Chainlink Price Analysis: LINK Price Establishing All Time High Again, Will Increasing Volume Boost Price Further?

Chainlink price’s recent expansion has breached swing high posting a new all-time high LINK price as the macro bull trend continues to be intact. Consecutive higher highs and higher low are still integral thus higher prices are probable until proven otherwise.

- Weekly Bullish Order Block holding true.

- Increasing volume profile suggestive of a climatic node.

- RSI and Stochastics Bullish Control Zones intact.

Chainklink Price Analysis: LINK Weekly Price Action Chart

Observing the chart we can clearly see LINK price action breaking the weekly S/R Zone with a strong impulsive break that led to an initial Bullish Volatility Expansion. This breakout established a weekly inside bar that contracted volatility for a total of three weeks. Evidently a consecutive expansion occurred where Chainlink price action established a clear swing high.

The swing high led to a short term bearish volatility expansion as price action made its way down. A rounded retest was confirmed at the Bullish Order Block where price action wicked down and immediately got bought up. This is technically indicative of strength in the immediate short term which did come to fruition with an expansion.

The 21 Moving Average can be considered as a clear visual guide, price action has found clean support over the majority of the trend. As long as this holds true, higher prices are expected, breaking below will be a sign of weakness.

Now observing both oscillators, momentum is still shifted bullish with key resistance yet to be tested, especially the stochastic momentum.

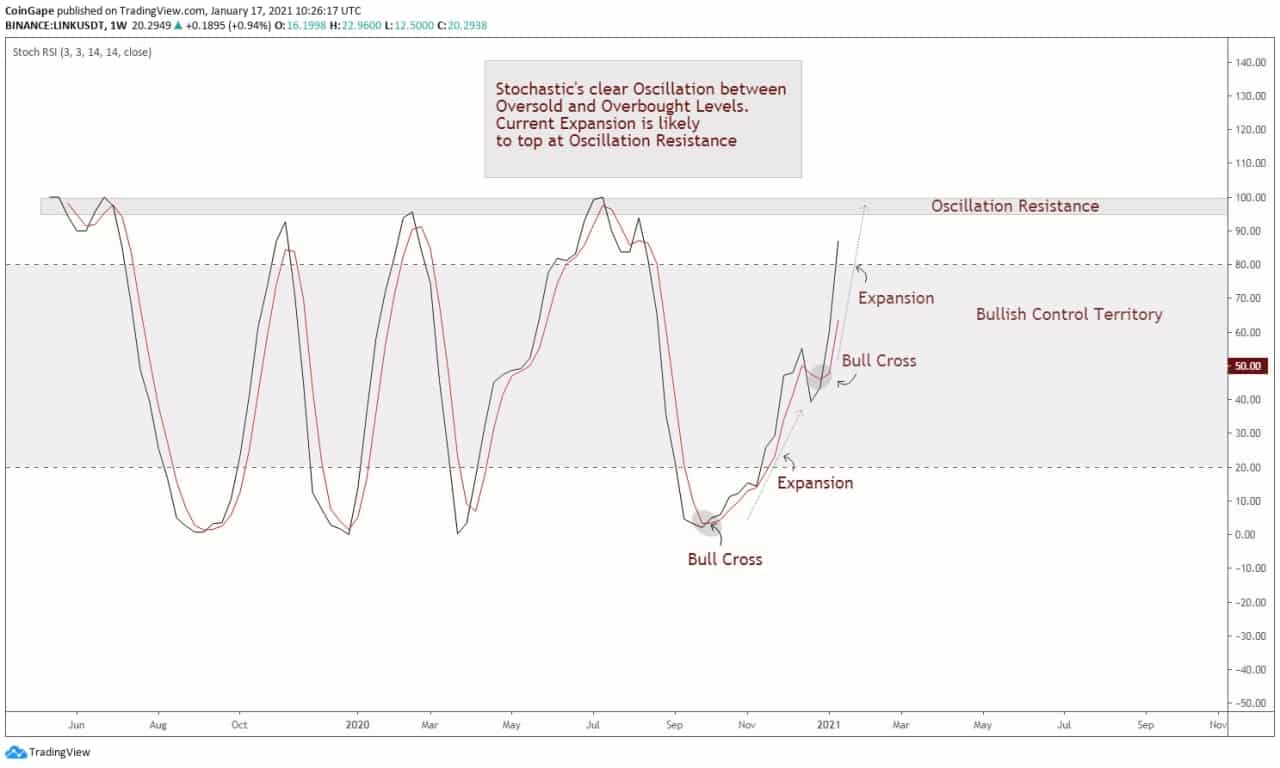

Chainlink Price Analysis: LINK Weekly Stochastic Chart

A few conditions to be valid here for LINKUSDT as the Stochastic’s have a clear oscillation that marks temporary tops and bottoms. As of most recent, there has been a Bull Cross with an expansion occurring. This expansion is likely to top out at Oscillators resistance, a reversion usually occurs at these regions before a diversion back to its mean – Bullish Control Zone Median.

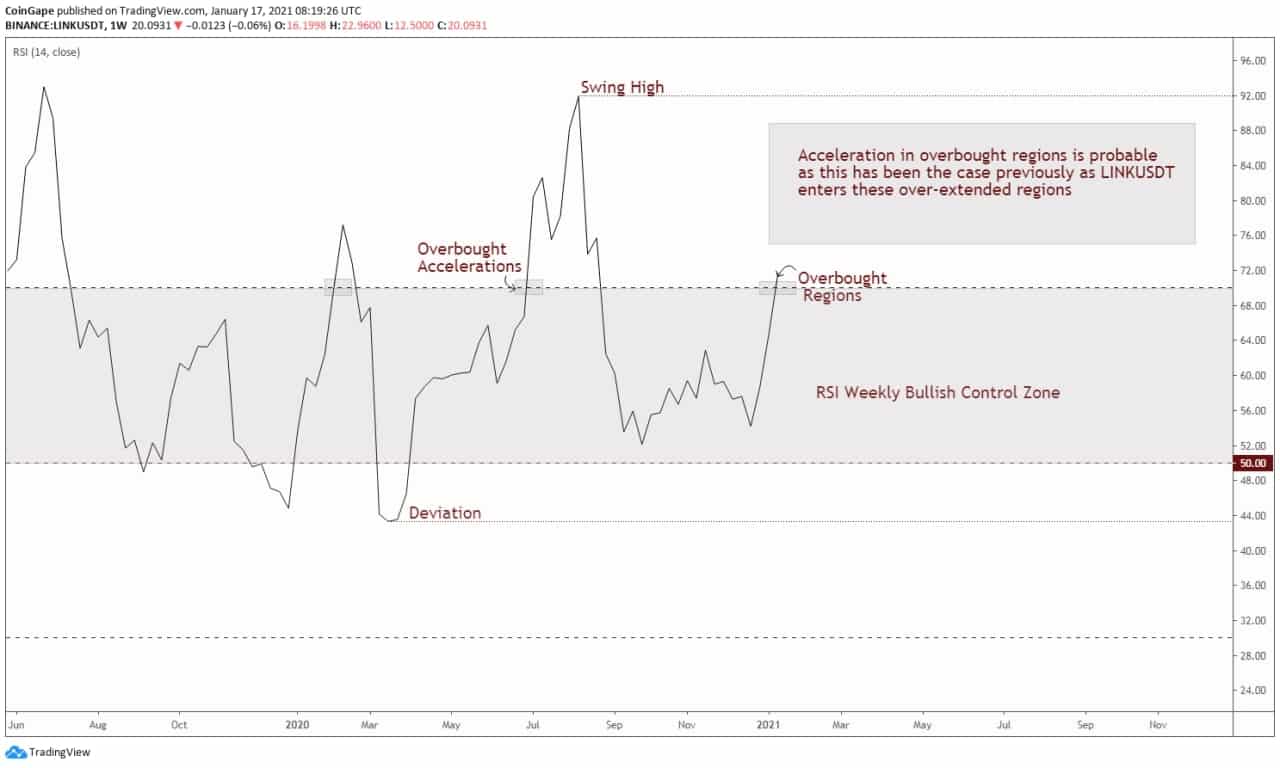

LINK Price Analysis: LINKUSDT Weekly RSI Chart

The RSI is also trading in the upper regions of its Bullish Control Zone where acceleration is likely to occur. This indicator is highly useful in measuring the speed and velocity of price action, especially on impulsive coins such as LINKUSDT . Swing high being the immediate objection suggests that further upside is probable in respect to LINK price action. This goes well with the current volume profile as there are no immediate climatic nodes suggestive of a temporary top being set.

What’s Next for LINK Price?

In conclusion, LINKUSDT remains its bullish market structure and continues to expand in a volatile manner, especially when breaking key levels. The volume profile analysis is indicative of further upside until a climatic node comes to fruition. This aligns very well with the Oscillators as they are yet to meet technical resistance, leading into a reversion.

Hope this article helps in making discretional management decisions.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple’s Valuation Tops $50B As Firm Begins $750M Share Buyback

- FDIC Proposes No Insurance for Stablecoins Under GENIUS Act Amid Banks’ ‘Deposit Flight’ Fears

- Ripple Joins Mastercard Crypto Partner Program to Advance On-Chain Payments

- Breaking: Crypto Prices Jump As IEA Members Agree To Release Record 400M Barrels Of Oil

- Breaking: U.S. CPI Holds Steady at 2.4% as Iran War Raises Inflation Concerns

- Bitcoin Price At Risk of Losing $65k as Iran Warns of “Continuous Strikes” That May Push Oil to $200

- XRP Price Prediction as Goldman Sachs Becomes Biggest Holder of Ripple ETFs

- Circle (CRCL) Stock Price Prediction Ahead of CPI Data Release-Is 120 Next?

- Bitcoin Price Today: President Trump Signals Iran Conflict May End Soon As BTC Eyes $72k

- Top Analyst Explains Why Pi Network Price May Soar to $0.50 This Week

- Is MSTR Stock Going to Rally $150?