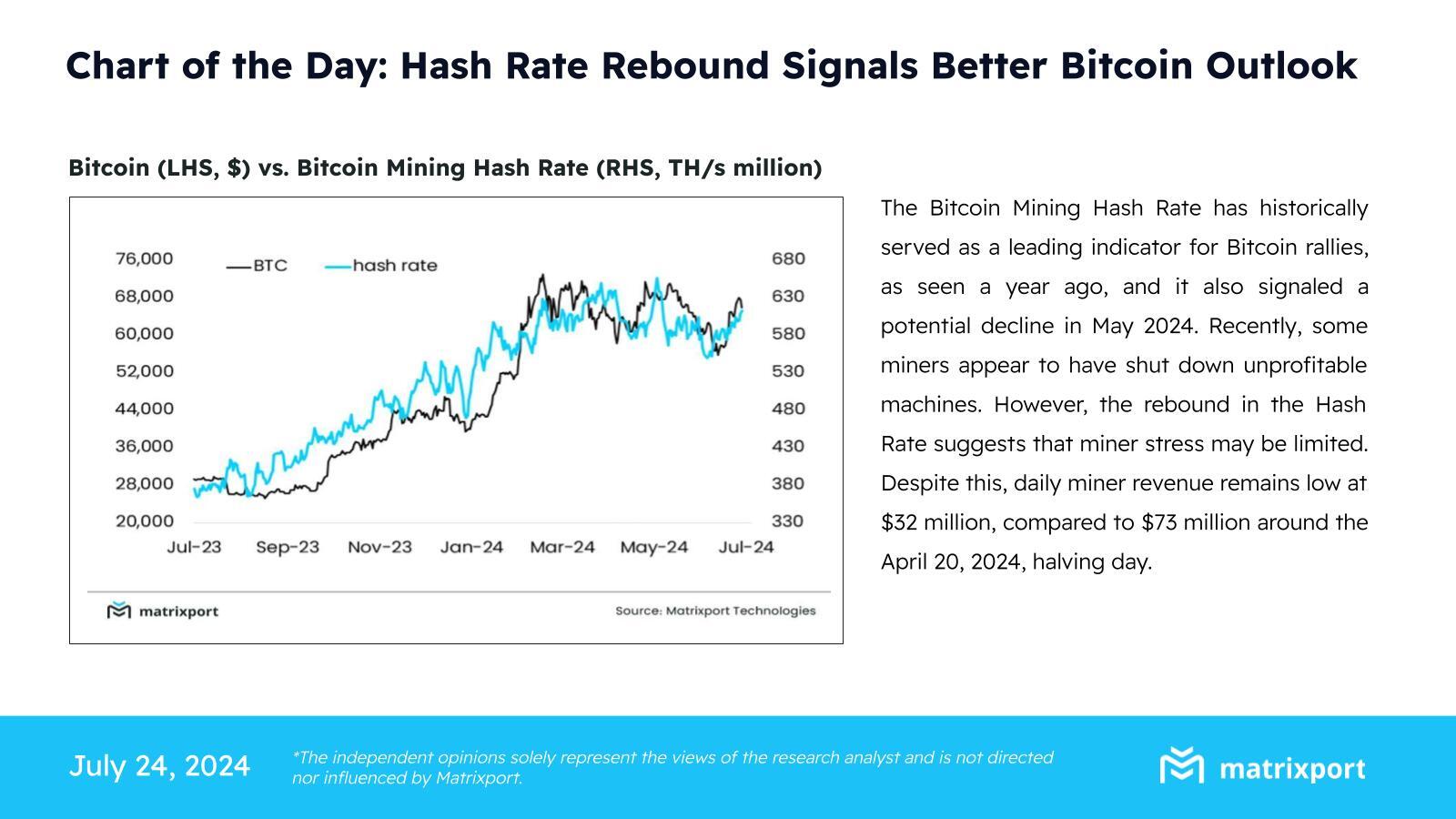

Matrixport asserts Bitcoin hash rate rebound are signal of a better outlook. It has historically been a leading indicator for BTC rallies, including the decline in May. BTC miners are also gradually expanding to AI after Bitcoin halving as miner revenue has dropped significantly.

BTC price fell 0.50% in the past 24 hours, with the price currently trading at $66,375. The 24-hour low and high are $65,484 and $67,359, respectively. The trading volume has decreased by 31% in the last 24 hours, indicating a decline in interest among traders due to uncertainty in the market. Moreover, the futures and options trading have are also low in the last 24 hours.

Also Read: XRP Lawyer John Deaton Slams Sen Warren’s Bill To Overturn Chevron Ruling

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs