Avalanche Coin Holds Recovery Opportunity With This Bullish Pattern

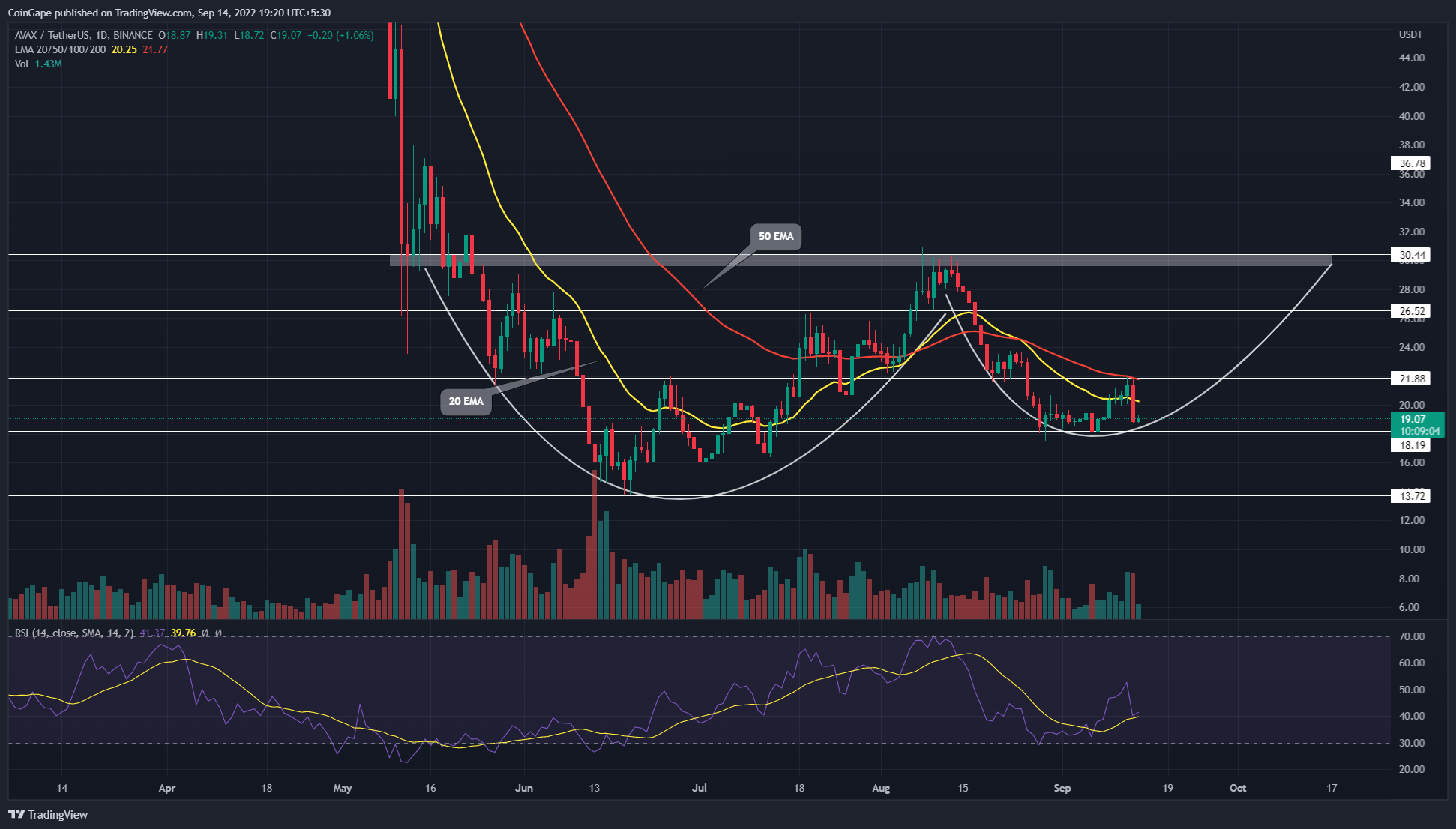

A V-top reversal from $30.5 resistance tumbled the Avalanche coin price to 0.786 Fibonacci retracement level at $18.2. The coin buyers obtained suitable floating at this level and triggered a 22% rally to $21.88. However, the recent sell-off in the crypto market offsets the AVAX price recovery and threatens further correction.

Key points from Avalanche:

- A bullish breakout from $21.8 will encourage the formation of the aforementioned bullish pattern

- The AVAX sellers reclaim the 20-day EMA slope

- The intraday trading volume in Avalanche coin is $479.2 Million, indicating a 38.5% loss.

Source- Tradingview

Concerning the June-July recovery and August correction, the daily time frame chart showed the formation of a cup and handle pattern. This bullish pattern, often located at the market bottom, gives an effective recovery opportunity upon execution. Thus, for the pattern completion, the Avalanche coin price should breach the neckline resistance of $30.5.

However, the Avalanche price recovery failed to rise above the $21.88 resistance due to the September 13th sell-off, weakening the possibility of pattern completion. Yesterday’s downfall was caused due to the high consumer price index(CPI) data.

Thus, the Avalanche coin price has dropped 12.37% from the $30.5 resistance and currently trades at $19.12. Today, the coin price is up 1.27% but backed by low volume activity, which suggests weakness in bulls’ commitment.

Therefore, if the selling pressure persists, the altcoin could plunge to $18.2 and attempt to break below it. Doing so will extend the ongoing downfall to June’s low support of $13.8.

On a contrary note, if the buyers defend the $18.2 support, the bullish pattern will remain intact, and the possibility of the Avalanche coin price will rise to the $30.5 neckline.

Technical Indicators

EMA’s: the downsloping crucial EMA’s (20, 50, 100, and 200) shows an overall downtrend. Moreover, the 50-day EMA slope is a dynamic resistance to coin price.

RSI indicator: the daily-RSI slope dived below the midline, indicating the market sentiment has turned negative.

- Resistance levels: $22.16 and $26.2

- Support levels: $20 and $16

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card