Legendary Peter Brandt Predicts Bitcoin Rendezvous With Parabola As CME Gap Closes

The crypto market saw $250 million liquidated over the last 24 hours, with $60 million Bitcoin longs liquidated from a total of $70 million. BTC price fell under key $40,000 support level as traders and experts anticipated a weak trend due to macro and technical reasons.

However, a correction in Bitcoin price has been pending since December after a rally triggered by massive buying from retail and institutional investors. CoinGape reported a CME Bitcoin gap near $39,700, which has finally filled as Bitcoin drops to a 24-hour low of $38,923.

Peter Brandt Shares Bullish Outlook

Reacting to Bitcoin price prediction to popular trader Cheds that side-liners will again take long positions under $40,000, Peter Brandt agrees the decline is most probably a wash out of weak longs.

In contrast to bearish sentiment and weak buying from bulls below $40K, Peter Brandt said “Would love to see what would happen when (if) parabola is retested.”

As the major support is broken and CME Bitcoin gap is filled, buying from the dip for longs is expected. However, the parabola shared by Peter Brandt depicts a retest most likely in Feb-end or early March.

March will be a crucial month for BTC traders in terms of macro and post-Bitcoin halving sentiment. The world will keep an eye on the US Federal Reserve monetary policy decision in March for a pivot. The macro currently is against the Bitcoin bullish momentum.

The U.S. 10-year treasury yield hovers near 4.15%. The US dollar remains strong reversed back to 103.50 from 101 in early January, currently at DXY index is at 103.29. Bitcoin traders brace for key economic data this month end including US Treasury quarterly refunding announcement on January 31.

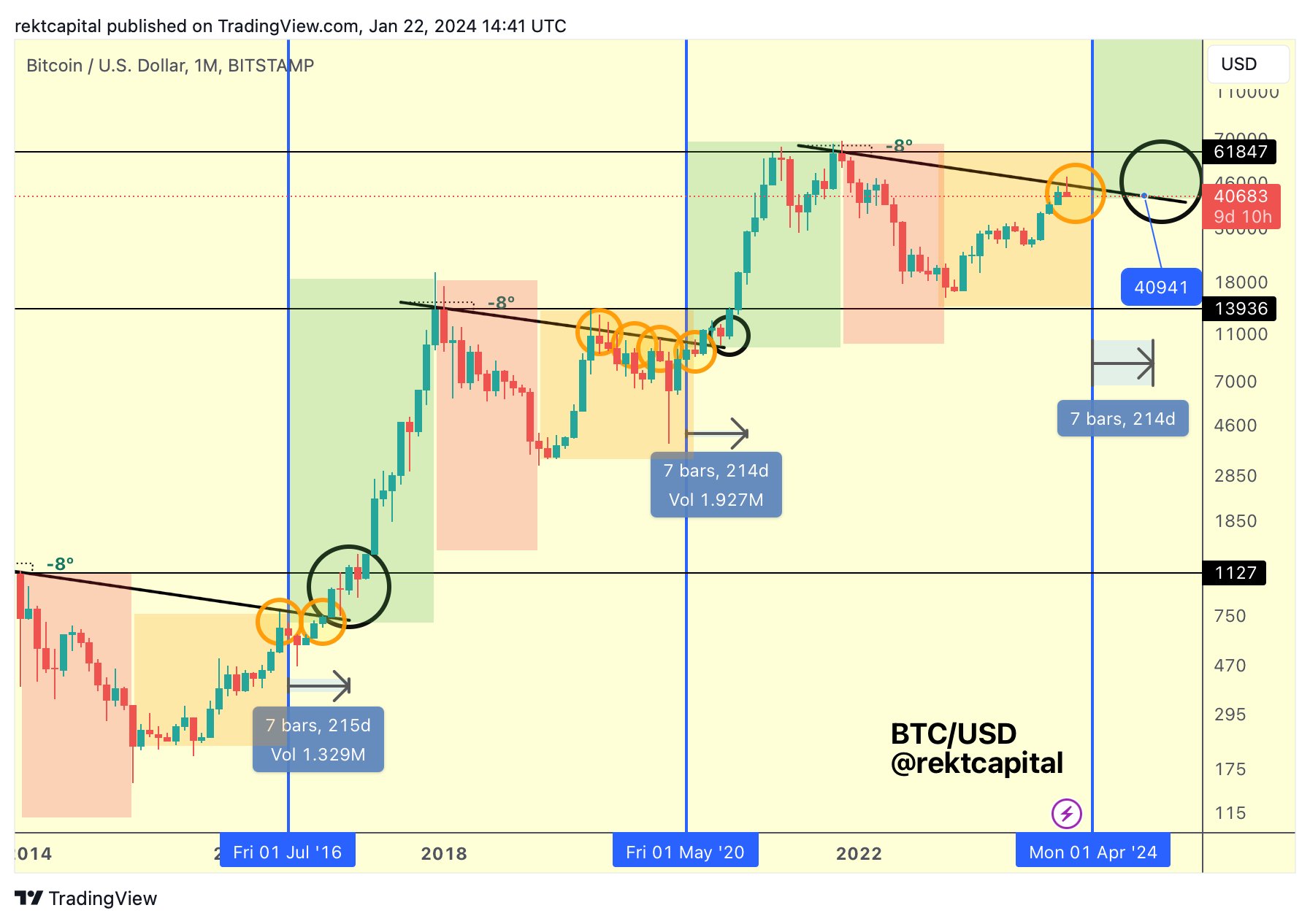

Whales have sold around 70,00 BTCs worth over $3 billion in the last two weeks, reported popular analyst Ali Martinez. Analyst Rekt Capital revealed that Bitcoin is repeating historical chart patterns over correction before a halving.

BTC price fell 5% in the past 24 hours, with the price currently trading at $38,964. The 24-hour low and high are $38,839 and $41,242, respectively. Furthermore, the trading volume has increased by 85% in the last 24 hours, indicating interest among traders.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Bitwise CIO Calls Bitcoin Selloff ‘Classic Cycle,’ Dismisses Manipulation Rumors

- Cardone Capital Takes Real Estate On-Chain With $5B Tokenization Plan

- Senator Elizabeth Warren Targets Trump-Affiliated World Liberty Financial Over Bank Charter Bid

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs