Long-Term Holders Not Selling Bitcoin Following Peak At $73K

Highlights

- Long-term holders (LTH) are currently not selling following a peak at Bitcoin all-time high.

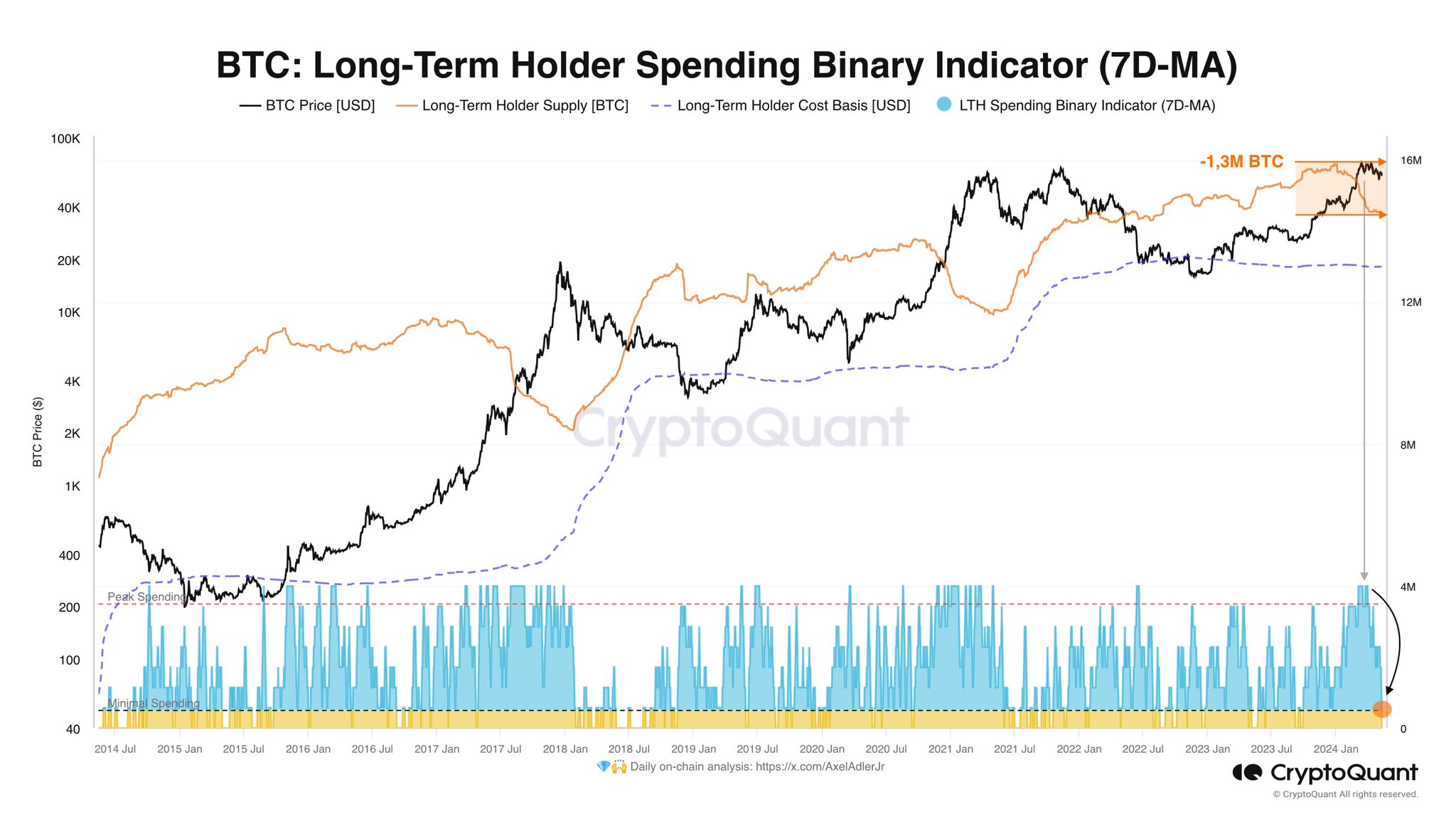

- Holders (LTH) sold 1.3 million BTC when Bitcoin hit over $73,000. However, they are not currently selling their BTC holdings anymore.

- BTC price hints at a recovery in line with market expectations.

Bitcoin price has been on a downtrend for 2 months and failed to hold upside momentum, with bulls turning weak. Bitcoin on-chain data reveals long-term holders (LTH) are currently not selling following a peak at Bitcoin all-time high.

Long-Term Bitcoin Holders Remain Bullish

CryptoQuant verified on-chain analyst Axel Adler Jr in a post on X on May 11 shared a key on-chain metric indicating that long-term holders are not currently their holdings. Bitcoin price has struggled to recover fully due to macroeconomic concerns such as Fed rate cut jitters.

Long-Term Holder Spending Binary Indicator showed Long-Term Holders (LTH) sold 1.3 million BTC when Bitcoin hit over $73,000. However, they are not currently selling their BTC holdings anymore.

The smart money are looking to enter Bitcoin at the local bottom. “They currently have a lot of cash, around 1.3 million BTC,” he added.

