Algorand Price Discounted 16% Amid Recent Sell-off; Buy This Dip Now?

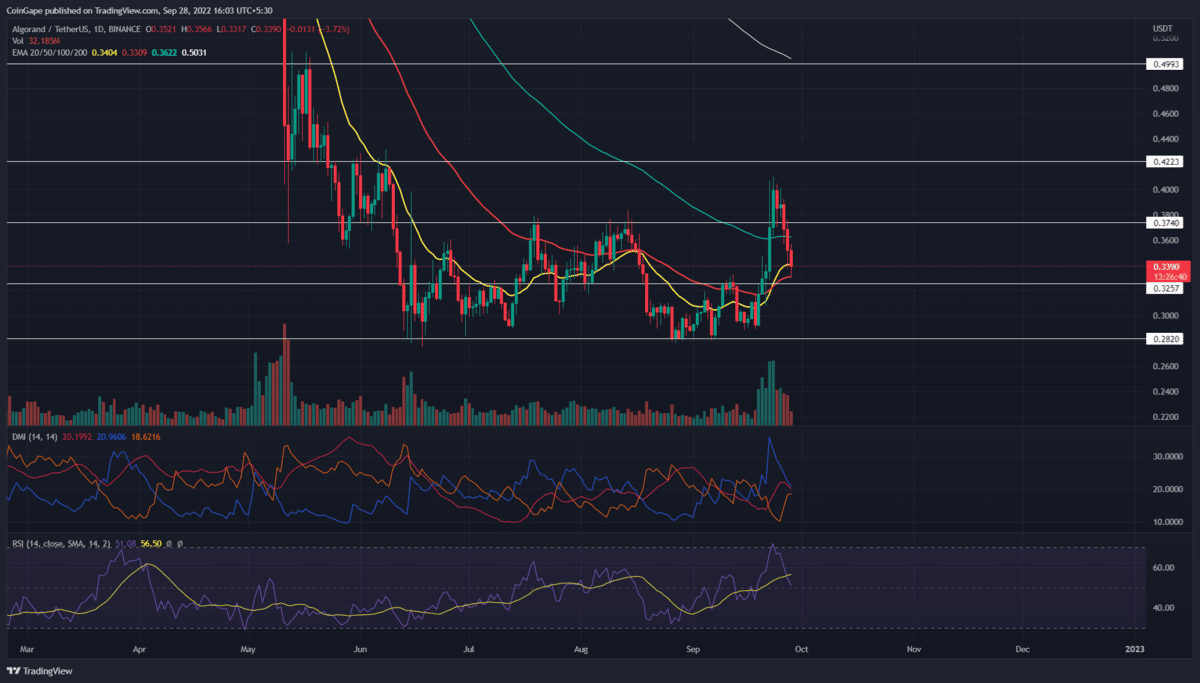

The Algorand price shows a sideways rally over the past three months. During this consolidation, the altcoin rebounded from this support multiple times, validating it as a strong accumulation zone. Furthermore, a recovery rally initiated from this support has witnessed a significant correction and plunged to $0.33 support. Thus, the coin chart displaying a recovery sign at this support should provide a good dip opportunity for traders.

Key points from Algorand price analysis:

- The ALGO holders can see a brighter future if the prices sustain above the 50-day EMA in the coming weeks.

- The long-wick daily candle projects high chances of a bullish reversal.

- The 24-hour trading volume in the Algorang coin is $195 Million, indicating a 5.87% gain.

The Algorand price action showcased a bullish reversal rally failing to sustain above the 100-day EMA due to the increased selling pressure at the $0.40 mark. The bullish failure leads to a price drop of 13% back under the 100-day EMA and the previous consolidation range.

The increase in the intraday trading volume supporting the bearish correction rally endangers the bullish dominance at the 50-day EMA.

However, the lower price rejection in the daily candle implies the correction as the retest to local support of $.33. Hence the price action analysis hints at a post-correction reversal.

The sideline buyers can find entry opportunities at the current prices due to this long-wick candle, taking support at the 50-day EMA, and the declining trend in the trading volume. The reversal rally can reach $0.37, where it will face double opposition from the 100-day EMA and the $0.37 resistance level, which can prove to be a solid roadblock.

Nonetheless, a more encouraging trend can give a bullish breakout entry, prolonging the uptrend to the $0.42 mark.

However, if reversal fails, the Algorand price could eventually lose the 50-day EMA and plummet price to $0.281.

Technical indicators:

DMI- The sharp fall in the Algorand price sabotages the bullish gap in the DI lines leading to a higher possibility of a bearish crossover.

RSI- The daily-RSI slope reverted from the overbought region and witnessed a significant downfall. This retracement indicates the prior aggressive buying has stabilized, and prices can continue their upward march.

- Resistance levels: $0.37 and $0.42

- Support levels: $0.33 and $0.28

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin & Gold Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs