Binance Coin Price Faces Steep Risk as Key BSC Metric Crashes 75%

Highlights

- The Binance Coin price could be at risk of a steeper bearish breakout in the near term.

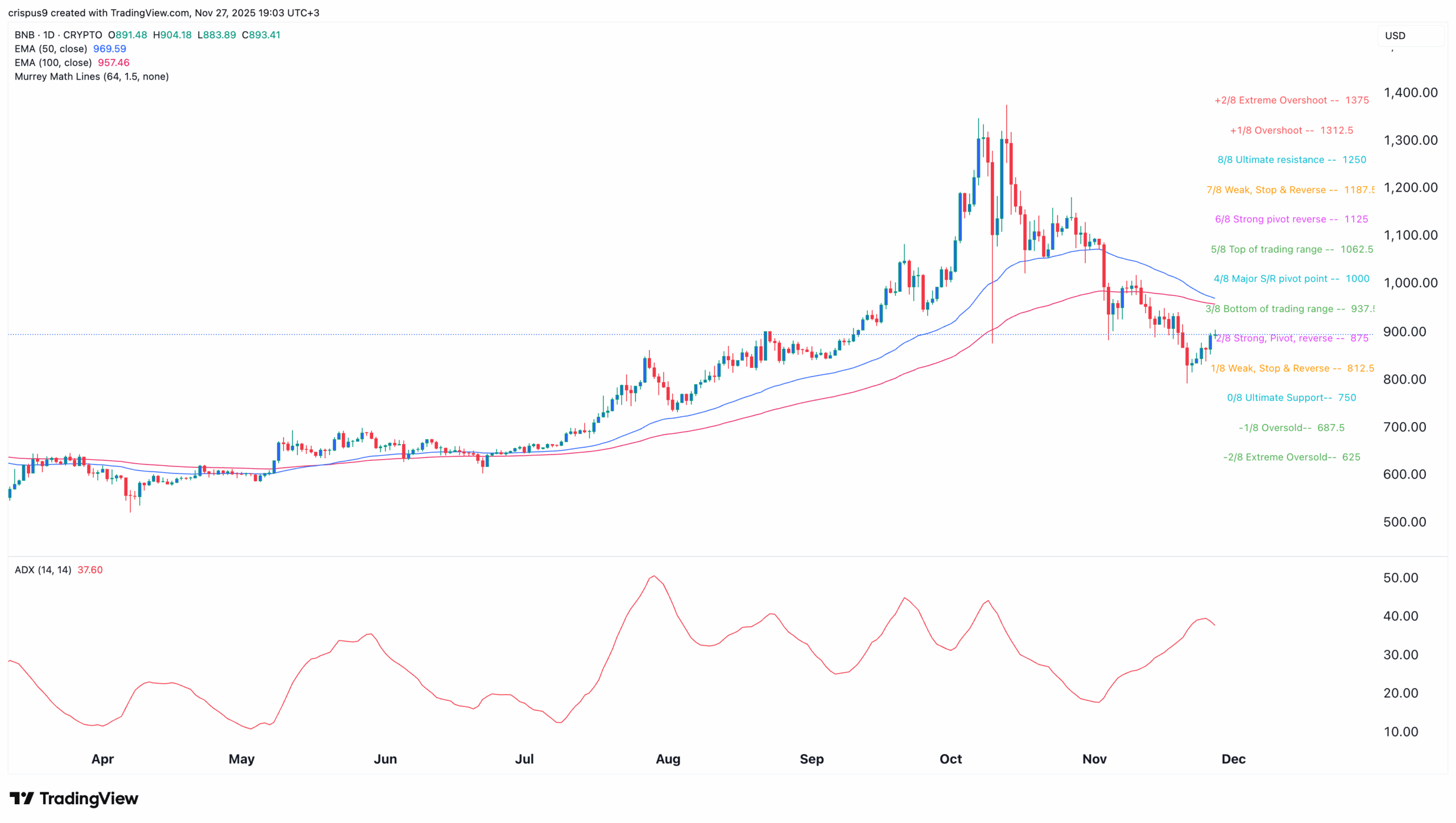

- The price remains below the Supertrend indicator and the Major S&R of the Murrey Math Lines.

- The number of transactions in the BSC network has dropped by 74% in the last 30 days.

Binance Coin price has rebounded by 12% from its lowest point this year, coinciding with the performance of most coins. This rebound, however, could be short-lived as the Supertrend indicator remains in the red and key DeFi metrics plunge.

Binance Coin Price Technicals Point to a Reversal

While the Binance Coin price has rebounded this week, technicals suggest that this is a dead-cat bounce. One of the top risks is that the Supertrend indicator has remained in the red zone.

The Supertrend indicator is a common trend-focused tool that combines the concepts of price action and volatility, using the Average True Range (ATR). A red cloud normally points to more downside.

Meanwhile, the 50-day and 100-day Exponential Moving Averages (EMA) are about to form a bearish crossover. A full crossover will be a mini death cross pattern, which will point to more downside.

There are signs that the ongoing recovery is not all that strong. For example, the Average Directional Index (ADX) has retreated from this week’s high of 41 to 37.

Most importantly, Binance Coin price has retested $875, which is the strong pivot, and reverse point of the Murrey Math Lines tool. It is also the neckline of the double-top pattern at $1,352. A break-and-retest pattern is one of the most popular bearish continuation patterns in technical analysis.

Therefore, the most likely BNB price forecast 2025 is bearish, with the initial target being the ultimate support of the Murrey Math Lines tool at $750. A drop below that level will point to more downside, potentially to the extreme oversold level at $625.

On the other hand, a move above the Major S/R pivot point at $1,000 will invalidate the bearish Binance Coin price forecast.

Top BSC Metrics are Crashing

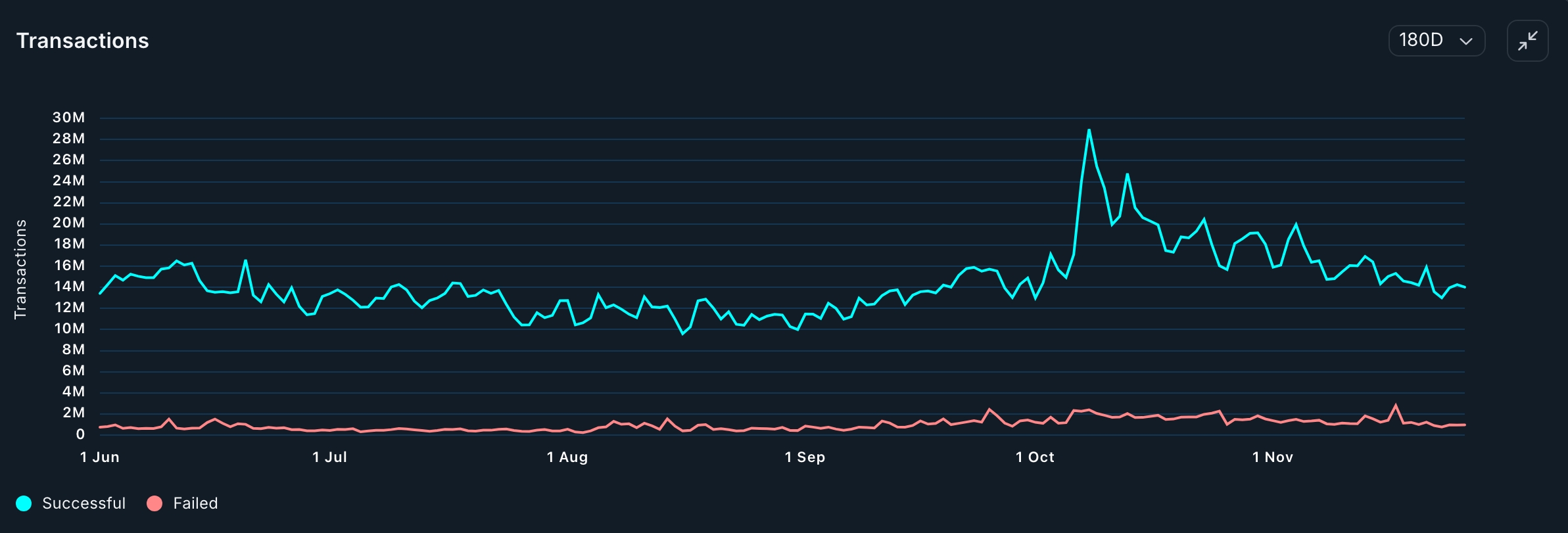

The bearish BNB price outlook is also supported by the fact that some of its important metrics are deteriorating.

Nansen data reveals that the number of active addresses dropped a bit to 3.6 million, while the number of transactions in the network has plunged by 74% in the last 30 days to 479 million.

These numbers have translated to lower fees. The amount of fees the network has collected in the last 30 days dropped by 75% to $17 million, a move that will slow its burn rate.

The BSC has two types of burn rates: real-time burn and the quarter auto-burn. The real-time burn, which has incinerated 320 coins in the last 7 days, does so by moving most of the fees to the burn address. This one will be affected by the falling fees in the network.

Meanwhile, data shows that the decentralized finance total value locked (TVL) has dropped sharply in the past few weeks. It dropped by 23% in the last 30 days to $10 billion, while the stablecoin supply in the network dropped to $13.2 billion from the year-to-date high of $14 billion.

On the positive side, these metrics may start to improve once the crypto market rally happens. Also, the Binance Coin price may rebound ahead of the BNB ETF launch.

Frequently Asked Questions (FAQs)

1. What is the most likely Binance Coin price forecast?

2. Is the BNB price a good buy today?

3. Why are the BSC transactions falling?

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?