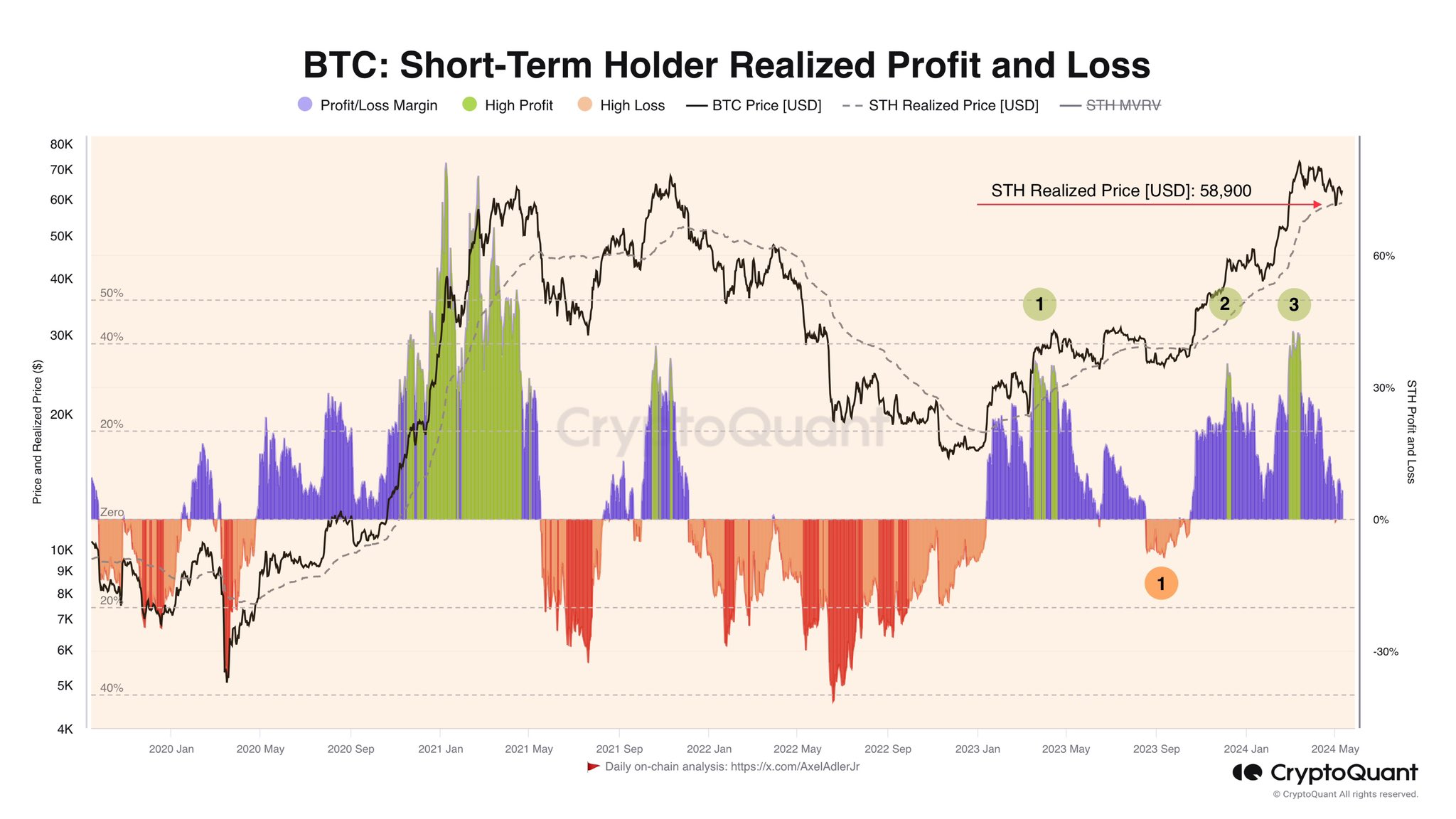

Furthermore, he believes it is the perfect time for a deep correction to filter out all the non-serious crypto investors. Short Term-Holders (STH) had three major profit-taking events at levels 28K, 44K, and 72K, but there was only deep correction in August-September last year.

May has key events next week such as PPI, CPI and Fed Chair Jerome Powell’s speech. The recent University of Michigan consumer sentiment data revealed a fall from 77.2 in April to 67.4 in May, the lowest in six months and also missed market expectations of 76. Furthermore, inflation expectations for the year ahead rises to 3.5%, a six-month high from 3.2% in April. Also, the five-year inflation outlook hit 3.1% from 3.0%.

Also Read: Ripple CEO Brad Garlinghouse Answers SEC Appeal, Crypto Predictions, Next Black Swan

Bitcoin Price Aims to Recover?

The US government’s budget surplus in April expanded to $210 billion from $176.2 billion a year earlier, driven by higher tax receipts that outpaced increased spending.

BTC price increased nearly 1% in the last 24 hours, with the price currently trading at $61,6009 Bitcoin tumbled from a high of $63,446 as it failed to sustain upside momentum after a recent breakout. Ethereum and other altcoins also fell 2-4%. The recent fall raised doubts about the crypto market recovery later this year.

Altcoin Market cap is still holding the $250 billion well as support, positioning itself for a future move to the upside via the black pathway, said popular analyst Rekt Capital.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale