AVAX Price Prediction: Multiple Support Around $65.0 Hints More Gains; Keep Eyes On $80.0 Next

AVAX price edges lower with significant losses but in a relatively known trading range. The price makes consolidative moves for the second straight day. Investors seem indecisive near the vital support placed near $65.0.

- AVAX price is trading within a familiar trading range on Tuesday.

- Multiple support around $65.0 makes bulls hopeful for the next move.

- The momentum oscillator’s trade with negative bias warns of aggressive bids.

AVAX price lookout for bullish reversal

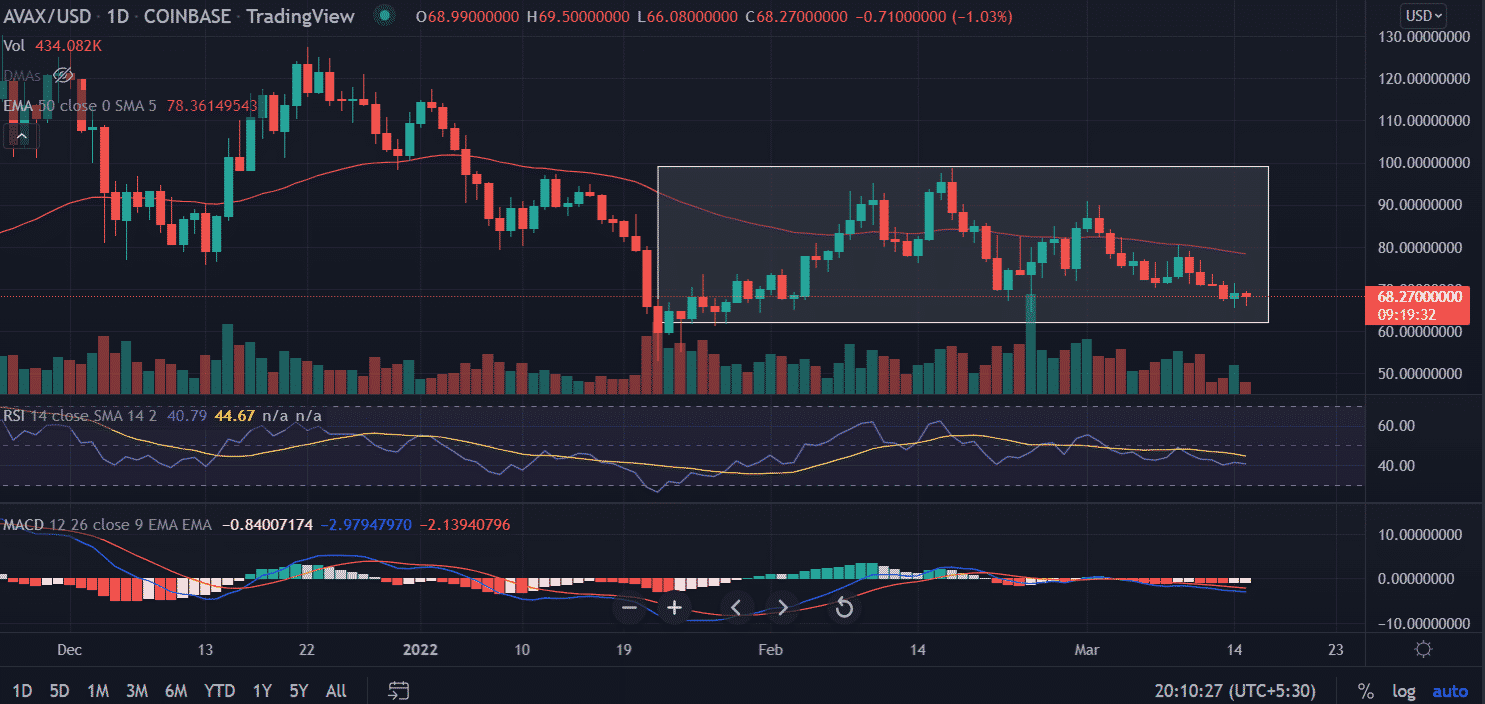

On the daily chart, AVAX price remains pressured below the 50-day critical 50-day EMA (Exponential Moving Average) at $78.0. however, the price is trading inside a ‘Rectangle’ formation since January 22. The highs are capped at the swing of $ 98.77 made on February 17.

Inside the formation, the price met the support zone around $65.0 two times and resulted in an ascent of 53% and 55% respectively. This time too, AVAX price is resting near the key level. We expect the price to bounce back to test the upside hurdle placed at $80.0.

If the buying pressure continues then bulls will jump toward the initial barrier of the moving average at $78.0. Next, market participants will take out the psychological $80.0 with ease as it marks the breach of the critical 50-day EMA.

An extended buying momentum will encourage buyers to revisit the highs of March 1 at $90.98.

On the flip side, a break of the session’s low will negate the bullish arguments. On the downside, AVAX’s price will meet the support at $62.0.

AVAX price is trading in a downside channel since November 22 after recording all-time highs at $145.25. As of publication, XRP/USD is trading at $68.24, down 1.10% for the day.

Technical indicators:

RSI: The daily Relative Strength Index makes lower highs and lower lows while trading below the average line.

MACD: The Moving Average Convergence Divergence is trading below the midline with a negative bias.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs