Markets Expect October Fed Rate Cut as Bitcoin Repeats Post-FOMC Pattern

Highlights

- Bitcoin trades close to $113,000, as traders expect a rate reduction of 25 basis points by the Fed.

- The post-FOMC statements made by Powell will have an impact on the price trend for Bitcoin.

- It is possible that Bitcoin price will drop and then rebound as it has done after previous FOMC meeting.

Bitcoin traders are preparing for a rise or fall in the price of Bitcoin, as the time for the Federal Reserve policy meeting for October approaches. The decision would lower the federal funds rate to a target range between 3.75% and 4.00%, continuing the central bank’s gradual easing cycle that began earlier this year.

Traders Eye Powell’s Comments as Markets Fully Price In Fed Cut

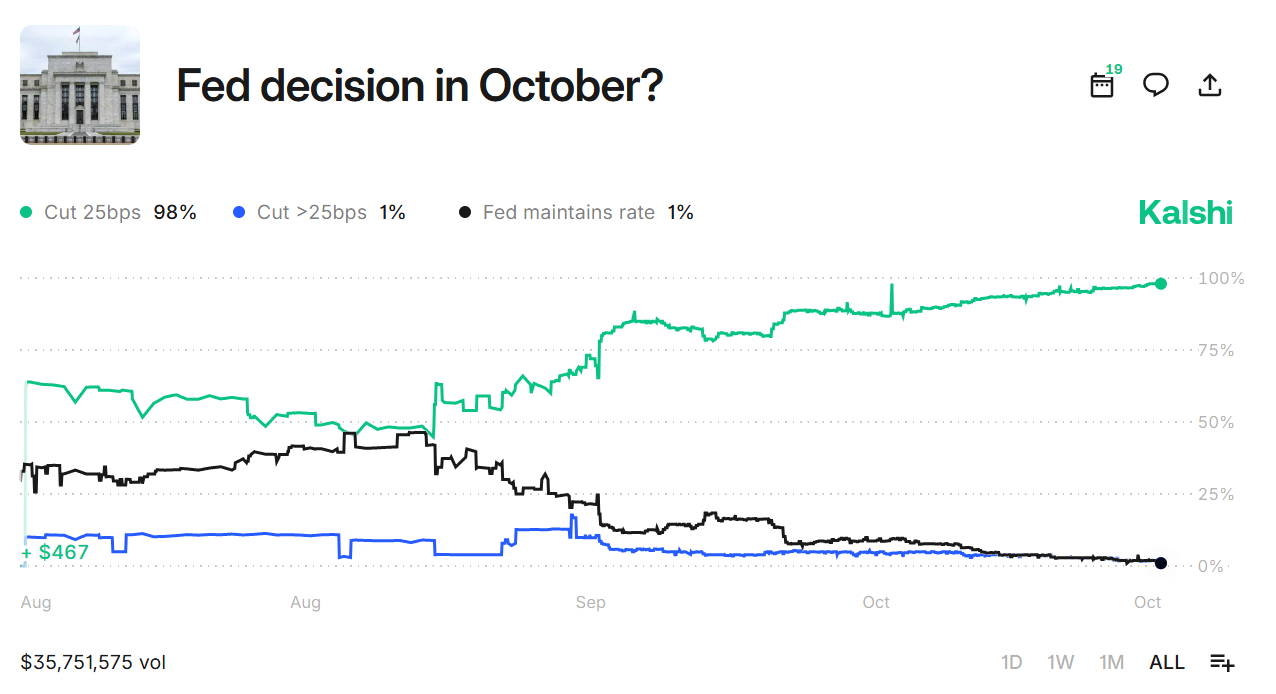

Market data from CME Group and Kalshi show overwhelming expectations for a 25-basis-point rate cut, with probabilities reaching 97.8% to 98%. CME data shows open interest remains high around Fed futures contracts.

Previously, the rising odds of an October rate cut helped fuel Bitcoin’s price surge. Meanwhile, the Kalshi market have traded more than $34 million in trading volume associated with this outcome for this month. The overwhelming consensus for a 25-basis-point cut underscores the market’s belief that the Fed is nearing the end of its tightening cycle.

Crypto analyst Daan Crypto Trades noted that today marks another pivotal FOMC day. He said the 25-basis-point cut itself is widely priced in and unlikely to move markets beyond short-term volatility. Traders can follow the FOMC meeting and watch out for key expectations that could affect the crypto market.

Also, analyst Daan emphasized that the focus will shift to Chair Jerome Powell’s post-meeting remarks. Traders will look for clarity on when the Fed might end quantitative tightening (QT) and possibly begin a new round of quantitative easing (QE) in 2026.

According to Daan, another Fed rate cut is already priced in for the December 2025 meeting with over 95% probability. He expects Powell’s tone on liquidity policy and balance sheet management to drive the next market reaction.

Bitcoin’s Post-FOMC Pattern Hints at November Price Recovery

Meanwhile, Bitcoin’s price pattern around past FOMC meetings has drawn renewed attention. Analyst Ted Pillows observed that BTC has dropped between 6% and 8% following the last three Fed announcements.

$BTC dropped 6%-8% after the last 3 FOMC meetings.

And it made a new ATH before the next FOMC meeting.

Will this pattern repeat again? pic.twitter.com/Ro2aRF4hXm

— Ted (@TedPillows) October 29, 2025

After those declines, Bitcoin proceeded to make new all-time highs till the next meeting. The same setup is now re-forming with BTC price close to the $113,000 mark before the October rate decision. Analysis showed that Bitcoin price could eye the $120,000 zone as the likelihood of a Fed rate cut strengthens.

All the Fed rate cuts have exerted sell pressure on Bitcoin in the short term before it regained its upward trend. If this setup repeats itself, then a plunge followed by a period of recovery into November should be expected.

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand