XRP Price: Here Are 2 Reasons Why XRP Could Blow Out Hitting 25$ In 2024

After the correction in January, February is beginning to take shape as a recovery month. Green shoots can be spotted across the board with XRP price steadying its outlook above $0.5 support. The cross-border money transfer token is up 2.8% to trade at $0.51 on Thursday, February 7, rising alongside its bigger siblings Bitcoin and Ethereum.

1. Can XRP Price Rally Amid Anticipation For Bitcoin Halving?

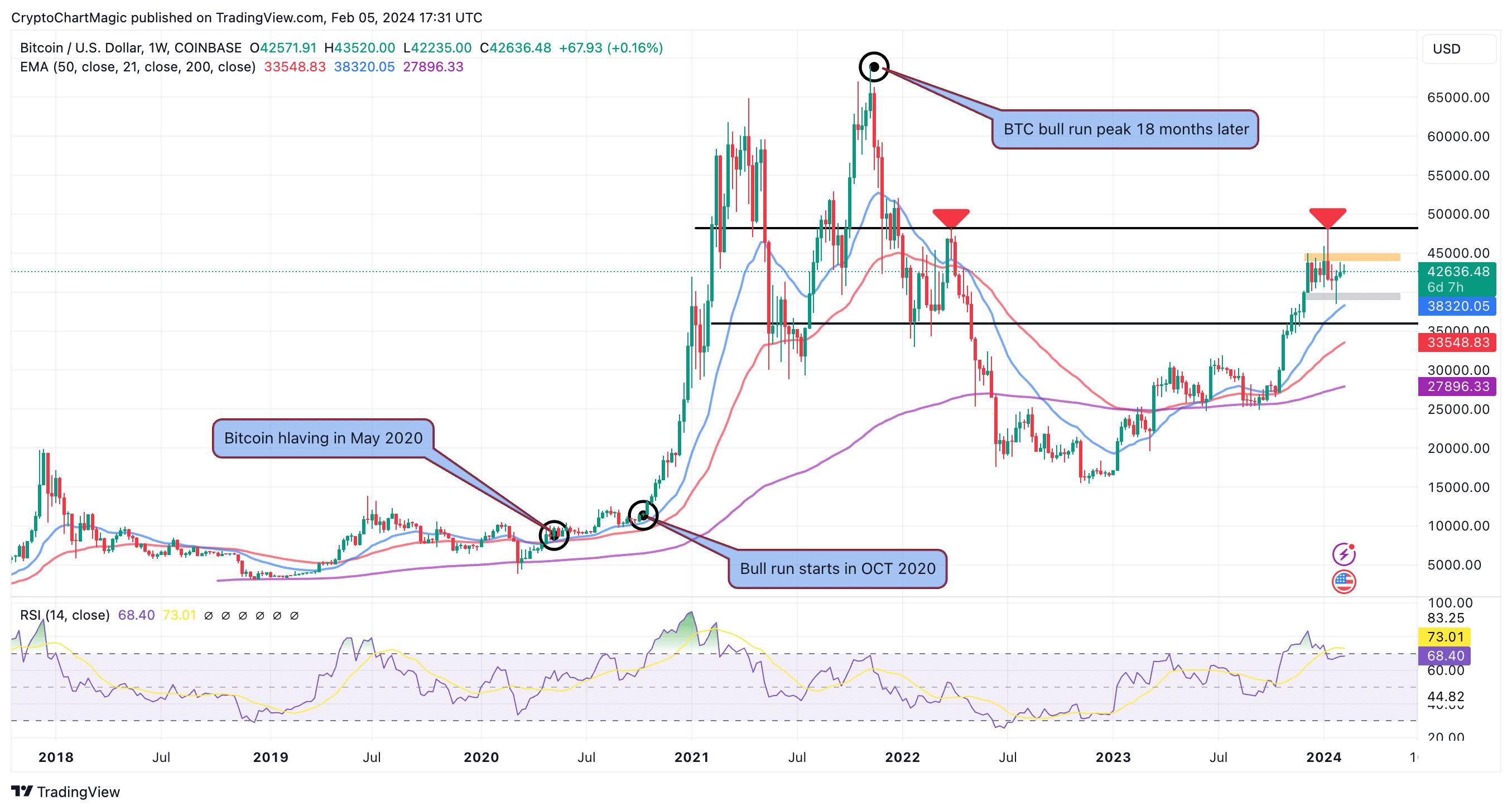

With the ETF out of the way, investors are looking forward to the next market mover, which in this case is the Bitcoin Halving. Although this event has a direct impact on BTC, it tends to trigger a wide-reaching bull market.

Bitcoin’s halving event, occurring roughly every four years, reduces the block reward by 50%, which directly impacts supply dynamics. This programmed scarcity, in theory, drives up prices due to classic supply and demand principles.

However, the impact on price isn’t always immediate or linear. Historically, price surges have materialized months after the halving, potentially due to anticipation and market cycles.

The previous halving occurred in May 2020 when Bitcoin [rice traded around $8,778. Subsequent price increases pushed BTC to a peak of nearly $69,000 roughly 18 months after the event.

Additionally, the halving’s influence extends beyond Bitcoin, often triggering bullish sentiment across the broader crypto market as investors seek alternative high-growth assets.

Nevertheless, attributing price movements solely to halving is difficult due to the complex interplay of market forces, regulatory changes, and broader economic factors.

While the halving presents a compelling long-term bullish case for Bitcoin and the crypto market in general, traders novice and experienced should carefully consider these nuances and conduct thorough technical and fundamental analysis before making investment decisions.

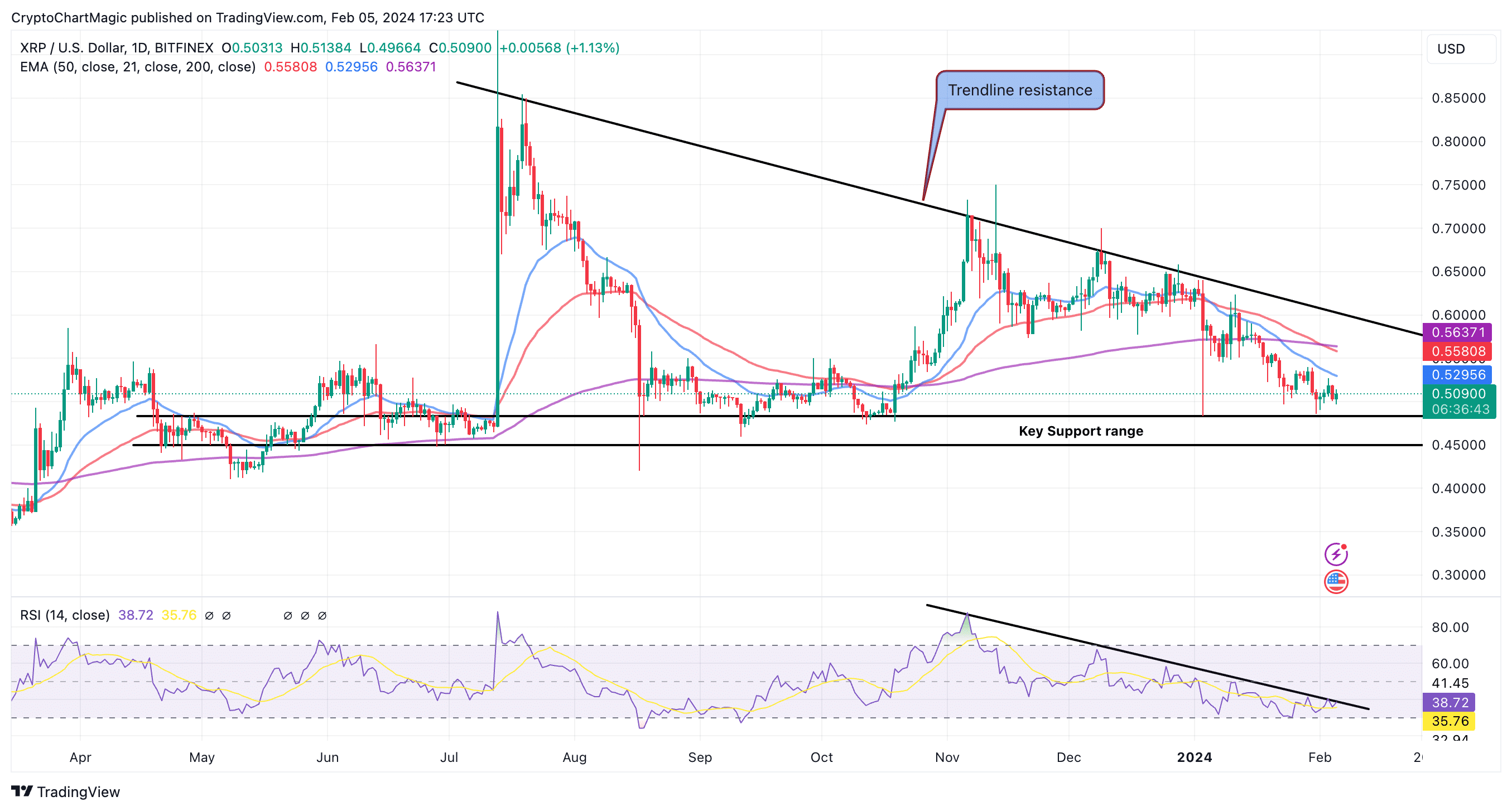

2. XRP Bottoming Out

XRP price is back to levels last seen in November and October. This means that it is testing the same support before the Q4 rally from $0.485 to $0.75. As long as bears respect this buyer congestion zone, the next move could boost XRP upward targeting key milestones at $0.6, $0.8, and $1.

The Relative Strength Index (RSI) although neutral at the time of writing, is nearing the oversold region, implying that a trend reversal is not far off.

In that case, traders should be on the lookout for successful bounces off the major support range between $0.54 and $0.48. Similarly, dollar-cost averaging (DCA) within this range would give investors a chance not to miss out on the next move.

Above $1, the uptick in the price of XRP could be parabolic and mainly driven by FOMO. Most holders missed the previous bull run as exchanges and other key entities delisted the token on allegations of being a security.

However, with XRP absolved by the court in July, there’s unlikely going to be another time bond to derail the token from hitting a new all-time high.

“The partial resolution of the dispute with the US Securities and Exchange Commission (SEC) could potentially spur growth for XRP in the near future,” Grzegorz Drozdz, a market analyst at Conotoxia, said in a statement regarding XRP price performance.

Drozdz added “A large-scale upswing in the crypto world could be a boon for XRP. If other cryptocurrencies rise, XRP could well ride the wave.”

A further decline below the range support cannot be ruled out as XRP price is not out of the woods. Besides, holding below all three bull market indicators; the 20-day Exponential Moving Average (EMA), the 50-day EMA, and the 200-day EMA suggest that the odds could still favor the bears and lead to a larger breakdown to the primary support range between $0.38 and $0.4.

Related Articles

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs